The Senate on Sunday passed a $740 billion reconciliation package. And last Monday, the VA released Circular 26-22-13, implementing new appraisal procedures for VA purchase loans.

Tag: Bill Killmer

MBA Advocacy Update Aug. 8 2022: Senate Passes Reconciliation Package

The Senate on Sunday passed a $740 billion reconciliation package. And last Monday, the VA released Circular 26-22-13, implementing new appraisal procedures for VA purchase loans.

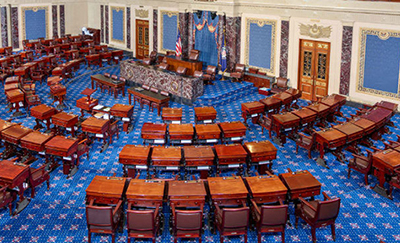

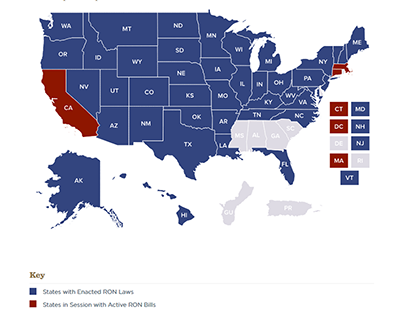

MBA Mortgage Action Alliance Call to Action Urges Senate Approval of RON Bill

Fresh off its victory last week, in which the House overwhelmingly approved legislation allowing notaries to perform Remote Online Notarization transactions nationwide, the MBA Mortgage Action Alliance set its sights on the next step: approval by the Senate.

MBA Mortgage Action Alliance Call to Action Urges Senate Approval of RON Bill

Fresh off its victory last week, in which the House overwhelmingly approved legislation allowing notaries to perform Remote Online Notarization transactions nationwide, the MBA Mortgage Action Alliance set its sights on the next step: approval by the Senate.

MBA Advocacy Update Aug. 1, 2022

Activities of note on Capitol Hill:

Last Wednesday night, Senator Joe Manchin, D-W.V., Senate Majority Leader Chuck Schumer, D-N.Y., and the White House reached agreement on a $740 billion reconciliation package, giving Senate Democrats another chance to enact broad climate and tax code changes before the end of Fiscal Year 2022.

MBA Advocacy Update Aug. 1, 2022

Activities of note on Capitol Hill:

Last Wednesday night, Senator Joe Manchin, D-W.V., Senate Majority Leader Chuck Schumer, D-N.Y., and the White House reached agreement on a $740 billion reconciliation package, giving Senate Democrats another chance to enact broad climate and tax code changes before the end of Fiscal Year 2022.

Mortgage Action Alliance Issues Immediate ‘Call to Action’: Support Nationwide Use of RON

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, issued a Call to Action Monday supporting bipartisan legislation that would allow notaries in all states to perform Remote Online Notarization transactions.

MBA Advocacy Update July 25 2022

Some activities of note during a busy week on Capitol Hill.

MBA Weighs In to Support Improving Access to the VA Home Loan Benefit Act

The Mortgage Bankers Association supports modernizing and streamlining the homebuying process for our nation’s veterans, including efforts related to home appraisals, MBA told Members of Congress.

MBA Advocacy Update July 18 2022

On Monday, MBA and a broad coalition of business interests sent a joint letter to congressional leaders stressing strong opposition to tax increases targeted at “pass-through” small business entities. Later in the week, Senator Joe Manchin (D-WV) also weighed in on tax matters, reportedly casting serious doubt on the future of tax provisions as part of any “slimmed-down” Build Back Better reconciliation package.