Avoiding the Misinformation Engine Cloaked in a Suit and Tie

Since early 2022, industry leadership has been bombarded with the virtues of Gen AI. Since late 2024, the next iteration (i.e., Agentic AI) began its ascent in the headlines and with business and IT leaders seeking to gain efficiencies at scale, enhance and grow revenue, ensure regulatory consistency, and understand complex customer behaviors.

In 2025, Gen AI and its next iteration Agentic AI have captured the imagination and spending of leadership. Yet there is another option that sits between these two pillars that delivers improved accuracy, efficiencies, outcomes, and experiences—retrieval augmented generation (RAG).

RAG is built utilizing the foundations of Gen AI, but incorporates industry and enterprise data (i.e., operational data stores—ODS—from applications) to “fine tune” the response and provide more specific, accurate solutions uniquely tailored to individual organizations.

However, as we have learned over the last three years, AI is a data driven solution that can produce error-filled results—i.e., misrepresented payoffs, manual rework, poor personalization, and weak borrower insight. To take AI at face value even when it is in full production, without human oversight or QA guardrails, is analogous to taking at face value an individual just because they are professional, well dressed, and articulate. AI without checks, that is without the inclusion of RAG components, is a “misinformation engine in a suit and tie.”

In 2025, the sheer number of options for inclusion of AI into the mortgage industry could fill a book—e.g., functional specific LLM/SLM, compliance algorithms, customer mining, self-service portals. Yet without context, without operational data, without cross-linked systems, and without transparency, AI will inspire action but will often lack integrity, auditability, and adaptability.

Why AI is Different Today: As implied, AI can generate outputs that appear correct, but can be flawed. Without the context of operational data tailored to organizational processes, solutions or outcomes can be misrepresented. To mitigate these risks while delivering AI solutions at scale, the inclusion of RAG examines and modifies outputs using contextualized data to improve accuracy, relevance, and resiliency for a growing base of off-the-shelf Gen AI solutions.

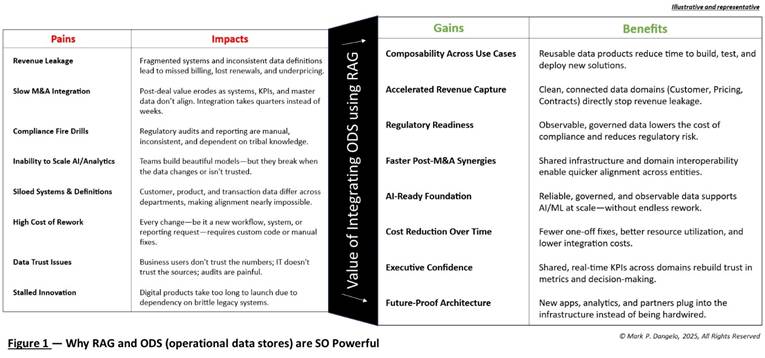

Rather than provide potential RAG architectures and GIF images of “how” it is accomplished, the journey with RAG begins with the “pains and gains” of AI. (Note: if you want to find numerous RAG potential architectural designs, log into LinkedIn as a dozen are posted every day).

To illustrate the impacts and benefits for RAG AI, Figure 1 provides a summary of pains and gains that are impacting the industry. If addressed in isolation and as was done with prior financial and regulatory technologies, AI will produce limited, compartmentalized advantages. However, when managed holistically and with the continuous integration of ODS, the value and confidence of crosslinked AI systems grows non-linearly.

The last three years for the mortgage industry represent the bottom of volumes going back 30 years. The bottoming happened to coincide with the explosion of AI capabilities. However, how many groups had available capital? Were they able to entice and hire advanced data science skill sets? Did the early experimentations in AI scale beyond the pilots?

Now the rise of Agentic AI brings a next-gen of independent, adaptable, and encapsulated “agent-to-agent” Lego-like building blocks for an industry still trying to recover. RAG represents a core of data competencies and designs that will be needed within the growing body of research and capabilities that will become Agentic AI for the mortgage industry.

Why RAG Matters: After three brutal years of headwinds—volumes, interest rates, affordability—RAG offers a spark that can be used by business and IT leaders to unlock insights already existing within corporate ODS’s. Meaning, the use of Gen AI is just a starting point—not the AI destination.

