Mark Dangelo: The Great Equalizer for Uncertain, Changing Times

Confusion surrounding AI is growing, as are indicators of uncertainty surrounding housing and mortgage markets. For executives, the challenges during this period of exponential AI capabilities is “Where do we begin?” To understand how to move forward, it is helpful to comprehend the AI differences, their applicability, and a cohesive plan of attack.

For over a decade within the mortgage and finance industries, competitive strategy started with “technology” solutions especially when it came to efficiency or regulatory technology offerings. Now as artificial intelligence explodes with capabilities and specialization, there is a rapid shift underway. While siloed data and standards across applications have been important for over 25 years, the speed by which AI use case solutions are being developed and deployed is placing new requirements on both data validity and systems development.

Why? Is it because the industry was expecting up to a 20% increase in loan volumes—or because political decisions and tariffs are now tempering anticipatory rebounds? Is it consumer sentiment and inflationary pressures, which have changed the economics of home ownership? Perhaps it resides with the huge 15-year increase in home insurance and property taxes that in some cases exceed the monthly mortgage payments (>30% of income)? Additionally, some industry experts ascertain that after a three-decade low of market volumes, the corporate ability to invest (e.g., on-premises, cloud, or Hybrid) is limited resulting in “making do” with legacy capabilities.

The Next-Gen Approach

With the rapid adoption of AI, technology alone cannot provide the differentiators nor profitability advantages when it comes to pricing efficiencies, system integrations, or common data governance. Today, and moving forward given what we can now project, executive leadership should include as their governing principles:

• Design data architectures before technology solutions using auditable, traceable, and reusable systems of record (SOR) as part of a robust and adaptable data architecture with active governance

• Leverage AI as the equalizer, driving operational efficiencies, mitigating risks, and identifying new lending segments.

• Prioritize customer retention using hyper-personalization and proactive financing solutions.

• Adopt new operating models using data to project profitability, risk management, and innovative capabilities (starting with data reusability with domains and enterprise fabrics).

• Anticipate regulatory uncertainty at both a federal and local level including the potential of GSE privatization spurring the rise of non-government MBS securities.

