ICE First Look: Delinquency Rate Ticks Up in September

(Image courtesy of ICE; Breakout image courtesy of Tom Fisk/pexels.com)

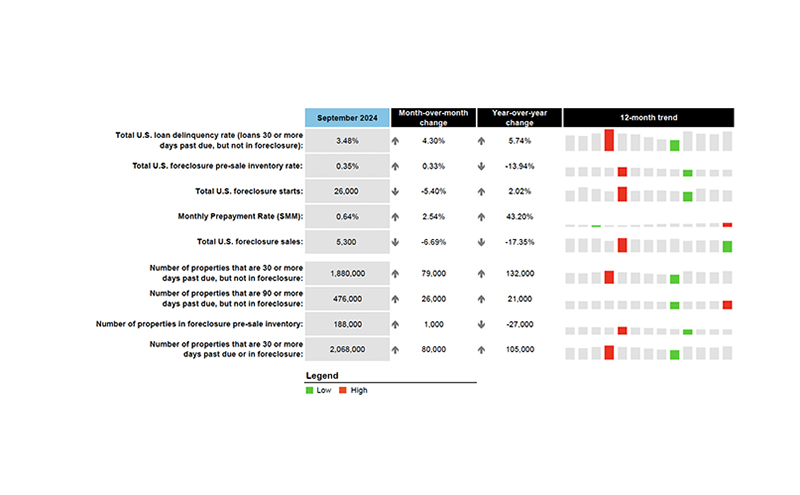

Intercontinental Exchange Inc., Atlanta, reported the national delinquency rate rose 14 basis points in September to 3.48%, up 4.3% from August and up 5.7% from September 2023.

This marks the fourth consecutive year-over-year rise in delinquencies, the longest stretch since 2018–not including some early COVID pandemic effects.

Serious delinquencies–defined as 90 or more days past due but not yet in active foreclosure–rose 5.9% to a 16-month high.

Delinquencies 30 days past due hit a three-month high, and those 60 days past due were at their highest level since January 2021.

The number of loans in active foreclosure ticked up slightly, by 0.4% month-over-month, but were down 12.5% from September 2023.

Loans in active foreclosure remain 34% below pre-pandemic levels.

Prepayment activity, at 0.64%, was up 2.5%, and up 43.2% from September 2023. That’s a level not seen since August 2022.

By state, the five with the highest non-current percentage were Louisiana at 8.31%, Mississippi at 8.2%, Alabama at 5.83%, Indiana at 5.46% and West Virginia at 5.28%.

The bottom five states by non-current percentage were Washington at 2.05%, Montana at 2.06%, Colorado at 2.09%, Idaho at 2.14% and Oregon at 2.19%.