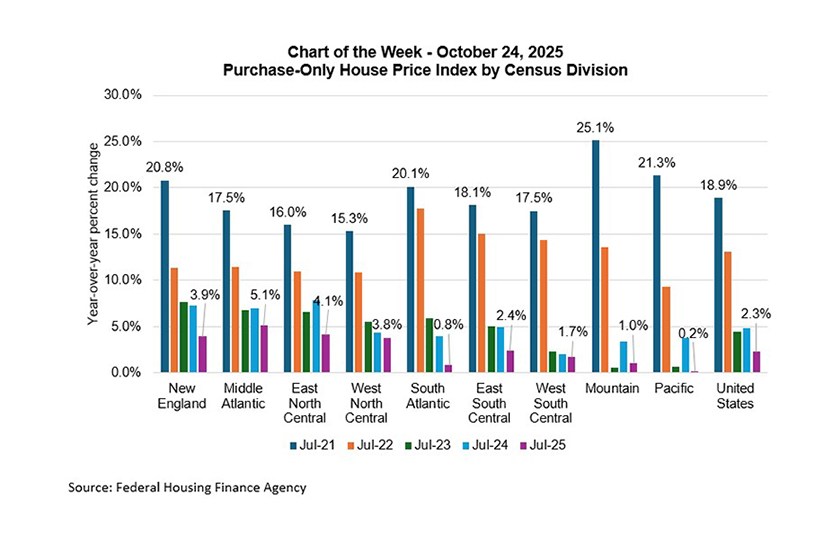

Chart of the Week: Purchase-Only House Price by Census Division

Home price growth in many markets around the U.S. is slowing. Based on July 2025 data from the Federal Housing Finance Agency’s House Price Indexes (HPI), year-over-year home price growth in the U.S. was 2.3% relative to July 2024. Comparing July data from the past five years, the nine Census divisions show slowing home price growth relative to 2021 peaks, but there is significant variation in current growth rates relative to the national average, due to unique state and local market characteristics.

For example, the Mountain and Pacific regions showed the slowest price growth in July 2025, at 1% and 0.2%, respectively, a rapid deceleration from price growth of 25.1% and 21.3% in 2021. In terms of monthly price changes, both divisions have seen decreases in five of the past six months. The South Atlantic division, with a growth rate down to 0.8% from a peak of more than 20%.

Growing housing inventory in markets such as Florida, Colorado, and Arizona has led to annual price declines. Increased levels of new construction in recent years helped ease inventory shortages, but now that housing demand is weaker, the elevated level of unsold inventory is putting downward pressure on prices. Additionally, Florida’s condo market has been adversely affected by rapidly rising HOA and insurance costs, leading to a drop in demand and increased unsold inventory.

Conversely, tight inventory and challenges to homebuilding, such as high input costs and stricter regulation, slow the pace of price deceleration and keep price growth above the national average in states such as New York, Connecticut, Illinois, and New Jersey. As a result, the New England, Mid Atlantic, and East North Central divisions saw less easing in annual home price growth relative to other parts of the country.

Deceleration in home price growth is likely to continue, following four consecutive month-over-month price declines and gradually increasing housing inventory growth. FHFA’s quarterly HPI series showed that in the second quarter of 2025, more than half of the top 100 metro areas experienced home price declines. The MBA’s forecast is for annual home price growth to ease to 1% by the end of 2025 and a decline of 0.3% for 2026, with several quarters of negative price growth between 2026 and 2027. Slower or declining home price growth will help ease some of the affordability challenges the housing market has been experiencing but will also make it more difficult for borrowers who fall behind in their payments to sell their homes, resulting in more mortgage delinquencies.

-Joel Kan (jkan@mba.org)