Cotality: Home Equity Continues to Dip

(Image courtesy of Dar ius/pexels.com)

Cotality, Irvine, Calif., released its Homeowner Equity Report for Q3 2025, finding borrower equity decreased year-over-year by 2.1%.

That equates to $373.8 billion in equity lost, with overall net equity at $17.1 trillion for homes with a mortgage. Homeowner equity peaked at nearly $17.7 trillion in Q2 2024.

On average, homeowners lost $13,400 in equity year-over-year. That compares with a gain of $25,000 in 2023 and $4,900 in 2024.

That also means some loan-to-value ratios have shifted–particularly an increase in homeowners with 85-94% LTVs.

In the quarter, 2.2% of homeowners had negative equity. That’s a 21% year-over-year increase in the number of homeowners with negative equity.

If home prices rose 5%, 168,000 properties would regain equity. But, Cotality forecasts prices will increase by just over 4% by October 2026.

If home prices fell 5%, 319,000 more homes would fall into negative equity positions.

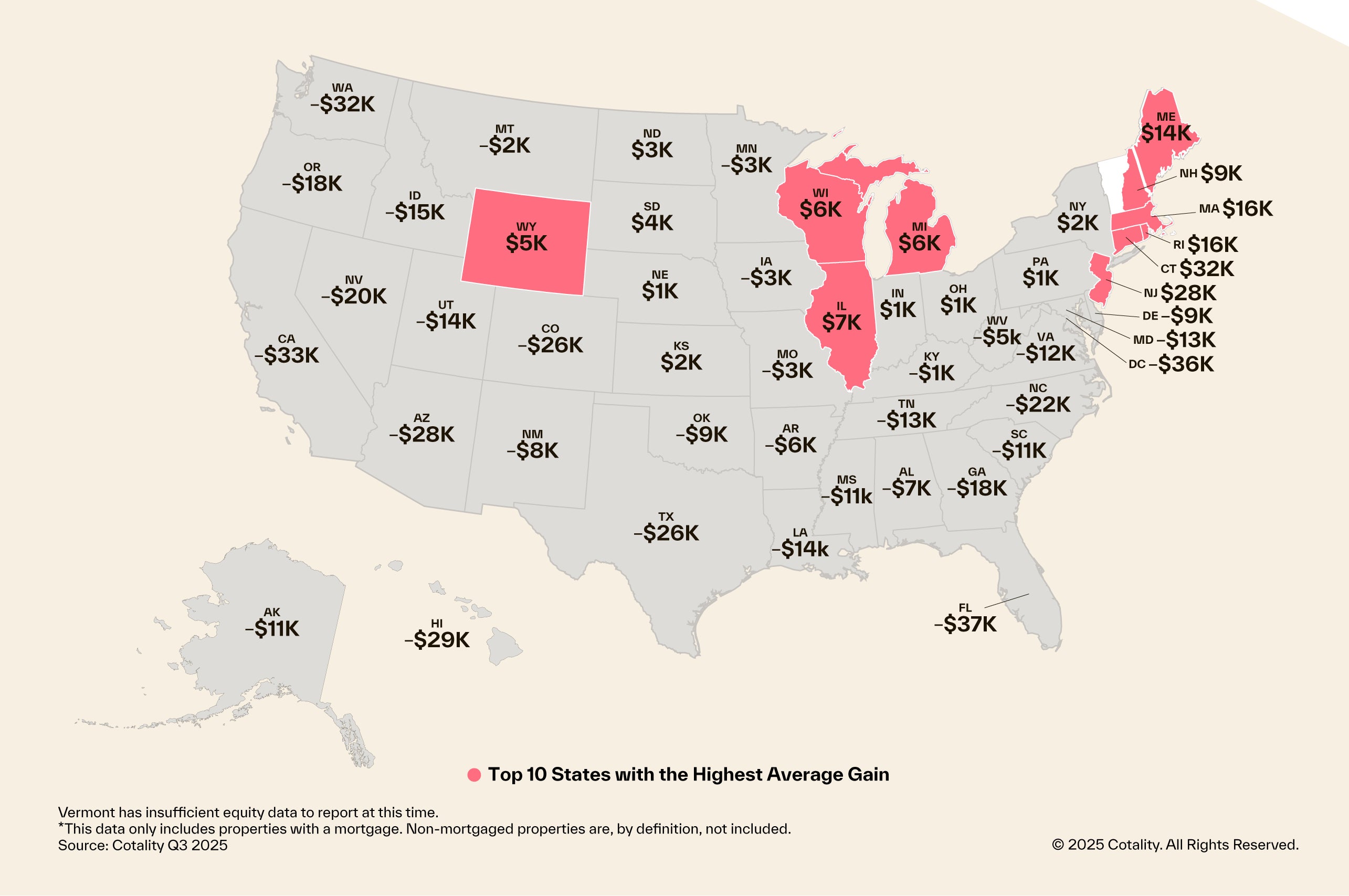

Some states have seen equity increase, however. Homeowners in Connecticut saw the largest jump on an annual basis, at $31,500, followed by New Jersey, at $27,500, and Rhode Island at $16,200.

The three states with the most lost equity were Florida, at a loss of $37,400 on an annual basis, Washington, D.C., at a loss of $35,500, and California, at a loss of $32,500.

“As the pace of home price growth slows and markets recalibrate from pandemic peaks, we’re seeing a clear shift in equity trends,” said Cotality Chief Economist Selma Hepp. “Negative equity is on the rise, driven in part by affordability challenges that have led many first-time and lower-income buyers to over-leverage through piggyback loans or minimal down payments. While overall home equity remains elevated, recent purchasers with smaller down payments may now face negative equity.”