CBRE: High-Supply Multifamily Markets Starting to Recover

(Illustration courtesy of CBRE)

CBRE, Dallas, reported that multifamily markets that have seen the most growth in new supply–and thus the most negative effective rent growth–may be recovering soon.

“Occupancy rates have stabilized across these markets as renter demand has absorbed much of this new supply,” CBRE said in a new research brief, High-Supply Multifamily Markets Begin to Recover.

The report said more than 20% of total inventory in most multifamily markets typically see rents decline in any given year. “Negative rent growth has been a bigger challenge in high-supply markets, where nearly 70% of the inventory had negative rent growth in Q2 2024,” CBRE said. “Even in the hardest-hit markets, it is notable that nearly one-third of the inventory is still showing positive rent growth.”

CBRE noted it expects the negative rent growth trend will soon reverse as demand begins outpacing new supply, boosting both occupancy rates and rent growth. “This is already occurring in the downtowns of Atlanta, Austin, Orlando and Phoenix,” the report said.

New supply pressures apartment vacancy rates, causing landlords to compete for tenants with price discounts or rent concessions. CBRE reported rent discounts have been highest in Sun Belt and Mountain markets as unprecedented in-migration in recent years induced developers to add new supply. “However, vacancy rates have now peaked in many of these markets as renter demand exceeds new supply growth,” the report said.

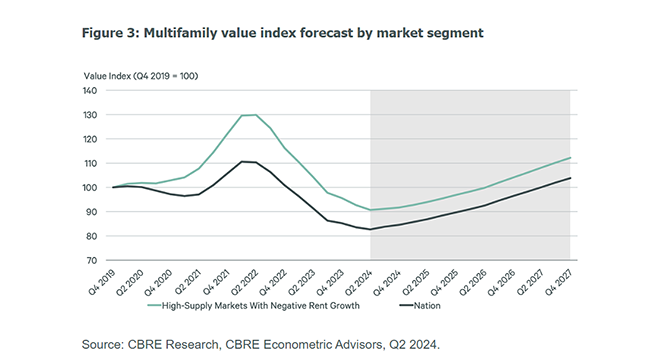

Overall multifamily property values appear to have stabilized and capitalization rates are expected to fall soon, CBRE said. “As higher multifamily occupancy rates lead to rent growth, multifamily property values will continue to climb,” the report said. “There is now light at the end of the tunnel for markets with the highest supply and most negative rent growth, some of which are poised to set the pace of the recovery in multifamily values.”