Rate-Lock Activity Remains Strong, Optimal Blue Reports

(Illustrations courtesy of Optimal Blue)

Rate-lock activity remained strong in October despite seasonal cooling, according to Optimal Blue, Plano, Texas.

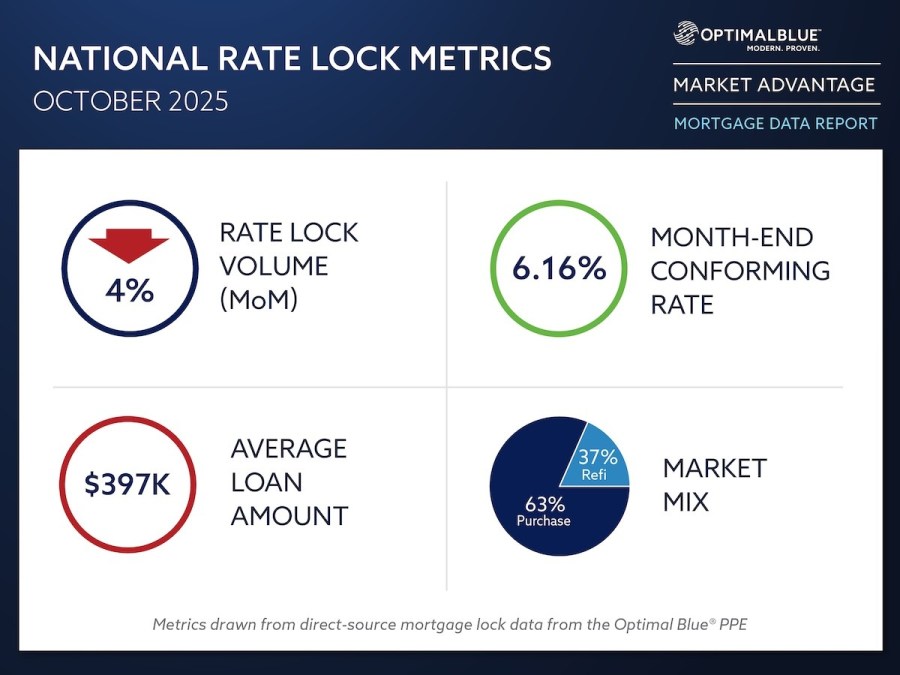

The latest Market Advantage report found that total lock volume fell 4.2% month over month from September’s peak but was still up 18% year over year as borrowers responded to improving affordability and narrower rate spreads.

Purchase locks declined just 1.5% in October, in line with typical seasonal patterns, while refinance lending remained a key driver of activity, the report said. Rate-and-term refinances fell 14% from September but stayed up 143% year over year and cash-out refinances rose 6% month over month and 29% year over year.

“October’s data speaks to the market’s resilience,” said Mike Vough, head of corporate strategy at Optimal Blue. “Purchase activity held steady and refinance demand – particularly cash-outs – remained strong. Even after September’s record pace, October delivered another standout month for originations.”

The Optimal Blue Mortgage Market Indices (OBMMI) 30-year conforming fixed rate – the benchmark for CME Group’s Mortgage Rate futures – dropped another 16 basis points to 6.16%, marking its lowest level since late 2023.

The report said lenders continued to strengthen execution strategies in the secondary market during October. Sales to agency mortgage-backed securities climbed 400 basis points to 46%, extending a multi-month trend of large-lender securitization growth.

“October’s secondary market data reflected clear strength in execution,” Vough noted. “Lenders leaned further into MBS sales and maintained access to top-tier pricing, signaling disciplined hedging and growing investor confidence. With securitization share and pricing quality both on the rise, large lenders appear well positioned to sustain profitability as production remains steady.”

Optimal Blue also produced a podcast episode that discusses the Market Advantage report’s findings.