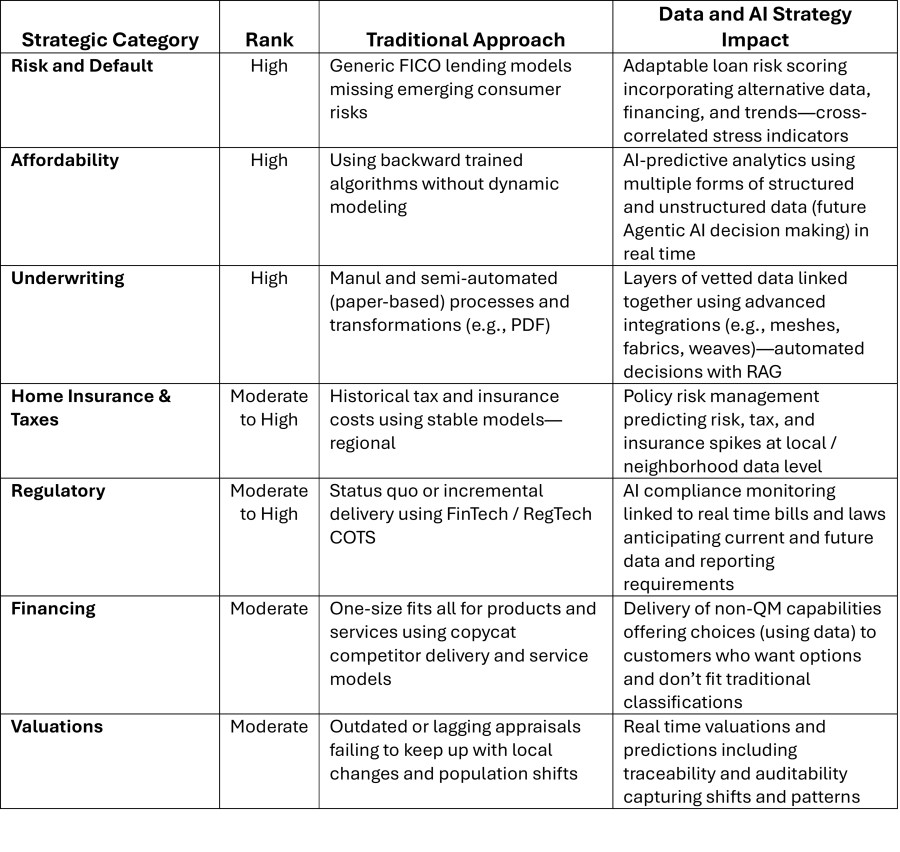

Using these changes and challenges to traditional ideas of technology and data, there are granular cases and categories that leaders must account for even with limited free capital and rising market uncertainty.

What the above table illustrates (e.g., implications) with representative use case comparisons is that adoption of AI is not about just technology. There are skills, organizational, and oversight demands that were traditionally siloed in practice, but now with adaptable application intelligence, the underlying data driving AI is more critical than the applications. The result is a comprehensive rethinking of how data is identified, manipulated, and shared (e.g., cascading, federated, democratized) across AI solutions.

Understand the Applicability

However, before teams rush into data ideations for the industry categories, it requires understanding the application of increasingly specialized AI solutions within three primary classifications:

• Generative AI (GenAI) for producing added content, insights, and simulations using large language models (e.g., GPT) for querying and linking diverse content.

• Retrieval Augmented Generation (RAG) which will build upon GenAI but include real time data retrieval from internal systems to deliver improved outputs across customers, functional applications, and industry.

• Agentic AI (AAI) being the most advanced current solution breaking down requirements into compartmentalized capabilities that can be dynamically linked together and learn from its outputs. The goal is to use these capabilities to build multi-step tasks that make decisions autonomously (humans not necessarily required).

