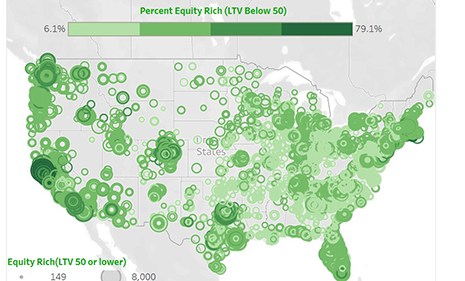

ATTOM Data Solutions, Irvine, Calif., said equity-rich properties in the U.S. now outnumber those considered seriously underwater by a nearly 5-1 margin.

Tag: ATTOM Data Solutions

ATTOM: ‘Zombie’ Properties Diminish Amid Foreclosure Moratorium

ATTOM Data Solutions, Irvine, Calif., reported 200,065 properties in the process of foreclosure in the fourth quarter, down by 7.3 percent from the third quarter. Of those, then number sitting empty—also known as “zombie” foreclosures, fell by 4.4 percent to 7,612.

77% of Metros Post Double-Digit Home Price Gains in 3Q

ATTOM Data Solutions, Irvine, Calif., said profits for home sellers nationwide continue to hit high points despite the economic distress caused by the coronavirus pandemic.

ATTOM: Foreclosure Activity at Historic Lows as Moratorium Stalls Filings

ATTOM Data Solutions, Irvine, Calif., reported just 27,016 properties with foreclosure filings in the third quarter, down by 12 percent from the previous quarter and down by 81 percent from a year ago to the lowest level since it began tracking quarterly filings in 2008.

ATTOM: Northeast Housing Markets at Highest Risk of Pandemic Economic Impact

ATTOM Data Solutions, Irvine, Calif., said its third-quarter Special Report shows pockets of the Northeast and Mid-Atlantic regions most at risk, with clusters in the New York City, Baltimore, Philadelphia and Washington, D.C. areas – while the West and now Midwest are less vulnerable.

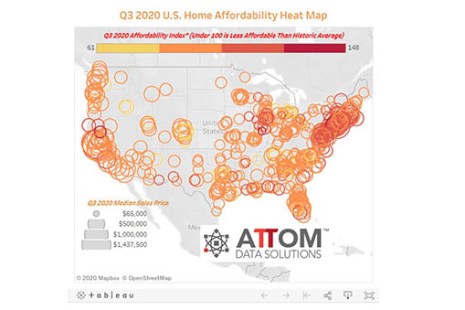

Homeownership Less Affordable for Average Workers Across U.S.

ATTOM Data Solutions, Irvine, Calif., released its third-quarter U.S. Home Affordability Report, showing median home prices of single-family homes and condos in the third quarter are less affordable than historical averages in 63 percent of counties with enough data to analyze, up from 54 percent a year ago.

Housing Report Roundup

Welcome to the Friday Housing Report Roundup. Click on the link to see what’s happening.

Properties with Foreclosure Filings Uptick as Pandemic Continues

ATTOM Data Solutions, Irvine, Calif., reported nearly 10,000 U.S. properties with foreclosure filings in August, up 11 percent from a month ago but down 81 percent from a year ago.

Properties with Foreclosure Filings Uptick as Pandemic Continues

ATTOM Data Solutions, Irvine, Calif., reported nearly 10,000 U.S. properties with foreclosure filings in August, up 11 percent from a month ago but down 81 percent from a year ago.

Industry Briefs Sept. 4, 2020

CoreLogic, Irvine, Calif., issued a new data analysis estimating insured wind and storm surge losses for residential and commercial properties in Louisiana and Texas at between $8 billion and $12 billion, with insured storm surge losses estimated to contribute less than $0.5 billion to this total.