Trepp: CMBS Delinquency Rate Falls for the First Time Since February

(Image courtesy of Trepp)

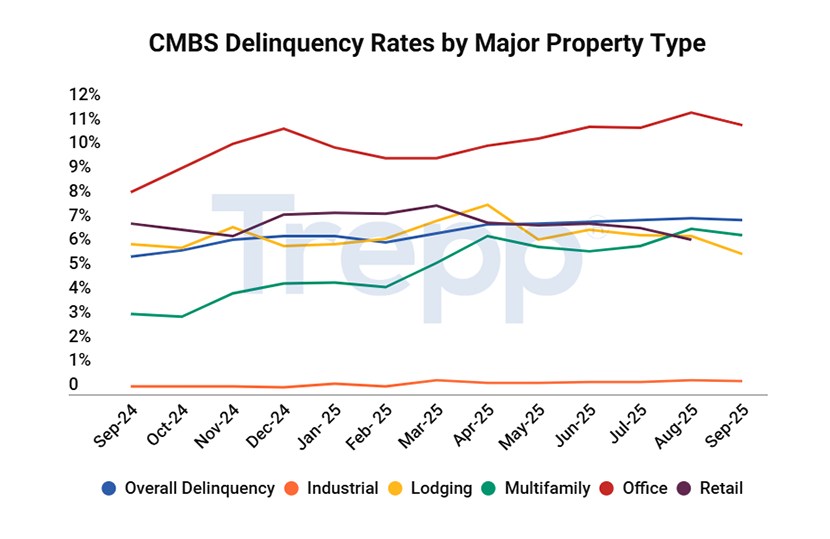

Trepp, New York, released the September CMBS Delinquency Rate, finding that it fell six basis points to 7.23%. That’s the first drop since February.

Year-over-year, the overall U.S. CMBS delinquency rate is up 153 basis points.

In September, the overall delinquency balance was $43.5 billion, down from $44.1 billion in August. The outstanding balance was $601.3 billion, down from $604.6 billion.

Through the month, $3.7 billion of overall loans became newly delinquent and $3.9 billion were cured.

If Trepp included loans that are beyond their maturity date but current on interest, the rate would be 9.48%. That’s up 17 basis points from August.

The percentage of loans in the 30-days delinquent category is 0.48%, up seven basis points from August.

The percentage of loans that are seriously delinquent–defined as 60-plus days delinquent, in foreclosure, REO or non-performing balloons, is 6.75%, down 13 basis points.

If defeased loans were taken out of the equation, the overall headline delinquency rate would be 7.43%.

The majority of property types saw their delinquency rates fall in September. Only retail saw an increase, up 34 basis points to 6.76% after a spate of declines.

Lodging fell 73 basis points from 6.54% to 5.81%, its lowest rate since March 2024.

Office fell from 11.66% to 11.13%. Multifamily fell 27 basis points from 6.86% to 6.59%. Industrial’s delinquency rate fell four basis points from 0.6% to 0.56%.

The CMBS 2.0+ delinquency rate fell six basis points to 7.14%.