Mortgage Application Payments Increase in April

(Image courtesy of MBA)

Homebuyer affordability declined slightly in April, with the national median payment applied for by purchase applicants increasing to $2,186 from $2,173 in March. This is according to the Mortgage Bankers Association’s (MBA) Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time – relative to income – using data from MBA’s Weekly Applications Survey (WAS).

“Homebuyer affordability conditions declined somewhat in April and remain elevated overall. Economic uncertainty and high mortgage rates continue to weigh on prospective buyers’ decisions on whether to enter the housing market,” said Edward Seiler, MBA’s Associate Vice President, Housing Economics, and Executive Director, Research Institute for Housing America. “Even with the increase in mortgage rates over the month, the median purchase application loan amount decreased slightly to $328,932, indicating that home prices are moderating. Moderating home-price growth, and the overall trend of more inventory, are positives for housing this summer.”

An increase in MBA’s PAPI – indicative of declining borrower affordability conditions – means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI – indicative of improving borrower affordability conditions – occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

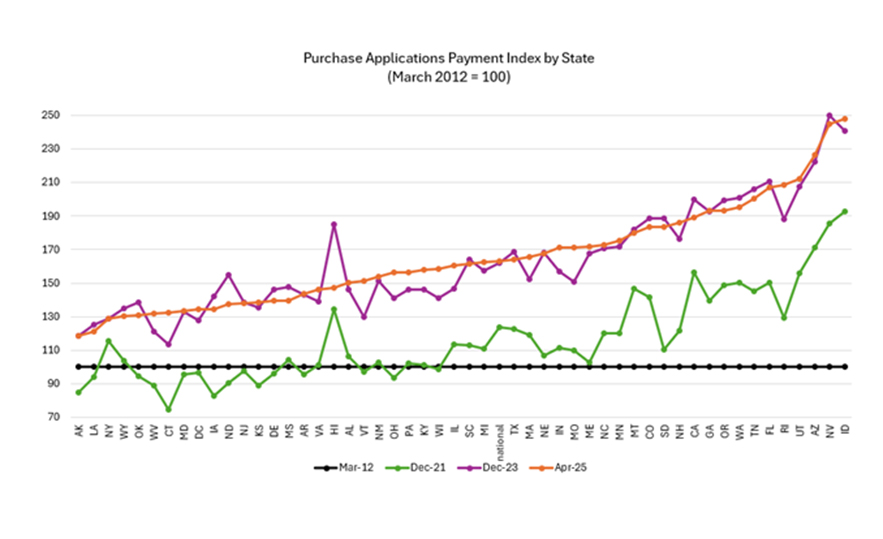

The national PAPI (Figure 1) decreased 0.6% to 163.0 in April from 164.1 in March. Median earnings were up 4.8 percent compared to one year ago, and while payments decreased 3.1%, the significant earnings growth means that the PAPI is down (affordability is higher) 8.4% on an annual basis. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment decreased to $1,497 in April from $1,499 in March.

MBA’s national mortgage payment to rent ratio (MPRR) increased from 1.44 at the end of the fourth quarter (December 2024) to 1.48 at the end of the first quarter (March 2025), meaning mortgage payments for home purchases have increased relative to rents. The Census Bureau’s HVS national median asking rent in first-quarter 2025 decreased to $1,468 ($1,475 in fourth-quarter 2024). The 25th percentile mortgage application payment to median asking rent ratio increased to 1.02 in March (0.99 in December 2024).

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey increased to $2,306 in April from $2,288 in March.

Additional Key Findings of MBA’s Purchase Applications Payment Index (PAPI) – April 2025

• The national median mortgage payment was $2,186 in April 2025—up $13 from March. It is down by $70 from one year ago, equal to a 3.1% decrease.

• The national median mortgage payment for FHA loan applicants was $1,895 in April, up from $1,872 in March and down from $1,955 in April 2024.

• The national median mortgage payment for conventional loan applicants was $2,206, up from $2,200 in March and down from $2,271 in April 2024.

• The top five states with the highest PAPI were: Idaho (247.8), Nevada (244.8), Arizona (226.6), Utah (212.1), and Rhode Island (208.7).

• The top five states with the lowest PAPI were: Alaska (118.4), Louisiana (121.2), New York (128.9), Wyoming (130.4), and Oklahoma (130.6).

• Homebuyer affordability increased for Black households, with the national PAPI decreasing from 161.8 in March to 160.7 in April.

• Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 155.5 in March to 154.5 in April.

• Homebuyer affordability increased for White households, with the national PAPI decreasing from 165.7 in March to 164.7 in April.

About MBA’s Purchase Applications Payment Index

The Mortgage Bankers Association’s Purchase Applications Payment Index (PAPI) measures how new mortgage payments vary across time relative to income. Higher index values indicate that the mortgage payment to income ratio (PIR) is higher than in a month where the index is lower. Contrary to other affordability indexes that make multiple assumptions about mortgage underwriting criteria to estimate mortgage payment level, PAPI directly uses MBA’s Weekly Applications Survey (WAS) data to calculate mortgage payments.

PAPI uses usual weekly earnings data from the U.S. Bureau of Labor Statistics’ Current Population Survey (CPS). Usual weekly earnings represent full-time wage and salary earnings before taxes and other deductions and include any overtime pay, commissions, or tips usually received. Note that data are not seasonally adjusted.

MBA’s Builders’ Purchase Application Payment Index (BPAPI) uses MBA’s Builder Application Survey (BAS) data to create an index that measures how new mortgage payments vary across time relative to income, with a focus exclusively on newly built single-family homes. As with PAPI, higher index values indicate that the mortgage payment to income ratio (PIR) is higher than in a month where the index is lower. To create BPAPI, principal and interest payment amounts are deflated by the same earnings series as in PAPI.

The rent data series calculated for MBA’s national mortgage payment to rent ratio (MPRR) comes from the U.S. Census Bureau’s Housing Vacancies and Homeownership (HVS) survey’s median asking rent. The HVS data is quarterly, and as such, the mortgage payment to rent ratio will be updated quarterly. March 2025 MPRR data was not included in this release.

For additional information on MBA’s Purchase Applications Payment Index, click here.