The Mortgage Bankers Association and a broad coalition of financial services stakeholders recently launched a consumer awareness campaign to reach borrowers who have missed one or more mortgage payments as a result of the COVID-19 pandemic and may be eligible for forbearance assistance under the CARES Act or other forms of mortgage payment relief.

Tag: CARES Act

MBA, Trade Groups Ask Banking Agencies for TDR Relief

The Mortgage Bankers Association and more than a half-dozen industry trade groups asked federal banking agencies for guidance that loan modifications with terms longer than six months fall within the troubled debt restructuring relief provided by a recent Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working with Customers Affected by the Coronavirus.

Trevor Gauthier of ACES Quality Management on Early Payment Defaults

Trevor Gauthier is CEO of ACES Quality Management, formerly known as ACES Risk Management (ARMCO). He has more than 20 years of executive experience in leading growth initiatives for tech organizations and building teams both organically and through acquisition.

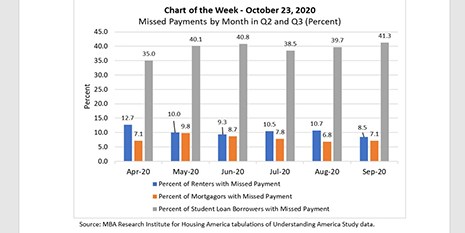

MBA Chart of the Week: Missed Payments By Month (Q2-Q3)

This week’s MBA Chart of the Week chart provides fresh third quarter 2020 insights on the Research Institute for Housing America’s special report released in September that highlighted household financial distress during the second quarter—the first three months of the pandemic.

Women in Leadership: An Interview with Cristy Ward of Mortgage Connect

Cristy and I sat down on October 13th and discussed the current state of the market and the trends we are observing in default management servicing.

ATTOM: Foreclosure Activity at Historic Lows as Moratorium Stalls Filings

ATTOM Data Solutions, Irvine, Calif., reported just 27,016 properties with foreclosure filings in the third quarter, down by 12 percent from the previous quarter and down by 81 percent from a year ago to the lowest level since it began tracking quarterly filings in 2008.

Women in Leadership: An Interview with Cristy Ward of Mortgage Connect

Cristy and I sat down on October 13th and discussed the current state of the market and the trends we are observing in default management servicing.

MBA Advocacy Update Sept. 14, 2020

With Congress (most notably the Senate) unable to reach consensus on the passage of any additional COVID-related economic relief, MBA sent a letter last Tuesday to the CFPB responding to the Bureau’s proposed rule revising the General QM definition. The letter explains MBA’s support for the price-based QM construct, and offers several recommendations to help ensure the rule meets its stated goals of robust consumer protections and broad access to sustainable credit.

MBA, Others Ask Congress to Avoid Adding New Credit Reporting Provisions

The Mortgage Bankers Association joined other associations to ask Congress to refrain from adding new credit reporting provisions that may negatively affect consumers as Congress considers new COVID-19 response legislation.

Zillow: Missed Rent Payments May Balloon as Boosted Aid Expires

Enhanced government unemployment aid expired last week, meaning more apartment renters could miss payments in coming months, said Zillow, Seattle.