As Figure 1 represented the business and IT pains and gains, Figure 2 illustrates the AI risks categorized into five distinct functional areas—financial, revenue, technical debt, consumer, and regulatory. RAG with Gen AI can help mitigate these risks and provide the adaptability and scale required across industry segments.

In Figure 2 we showcase distinct RAG opportunities fueling industry demands, yet RAG requires and excels with the inclusion of retrieved data to ground its responses. To mitigate the risks, the operational data incorporated must be identified, assessed, and remediated to ensure that incomplete, incorrect, or outdated data does not generate output that appears credible (i.e., a “misrepresentation engine”).

The above are the most consistent areas of risks with current AI solutions and represent groupings where RAG can deliver superior results with the continual ingestion of legacy structured and unstructured data.

Implied within RAG designs are proactive feedback loops designed for continuous improvement. Additionally, the constant ingestion and integration of ODS ensures that decisions are adaptable and interactions up-to-date. When it comes to costs and efficiencies, RAG requires less model retraining, improved accuracy, context aware, and is designed for growing complexity of queries and interconnected AI solutions.

However, as RAG has emerged with greater value and capabilities, the challenge for many industry leaders who began with Gen AI (and struggling to scale) is how to prioritize when markets and consumer confidence remains opaque. Where are the opportunities? What is the likelihood for RAG inclusion? And, what are the risk severities where RAG can offer consistent mitigation solution capabilities?

The Priority of RAG: Already we are witnessing that RAG is an implementation capability and core competency that has merit beyond its 2022 mainstreaming. Today designs and options for using RAG with the latest AI architecture—Agentic AI—are being developed and deployed (i.e., Agentic RAG AI) by progressive adopters of the technologies.

Think of it this way, AI represents the engine or batteries of a vehicle—RAG represents the myriads of electrical systems and connections generated by the AI engines. RAG provides the “reality” of AI for specific industries and institutions.

Given the market conditions, RAG offers the battered mortgage industry options, improved accuracy, and insights that could not be singularly achieved with either Gen AI or Agentic AI. By using ODS (i.e., structured) and granular data sources (i.e., unstructured), investments made can be leveraged and made adaptable regardless of the AI architecture.

To provide some reality to this discussion, Figure 3 represents the ranking of the prior illustrations along with a summary explanation of the importance of deploying RAG to improve the exponentially growing horsepower of AI.

To be certain RAG is a complex topic populated with unfamiliar designs—retrieve and rerank, graph, multimodal, hybrid, agentic—that can overwhelm leaders seeking a quick fix set of solutions. It will require specialized skill sets, but these represent extensions of Gen AI and Agentic AI “engine” personnel. As shown in Figure 3, RAG can be used to adaptively address critical voids and circumstances of AI drift, while doing it with greater accuracy and improved price points.

The Takeaways: RAG offers an industry in transition the opportunity to develop and implement AI solutions that are uniquely customized for their customer base, while reducing the negative risks—hallucinations, model drift, retraining. However, for RAG to deliver sustained results, it requires core data that is accurate, integrated, and has lineage. RAG is like all components of AI data-driven systems—if you have garbage in, you will get garbage out (i.e., GIGO).

With AI, if GIGO is present, then how will you know (it is garbage) given the speed and presentation of the AI outputs? RAG can solve the “Misinformation Engine Cloaked in a Suit and Tie” mindset that currently is pervasive with the AI engines. It does represent yet another challenge with AI. It does create additional costs with AI. It does offer a mitigation solution that challenges and checks intelligent systems, which offer implied credibility based upon their sheer ease of use and hidden complexities.

So ask yourself, if AI is wrong, what will the damage be to financials, revenue, technologies, consumer, and regulatory outcomes? We can look at the above illustrative Figures to understand the impacts, severity, and likelihood of what happens when AI makes a mistake—and we have to determine how to clean up after its data has been ingested into all down stream systems and partner connections.

After these last three years of declining markets, profitability, and limited opportunities, who can afford to have their shiny new AI solutions to be mediocre, or worse, wrong? AI is a truly amazing opportunity for the mortgage industry—if the data used for tailoring is ready for inclusion (see Rethinking the Data Core, Overcoming Legacy Data’s “Tower of Babel”— available July 2025).

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes submissions from member firms. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)