Homeownership Less Affordable for Average Workers Across U.S.

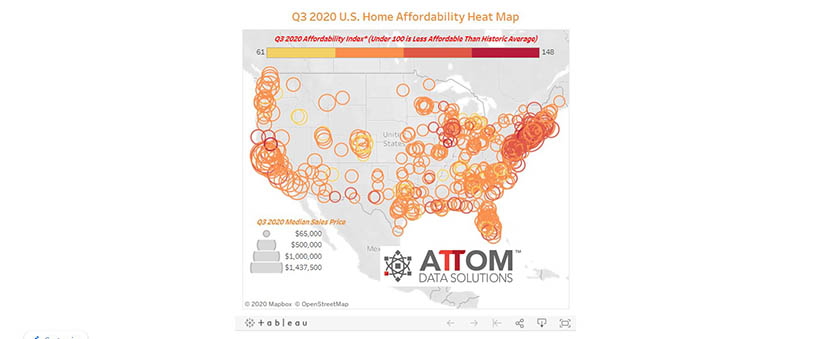

ATTOM Data Solutions, Irvine, Calif., released its third-quarter U.S. Home Affordability Report, showing median home prices of single-family homes and condos in the third quarter are less affordable than historical averages in 63 percent of counties with enough data to analyze, up from 54 percent a year ago.

Compared to historical levels, 308 of the 487 counties analyzed in the third quarter are now less affordable, up from 262 of the same group of counties a year ago. The fallback has come as spikes in single-family home prices – occurring despite economic troubles related to the ongoing coronavirus pandemic – have outpaced the impact of increasing wages and declines in mortgage rates to historic lows.

The report said costs associated with median-priced homes are unaffordable for average wage earners in 61 percent of the counties in the report during the third quarter. That means that those expenses consume more than 28 percent of average wages from county to county across the nation.

“In a year when nothing is normal, owning a single-family home has become less affordable to average wage earners across the U.S., despite conditions that would seem to point the opposite way,” said Todd Teta, chief product officer with ATTOM Data Solutions. “Wage are up and mortgage rates are down to rock-bottom levels, which should work in favor of home buyers. On top of that, the American economy has suffered greatly since the Coronavirus pandemic began surging over the Winter – a plight that normally would drop home demand and home prices. But those same low mortgage rates, along with other factors, have led a lot of buyers into the market chasing a reduced supply of homes. The result is price hikes have raced past the impact of wages and mortgage rates.”

The report said the largest of the 299 counties in the report where the median home price is not affordable for average wage earners in the third quarter, based on the 28-percent benchmark, include Los Angeles County; Maricopa County (Phoenix), Ariz.; San Diego County; Orange County, Calif.; and Miami-Dade County, Fla.

The 188 counties with affordable median-priced homes in the third quarter for average local wage earners (39 percent of the 487 counties analyzed) include Cook County (Chicago), Ill.; Harris County (Houston), Texa; Philadelphia County, Pa.; Hillsborough County (Tampa), Fla.; and Cuyahoga County, (Cleveland), Ohio.

The report said an annual wage of more than $75,000 is needed in the third quarter to afford the typical home in 114, or 23 percent, of the 487 markets in the report. It said 308 (63 percent) are less affordable in the third quarter than their historic affordability averages, up from 54 percent of counties in both the previous quarter and a year ago.