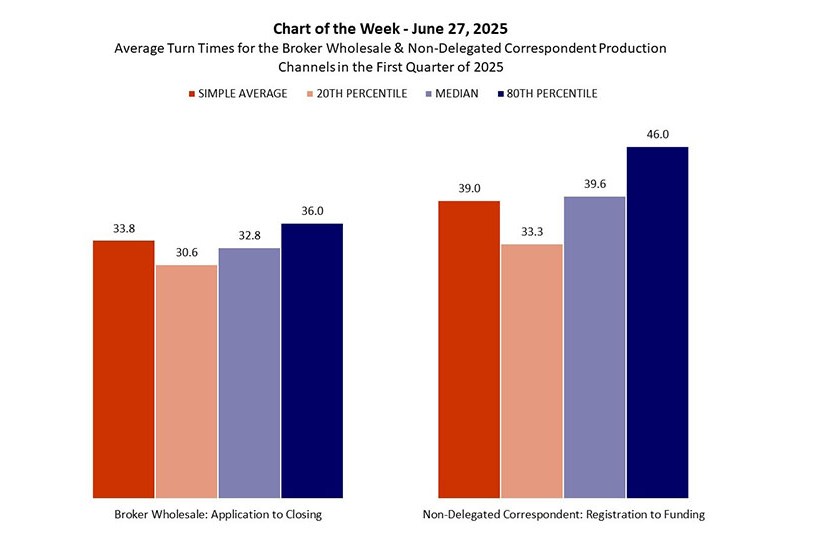

Chart of the Week: Average Turn Times for the Broker Wholesale & Non-Delegated Correspondent Production Channels in Q1 2025

Source: MBA’s Wholesale Lending Survey

This week’s Chart of the Week details turn times for the broker wholesale and non-delegated correspondent production channels in the first quarter of 2025. For the broker channel, “application to closing” is defined as the number of calendar days from which six pieces of information are received from the borrower per RESPA (name, income, Social Security number, property address, estimated property value, and loan amount) and the closing date, even if there may be a delay between closing and funding. For the non-del channel, “registration to funding” spans the time from which a loan is registered in the lender’s loan origination system to the date of funding.

In Q1 2025, turn times averaged 33.8 days for the broker channel, the lowest level in almost four years since MBA started tracking this data in the third quarter of 2021. The fastest lenders – those at the 20th percentile with shorter turn times than 80 percent of other lenders – averaged 30.6 days or less, while those at the 80th percentile averaged 36.0 days or more. On average, turn times for the broker channel in Q1 2025 were 8.7 days lower than the high of 42.5 days seen in Q3 2021, suggesting improved efficiencies in the loan fulfillment process. Such efficiencies could derive from improvements to underwriting technologies, such as those used to verify borrower assets, income, and/or employment, those used to value properties, or even those used to automate decisions entirely. Optimizing operational tasks between processing, underwriting, and closing could also contribute.

Turn times in the non-delegated correspondent channel averaged 39.0 days in Q1 2025. However, there is a much larger disparity across lenders. Those lenders at the 20th percentile averaged 33.3 days or less from registration to funding – much more in line with the broker channel – while those at the 80th percentile averaged 46.0 days or more, almost 13 days longer. Non-del turn times in Q1 2025 were 3 days shorter than the near study-high 42.2-day average seen in Q3 2021 when the demand for mortgages was much higher.

MBA’s quarterly Wholesale Lending Survey tracks production metrics – volume, product mix, pull-through, and turn times – for lenders that originate through the broker wholesale and non-delegated correspondent production channels. Participation is free for MBA members, and participants receive customized “Your Firm” reports that align their company’s data against the survey aggregates for benchmarking purposes. If your company is interested in participating in next quarter’s survey for Q2 2025, please contact us directly.

– Jon Penniman: jpenniman@mba.org