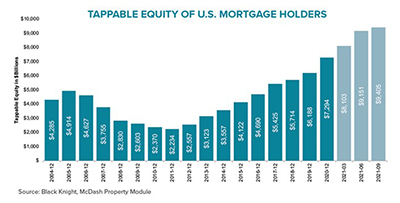

Black Knight, Jacksonville, Fla., said tappable equity – the amount available for homeowners to access while retaining at least 20% equity in their homes – rose by 32% over the past year, an increase of $2.3 trillion over the past year.

Tag: Black Knight

Industry Briefs Nov. 23, 2021: Fitch Says Banks Relatively Unscathed by Pandemic

Fitch Rating, New York, said global financial institutions’ credit ratings have been affected less severely by the pandemic than by the two previous crises this century.

Housing Market Roundup Nov. 9, 2021

We’re starting to get a lot of year-end housing market reports—which means we should be soon getting 2022 forecasts. Here is a roundup of recent reports to come across the MBA NewsLink desk:

Industry Briefs Nov. 5, 2021: Pretium Acquires Anchor Loans

Pretium, New York, a specialized investment management firm with $30 billion in assets, acquired Anchor Loans LP, a provider of financing to residential real estate investors and entrepreneurs

Industry Briefs Nov. 4, 2021: Pretium Acquires Anchor Loans

Pretium, New York, a specialized investment management firm with $30 billion in assets, acquired Anchor Loans LP, a provider of financing to residential real estate investors and entrepreneurs

Industry Briefs Nov. 3, 2021: Pretium Acquires Anchor Loans

Pretium, New York, a specialized investment management firm with $30 billion in assets, acquired Anchor Loans LP, a provider of financing to residential real estate investors and entrepreneurs

Industry Briefs Oct. 29, 2021

The Consumer Financial Protection Bureau and the Department of Justice, in cooperation with the Office of the Comptroller of the Currency, alleged Trustmark National Bank of Jackson, Miss., engaged in redlining against Black and Hispanic neighborhoods in Memphis, Tenn.

Housing Market Roundup: Oct. 25 2021

While we were in San Diego last week for the MBA Annual Convention & Expo, a number of housing reports came across the MBA NewsLink desk that we didn’t get a chance to cover. Here’s a quick summary of those reports:

Industry Briefs Oct. 20, 2021: SimpleNexus Acquires LBA Ware

SimpleNexus, Lehi, Utah, announced its acquisition of software firm LBA Ware, Macon, Ga. The transaction, SimpleNexus’ first, brings together 325 employees in 29 states to serve 425 distinct lender customers and dozens of mortgage technology integration partners.

Industry Briefs Oct. 13, 2021: Ginnie Mae Reports Record Fiscal Year MBS Issuance

Ginnie Mae, Washington, D.C., reported mortgage-backed securities issuance volume for fiscal year 2021 grew to a record $939 billion, with issuance for September coming in at $73 billion.