MBA Premier Member Editorial: Seven Stages of AI Adoption in Mortgage Lending

Sandeep Shivam, AMP, is Product Evangelist and Associate Director with Tavant

In today’s fast-moving mortgage landscape, digital transformation isn’t just a trend, it’s the new standard. One of the biggest game-changers? AI-powered assistants.

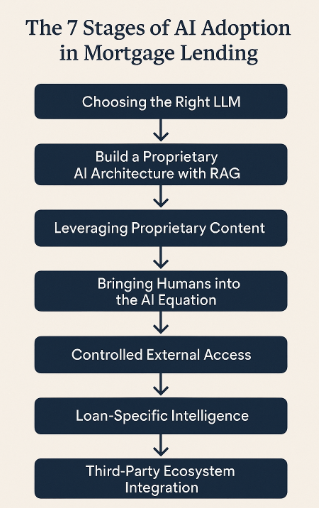

These tools have grown from basic assistants into smart, domain-aware agents that can truly elevate both the borrower and lender experience. While some staff may already be using Gen AI on their own, the real value comes when it’s embedded into the mortgage process at an organizational level. To help make that happen, I’ve broken down the journey into seven key stages. Let’s walk through them to see what a fully Gen AI-powered mortgage process can look like.

Stage 1: Choosing the Right LLM

The journey typically starts with public large language models (LLMs) like ChatGPT, Gemini, and others–powerful tools designed for general-purpose conversations. They’re great at handling a wide range of topics and demonstrating the potential of AI in everyday interactions. But when it comes to highly regulated sectors like mortgage lending, they fall short. These models often lack deep context-awareness, don’t offer enterprise-grade security, and can’t access or reason over proprietary business content—making them ill-suited for critical use cases in our domain.

That said, they serve as a solid foundation. They give us a glimpse into what’s possible and help shape the direction for more tailored solutions. So the first step? Let’s pick the base LLM we want to work with—this will be the engine we adapt and refine to meet the specific needs of a mortgage lender, ensuring it is voice-enabled and supports bi-directional voice interfaces.

Stage 2: Build a Proprietary AI Architecture with RAG

To tackle the limitations of public LLMs, many forward-looking mortgage tech leaders are taking a smarter route—they’re moving away from open, general-purpose models and embracing secured, proprietary versions tailored specifically for the mortgage industry. A big part of what makes this shift possible is something called Retrieval-Augmented Generation, or RAG. Imagine it as a highly capable AI assistant that doesn’t just rely on what it already knows, it actively pulls in the most relevant, up-to-date information from your organization’s own knowledge base while responding. That means it understands your policies, keeps pace with your compliance rules, and speaks your business language.

The result? Sensitive borrower data stays protected, responses stay accurate and compliant, and the AI experience becomes something you can trust and scale. It’s the perfect balance of intelligence, security, and business relevance—exactly what the mortgage world needs.

Stage 3: Leveraging Proprietary Content

By connecting AI to dynamic content like CRM data, SharePoint documents, internal policies, and even video libraries, lenders can unlock far more powerful responses. The AI isn’t just guessing—it’s pulling answers directly from your organization’s own trusted sources. That means every response is not only accurate, but also tailored to your specific processes and context, making the interaction much more relevant and reliable.

Stage 4: Bringing Humans into the AI Equation

RAGs help score AI-generated responses based on how precise, relevant, and grounded they are. And if something seems off—an outlier response or a confidence dip—the system knows to flag it and escalate to a human for review. It’s a smart, hybrid approach that blends the efficiency of AI with the judgment of experienced professionals. The result? Consistently high-quality interactions that not only meet compliance standards but also reinforce user trust.

Stage 5: Empowering External Users

At this point, lenders have an exciting opportunity—they can start extending their AI tools beyond internal teams to include external users like borrowers, brokers, realtors, and others in the ecosystem. The key is to provide controlled access, ensuring the right level of visibility and interaction for each user type. This allows everyone to get the information they need, complete their tasks, and keep things moving—without waiting on a support rep or loan officer. Imagine a borrower getting instant clarification while filling out the 1003 form, a broker checking turnaround times for a specific step, or a realtor seeking information on stages involved in lending process. These are just a few examples of how AI can make the experience faster and more seamless. It’s a win for everyone: external users feel empowered and informed, while internal teams can focus on higher-value priorities instead of fielding routine questions.

Stage 6: Loan-Specific Intelligence

At this point, it’s time to connect the Gen AI we’ve built with the core systems—like the loan origination system, servicing platform, and the point-of-sale solution. By tying everything together, we give the AI the context it needs to handle real, transaction-level questions. Now, borrowers can ask things like, “Why did my escrow payment go up?” or “What’s the status of my loan application?” and get accurate, personalized answers. It’s a big step toward making the entire experience more seamless and intelligent for borrowers, loan officers, and everyone else involved.

Stage 7: Third-Party Ecosystem Integration

This is the final frontier of Gen AI adoption for mortgage lenders—where AI transitions from a helpful assistant to an active player in loan decisioning. At this stage, it’s fully integrated with third-party systems like Automated Underwriting Systems (AUS), Product & Pricing Engines (PPE), income and asset verification tools, credit checks, and compliance platforms. With these integrations, the AI can do more than just answer questions—it can act. Loan officers can ask, “What’s the best rate for this borrower?” or “Can you run AUS on this file?” and get instant results. This dramatically reduces manual effort, speeds up workflows, and helps teams make faster, more informed decisions—boosting efficiency while staying fully aligned with policies and compliance.

Conclusion

AI-enhanced assistance isn’t just a support tool anymore—it’s becoming a key part of how modern mortgage operations run. As lenders work to reduce friction, deliver more personalized experiences, and improve margins, AI is stepping into a more central role. It’s clear that this technology is no longer just a nice-to-have—it’s becoming essential to driving the future of mortgage lending.

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes submissions from member firms. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)