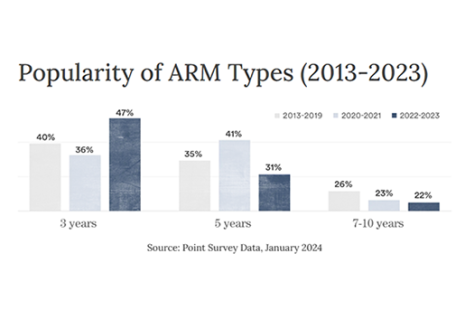

More than two-thirds of homeowners who have taken out an adjustable-rate mortgage in the past 10 years regret it, according to a new study from home equity investment platform Point, Palo Alto, Calif.

Tag: Adjustable-Rate Mortgages

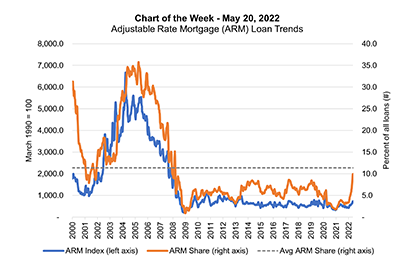

MBA Chart of the Week May 20, 2022: ARM Loan Trends

The recent increase in the adjustable-rate mortgage share of applications has caught the attention of market participants and the media. The ARM share has increased from 3.1 percent in the first week of January to 10.3 percent as of the week ending May 13, peaking at 10.8 percent the week prior.

MBA, Trade Groups Urge HUD to Issue ‘Clear Roadmap’ for Servicers in LIBOR Transition

As HUD considers changes to its index for FHA-insured adjustable-rate mortgages away from LIBOR, the Mortgage Bankers Association and other industry trade groups urged the Department to issue a clear roadmap for servicers of FHA-insured ARMs, including specification of a replacement comparable index or indices for existing mortgages, as well as guidance on communications with borrowers.

Sherri Carr: A New Solution for Variable-Rate Loan Products

As competition heats up in the face of the anticipated slowdown in mortgage demand, adjustable-rate loans will become an important competitive tool for many loan originators.

Sherri Carr: A New Solution for Variable-Rate Loan Products

As competition heats up in the face of the anticipated slowdown in mortgage demand, adjustable-rate loans will become an important competitive tool for many loan originators.

Sherri Carr: A New Solution for Variable-Rate Loan Products

As competition heats up in the face of the anticipated slowdown in mortgage demand, adjustable-rate loans will become an important competitive tool for many loan originators.

Sherri Carr: A New Solution for Variable Rate Loan Products

. As competition heats up in the face of the anticipated slowdown in mortgage demand, adjustable-rate loans will become an important competitive tool for many loan originators.

Sherri Carr: A New Solution for Variable Rate Loan Products

. As competition heats up in the face of the anticipated slowdown in mortgage demand, adjustable-rate loans will become an important competitive tool for many loan originators.

Mortgage Applications Tumble in MBA Weekly Survey

Mortgage applications took a tumble this week as key interest rates jumped to their highest level since January amid increased economic turmoil, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending March 20.

Mortgage Applications Up Again in MBA Weekly Survey

Mortgage applications rose for the third straight week, continuing a solid start to the new year despite a slight increase in interest rates, the Mortgage Bankers Associations morning in its Weekly Mortgage Applications Survey for the week ending February 7.