TransUnion: Mortgage Originations, Delinquencies Both Up

(Image courtesy of TransUnion; Breakout image courtesy of Tina Nord/pexels.com)

TransUnion, Chicago, released its Q1 2025 Credit Industry Insights Report, finding that mortgage originations saw an annual increase at the end of last year.

Mortgage originations were up 30.2% year-over-year in Q4 2024 (the most recent data available), at 1.2 million. The majority–78%–were purchase originations. And, purchase originations specifically were up 15.4% year-over-year, in the first annual increase since Q2 2021.

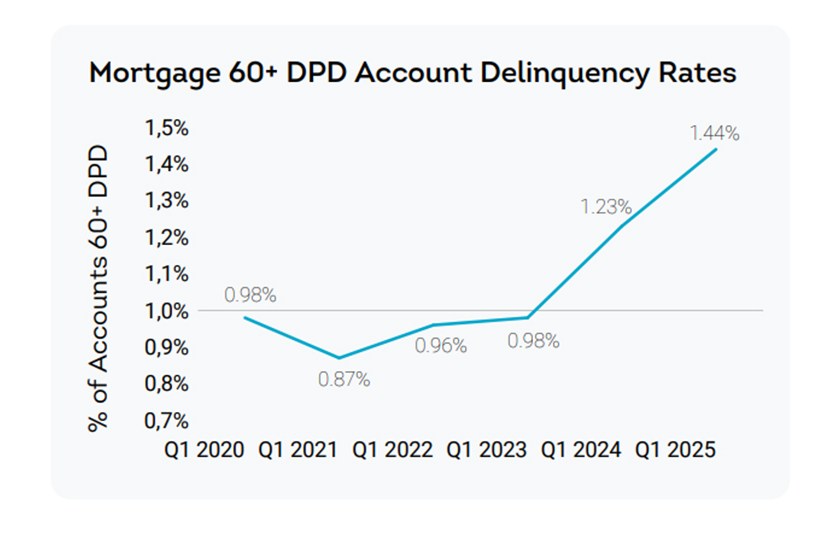

However, 60+ days past due account-level delinquencies ticked up year-over-year in Q1 2025 to 1.44%–although TransUnion noted that level remains low compared to historical data.

“Due to the anticipated impacts of announced tariffs on near-term inflation, mortgage rates are expected to remain elevated above 6% in the next quarter. Without a significant decrease in mortgage rates, origination activity for both purchases and refinances is likely to remain subdued,” said Satyan Merchant, Senior Vice President, Automotive and Mortgage Business Leader at TransUnion. “Although the upward trend in mortgage delinquencies continues, the levels remain below long-term averages, and far below historical highs during the Great Financial Crisis, but still warrant close monitoring.”

Looking at the credit landscape more broadly, while total balances across all consumer credit products rose in Q1, when adjusting for inflation, total balance growth in real dollar terms was fairly modest–at around 3%.

“Our latest analysis reveals a picture of credit usage that goes beyond simply an increase in total balances. When we account for the recent period of higher inflation, the rise in balances suggests that consumers in most risk tiers are not over-extended. In fact, many consumers experienced significant income gains since 2019, which have enabled most borrowers to effectively manage their debt levels,” said Jason Laky, Executive Vice President of Financial Services for TransUnion.