Point Survey: 70% of Homeowners With Adjustable-Rate Mortgages Regret It

(Illustration courtesy of Point)

More than two-thirds of homeowners who have taken out an adjustable-rate mortgage in the past 10 years regret it, according to a new study from home equity investment platform Point, Palo Alto, Calif.

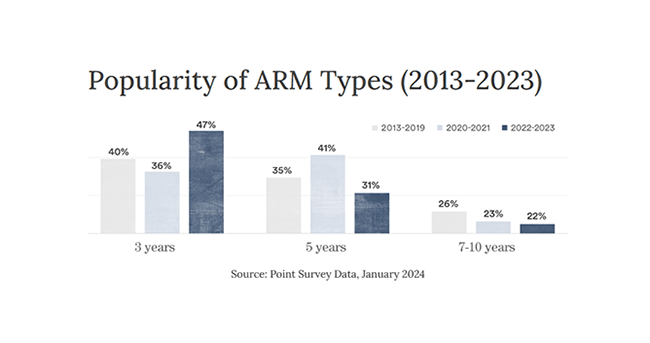

Adjustable-rate mortgages typically offer lower interest rates during the introductory period than fixed-rate mortgages, but unlike fixed-rate mortgages, ARM rates adjust to market levels once the initial introductory period ends. The report noted many homeowners who took out an ARM within the last 10 years may be approaching the end of their fixed-rate period at a time when interest rates are at their highest levels in decades. “As a result, many ARM holders can expect a higher monthly mortgage payment now than they had three, five, seven or 10 years ago,” the report said.

Despite increasing payments and the fact that many of the homeowners surveyed said they regret getting their ARM in the first place, an overwhelming majority 82% of those still in the fixed-rate period said they plan to keep it even after the fixed-rate period ends.

“Homeowners are living in a very different economic environment than just a few years ago – high inflation has made everyday goods more expensive than ever,” said Eddie Lim, co-founder and CEO of Point. “Given all these factors, it’s a less-than-ideal time to incur a sudden increase in monthly mortgage obligations.”

Among the survey respondents who are in the fixed-rate period and said they plan to exit their ARM, 39% said they plan to refinance into a fixed-rate mortgage. Of those homeowners, 71% said they don’t know if their monthly mortgage payment will increase or decrease after a refinance. Additionally, those who elect to refinance into a fixed-rate mortgage in the current rate environment would still be contending with historically high rates while also adding time to their loan.

“Refinancing to get out of a high-interest, fluctuating mortgage may seem like the best option at first glance, but in reality, it could cost homeowners more in the end, depending on their situation,” Lim added. “No matter what kind of decision a homeowner needs to make, it pays – literally – to consider all of your options.”