ICE First Look: Delinquencies Remain Low Despite Year-Over-Year Rise

(Illustration courtesy of Intercontinental Exchange)

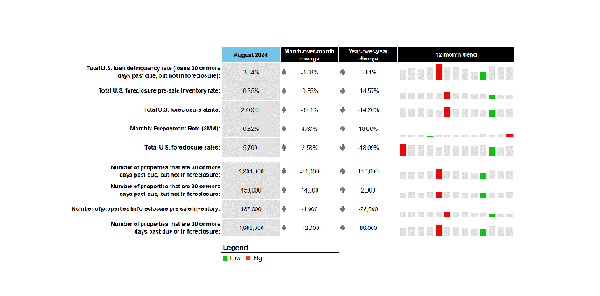

Mortgage delinquencies remain low despite a modest year-over-year increase, according to Intercontinental Exchange, Atlanta.

The national delinquency rate fell 3 basis points to 3.34% in August, dropping 0.9% for the month but up 5.1% from last year, ICE’s First Look at August 2024 mortgage performance data found.

The number of borrowers a single payment past due dropped by 26,000, while 60-day delinquencies rose slightly, by 1,000, ICE found. Serious delinquencies–loans 90-plus days past due but not in active foreclosure–rose by 14,000 (+3.3%) to a six-month high, but remain historically low, the report said.

Foreclosure starts fell by 9% from the month prior and remain 32% below their 2019 levels, ICE said. Active foreclosure inventory also improved in the month, with the share of mortgages in foreclosure hitting the second-lowest level on record except for during the COVID-19 moratorium.

Prepayment activity rose to 0.62%–a level not seen since August 2022–as interest rates eased. Prepayments rose by 4.7% from July and 18.0% from last year

The ICE Mortgage Monitor report, which includes a more in-depth review of this data, will be available online at https://www.icemortgagetechnology.com/resources/data-reports by Oct. 7.