Optimal Blue: February Sees Surge in Rate-and-Term Refinances

(Image courtesy of Optimal Blue)

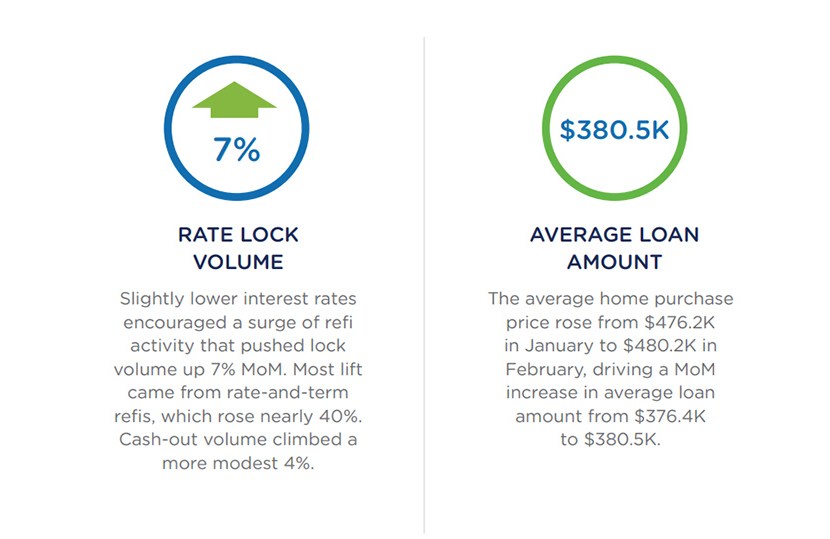

Optimal Blue, Plano, Texas, recorded a 7% month-over-month increase in mortgage lock volume in February, largely driven by strong refinance activity.

Specifically, rate-and-term refinances were up 39.2%. Cash-out refinances were up 4.4%, and purchase locks were up 3.8%.

However, purchase locks were down 4.8% year-over-year. And, purchase lock counts, which control for home price appreciation, were down 9% from the same time in 2024.

“Interest rate improvement, while marginal, is attracting refinance activity as homeowners who bought at higher rates work the numbers and find they can reduce their monthly payments or tap into home equity,” said Brennan O’Connell, Director of Data Solutions at Optimal Blue. “The upcoming homebuying season will reveal whether purchase demand is poised for a rebound or if elevated rates will continue to keep buyers on the sidelines.”

Conforming loan volume grew for the second consecutive month, hitting 52% of total volume after a multiyear low notched in December. FHA share is about 20%, and VA share is approximately 11.5%.

Credit scores for cash-out and rate-and-term refinances grew, by 2 and 4 points respectively. The average credit score for cash-out refinances now sits at 695, and the average for rate-and-term refinances is at 732. The average purchase credit score was flat at 737.

The average home purchase price rose from $476,200 in January to $480,200 in February. The average loan amount increased from $376,400 to $380,500.