AI Alone Won’t Save Us: Why Data is the Real Fuel for Mortgage Reinvention

“May you live in interesting times” has been said during numerous economic cycles by CEOs and advisors for decades. Today “interesting times” are characterized by advancements in artificial intelligence (AI), continuous and rapid cycle innovations, and consumer economic and behavioral shifts. As MBA members travel home from Las Vegas from the Annual convention, the challenge will be how to turn “interesting” into “profitable” across markets, policies, and demographics, which have remained tepid since post-Covid.

The realities remain—low origination volumes, high interest rates, and cautious consumers—and no amount of advanced technology can remedy these. Combine these realities with consumer trust in financial institutions near historic lows, organizations are continuing to look for differentiations and models that change borrower experiences and mindsets. Is there a roadmap? Has the organization and industry modernized its data to anticipate the needs future borrowers will seek out? What reinventions will be demanded within the organization, across its partners, and from technology vendors?

While I cannot offer a prescriptive, magical AI solution (so common nowadays), there are steps that should be taken which when linked together may provide a roadmap to improved margins and market differentiation. The list below is both foundational and transformative when taken holistically—not as “one-and-done’s”:

- Attack all exceptions with rigor and tenacity: Is there a priority order? Can we quantify the cost of exceptions and when they occur during the lending cycle? Do we have the robust data to support improvements, and if not, what needs to be done? Rationale: For IMB’s and using the MBA Q4 2024 data, the average per-loan production costs rose to $11,230 up from $10,716 in the prior quarter with only 61% showing pre-tax profitability.

- Analyze and compress cycle times: If loan volumes dropped another 15%, could your cost structure absorb it? If there are manual interventions or “human-in-the-(AI) loop” processes, what time and efficiencies could be gained by additional improvements? Are the improvements about the systems (i.e., system architectures) or within the data (i.e., data architectures and governance)? Rationale: Industry baseline remains over 45 days, but the days over or under can impact pull-through / abandonment rates resulting in improved customer loyalty, overhead savings, and stronger pipelines.

- Leveraging regulatory compliance and AI uniquely: Can you answer using your regulatory processes and technology, “where does our ‘check-in-the-box” compliance solutions double as exception management? Is the data used in regulatory or investor reporting directly auditable back to the individual data elements—or are we relying on steps in between that loses data lineage? The “swarm” of AI solutions show great promise, but is it scalable? If we change the data, what happens to the “trained” AI solutions being piloted—and what is the cost? Rationale: AI and compliance are all about the data. If the data is contained with custom or siloed vendor solutions, then how can it be “submitted once, used everywhere” versus “lift, shift, and manipulate” traditionally common across the industry?

- Data Modernization and M&A Events: Data is the fuel for all solutions of the future—AI will adapt the processes, but it needs data for training, learning, and retraining. Beyond adherence to standards, what data does your operations need to improve cycle times and reduce exceptions? When was the last time you performed an end-to-end data audit where you rationalized data sources, uses, and interfaces? Are the data pipelines able to support newer data weaves that extend traditional API structures? Who is leading the data modernization efforts and what rigor, disciplines, and strategies will be needed to compete in the “next” cycle? Rationale: Much has and will continue to change when it comes to data—structured blends with unstructured and is supported by semi-structured and now is enjoined with synthetic. What data “glue” will be used to link these comprehensively together, skill sets, governance, and oversight? Advanced AI solutions—Gen AI, retrieval augmented generation (RAG), Agentic AI, and now Agentic RAG—are all data trained solutions with industry applications, can we map where “our” data fits into these rapidly emerging solution sets?

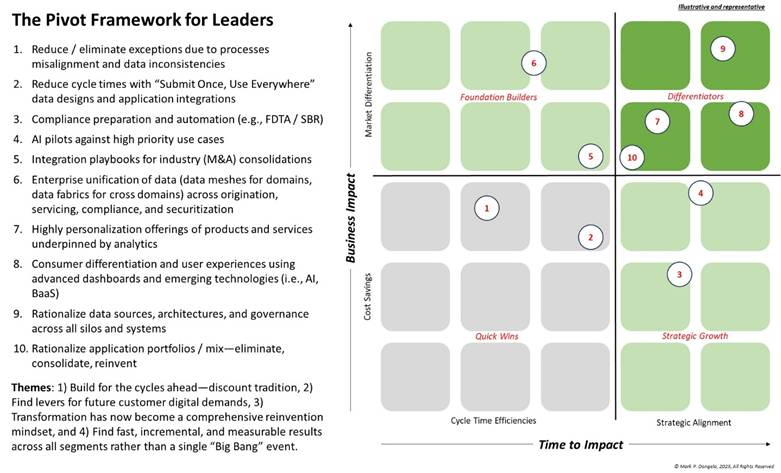

When it comes to addressing and adapting to the new market and technology realities, the above categories create a multi-modal approach—yet there needs to be discrete execution to get quick wins and continued momentum. Figure 1 illustrates representative programs that when stacked together create a plan-of-attack that not only delvers profitability, but will also ensure adaptability during these “interesting times.”

Figure 1—A Pivot Framework for Continuous Reinvention

When organizations and their leaders embrace the market realities—rising costs, tight margins, and lower volumes—additional programs and solutions moving forward can easily be mapped to a Pivot Framework as illustrated. Today it is about looking for measurable and achievable “deltas” using focused sprints, automations, and advancing data solutions (e.g., data meshes for domains, data fabrics for enterprise, and weaves for data ingestion).

And most importantly, using the direct to the bottom line approaches support the inclusion of AI, upcoming regulatory compliance (e.g. FDTA / SBR), and expand credibility and trust with digitally native consumers looking for consistency and differentiation.

As 2026 rises, new demands that include FDTA will begin to impact operations for the next 2 to 3 years. The FDTA (tied to ULDD/HDMA obligations) at is core requires machine readable data—not PDF’s that have been scanned—all against the premise of submit once to all agencies data and reuse continually. The implication of this approach, while fueling a reduction of overhead and fragmented regulatory technology (as FDTA covers nine distinct government agencies), means that any data quality errors either sent to agencies directly or to partners will be visible immediately.

Why does this matter? Whereas the mortgage industry has been a leader in data standardization, that represents only a first step in broad, cross-industry data modernization efforts that move beyond digitizing paper-based forms and systems. Native digital is now moving from the consumer to the regulators and with it comes new demands, requirements, and data competencies.

We can discuss the swarm of AI solutions all pervading all aspects of operational systems and decision support capabilities. However, the foundation for everyone begins with data modernization. Therefore, when leaders begin to book efficiencies and reduce cycle times, those “wins” will be short lived if their organizations fails to address the fuel for the gains—the unglamorous and mundane discussions about data.

AI is not a panacea for all the problems—right now is still is a “grand experiment” being piloted and rolled out in segments where it can yield positive results and understand its impact on organizational dynamics, skill sets, process reinvention, security, and privacy. AI has not to date, had a great ROI when it comes to broad deployment and scalability demands.

The months ahead will not reward organizations waiting for a “perfect” AI solution, nor those that mistake digitization for modernization. Success will depend on leaders who recognize that sustainable profitability begins with disciplined data practices, deliberate reinvention, and pragmatic adoption of emerging tools. For mortgage professionals, the question is no longer if change is coming—it is how quickly you can adapt and turn today’s “interesting times” into tomorrow’s competitive advantage.

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes submissions from member firms. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)