LendingTree: Young Homeowners Underrepresented in Largest Metros

(Image courtesy of Andrea Piacquadio/pexels.com)

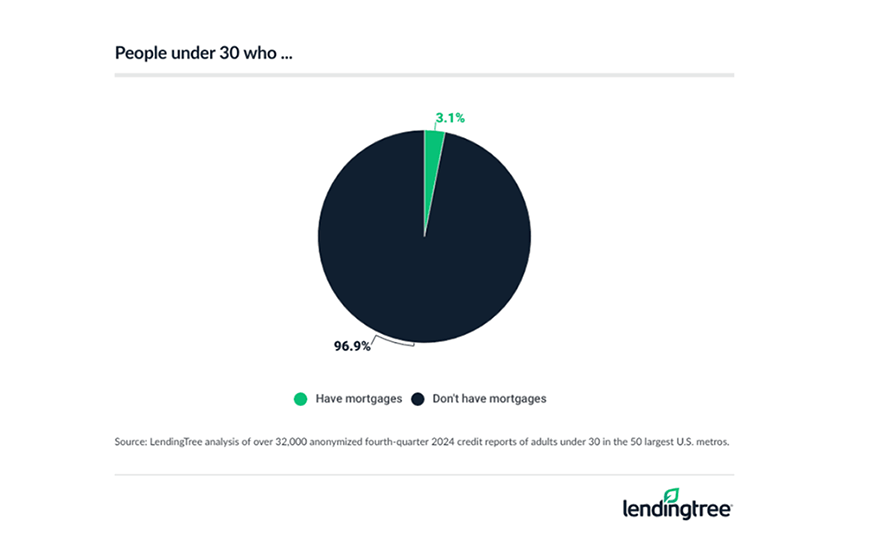

LendingTree, Charlotte, N.C., released a new study finding that only 3.1% of Americans under 30 have a mortgage in the 50 largest U.S. metro areas.

The age group makes up just 4.7% of mortgage holders in the 50 largest metros, despite being 20.3% of the adult population.

The metros with the largest share of under-30s with mortgages are Nashville, Tenn., at 9.4%, Indianapolis, at 8.4%, and Pittsburgh, at 7%.

And, metros with the highest rate of mortgage holders under 30 are Indianapolis, at 10.2%, Salt Lake City, Utah, at 9.4%, and Cincinnati, Ohio, and Oklahoma City, both at 8.9%.

The metros with the smallest share of under-30s with mortgages are San Jose, Calif., at 0.8%, New York, at 1.2%, and Los Angeles, at 1.3%.

The metros with the lowest rate of mortgage holders under 30 are New Orleans and Boston, both at 2.2%, and San Jose, Calif., and New York, both at 2.3%.

“Sure, big-metro dwellers may have higher incomes than their rural or suburban counterparts, but the cost of living and cost of housing can be so astronomically high that it eats up all that extra income–and then some,” said Matt Schulz, LendingTree Chief Credit Analyst. “Also, if you’re able to find a home you can afford to buy, it may be so far from your workplace that you spend large amounts of money commuting. It all adds up to a challenging situation leading many young people to forgo homeownership altogether.”

In terms of pricing, prospective buyers under 30 look for houses that only cost a quarter of the average price that older prospective buyers look at.

And those aged 18 to 29 hold a total of $527 billion in mortgage debt, or 4.2% of all mortgage debt.