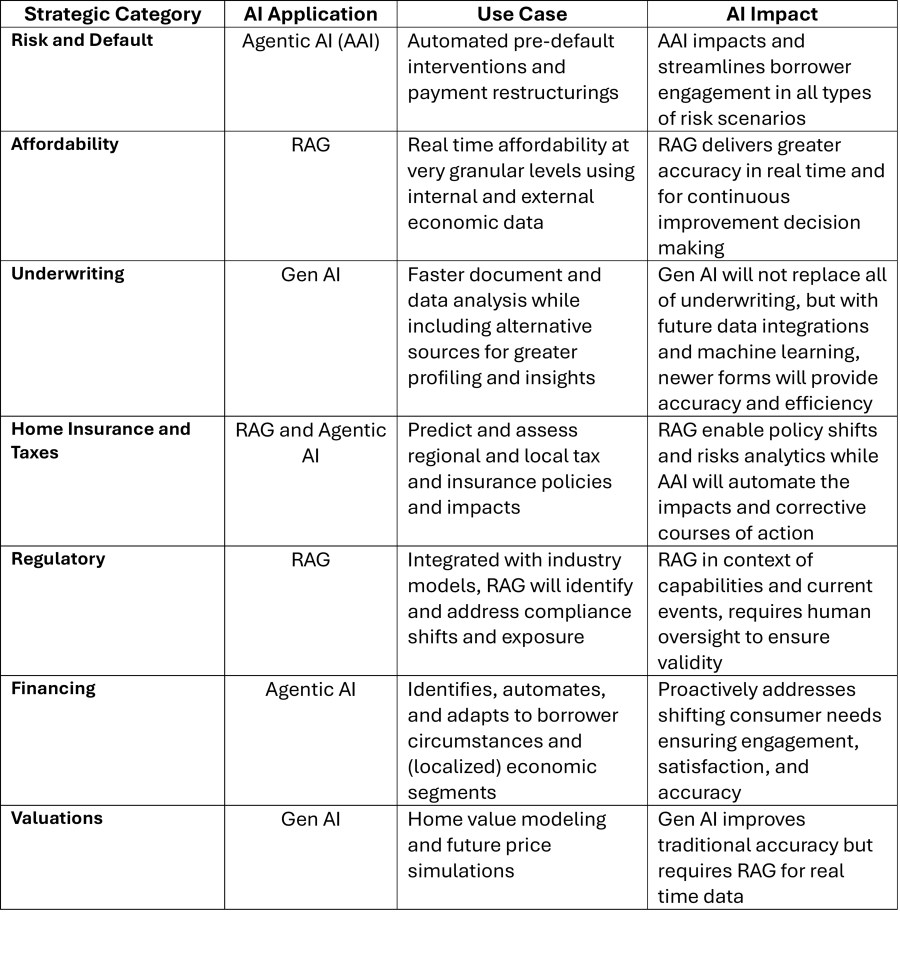

The following table, using the above classifications, presents representations of potential use cases and its deployment for each category of AI.

AI data-driven solutions can help lenders, servicers, and real estate professionals deliver efficiencies, reduce risks, improve auditability, expand borrower engagement, and address uncertain regulatory compliance requirements. Indeed, there are additional categories and use cases that can be addressed: fraud, customer service, security, servicing, capital markets, securitization, portfolio analysis, and of course, cross-selling and upselling.

Yet to take the use cases into action, there needs to be a consistent and repeatable framework sequence that can be deployed, assessed, and improved to match the rapid cycle capabilities of exploding AI capabilities.

Implementation Strategy and Steps

When organizations take a data-driven approach as the first step in their AI solution architecture, there is a progression of steps that deliver faster results. This sequence is an iterative process that represents repeatability and adaptation due to changing economic factors, customer needs, technological shifts, and political impacts.

1. Start with the Data. AI’s initial and on-going success depends on high quality data that spans structured and unstructured classifications. Additionally, these data sources must be sourced and integrated using advanced data architectures which include data weaves (for ingestion), data meshes (for domain verticals), and domain fabrics (to link across the enterprise).

2. Automate Routine Processes: Use Gen AI to craft solutions that leverage the data architecture layers and governance structures. This may start with use cases within underwriting, regulatory compliance, and consumer personalization to build capabilities, identify necessary skills, and define an AI Ops development framework that can proactively manage complex AI demands.

3. Develop AI Augmented Decision Making: Build compartmentalized routines using common data isolation modules to establish building blocks of AI capability that deliver reusable, verifiable functionality.

4. Expand Customer Interactions: Currently, AI chatbots have gained widespread attention, but when these are augmented with predictive analytics, hyper-personalization, and RAG content, enterprises can expand their cloud and on-premises capabilities with minimal disruptions, while delivering efficiencies and insights.

5. Monitor Risks and Continually Improve: A notable distinction from AI of 2022-2023 is that these early wonders were non-determination solutions (that is, the same inputs could produce varied outputs). Today, improved algorithms coupled with larger data sources, training, and parameters create more reliable capabilities and outcomes. However, with self-learning systems ingesting and manipulating data (weave) sources, the ability to apply guardrails to decisioning outcomes cannot be left to chance. Continuous monitoring and improvement are not optional.

What is notable for executives is that the prescriptive playbooks of how they worked with vendors, conducted the digital transformation of manual processes, created the piecemeal implementation of numerous FinTech and RegTech capabilities, have themselves been transitioned into data-first designs, architectures, and development. In short, AI has fundamentally changed the rules and focus of what, how, and why system ideation has become secondary to data ideation.

For lenders and financial professionals trying to mitigate the industry risks and uncertainty presenting itself in Q1 2025, the arrival of more complex AI capabilities creates additional fear. To move beyond FUD (fear, uncertainty, and doubt), leaders must recognize that legacy mindsets, system provisioning, and data requirements have permanently been altered.

Using the aforementioned guidance, leaders and their firms will have an improved chance of adapting to revolutionary AI capabilities, while being able to build tangible capabilities that are not disposable.

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes submissions from member firms. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)