Optimal Blue: Spring Homebuying Season Kicks Off With Increase in Origination Activity

Optimal Blue, Plano, Texas, released its February 2024 Originations Market Monitor report, finding an increase in monthly purchase mortgage locks. That propelled a net increase in origination activity despite the interest rate environment.

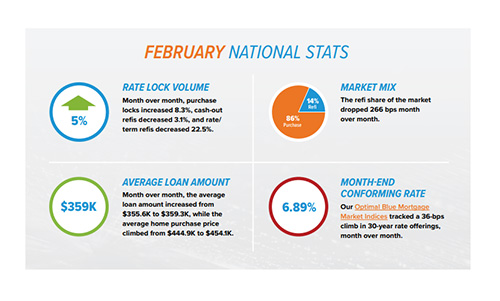

Month-over-month rate lock volumes were up 5% due to an 8.3% jump in purchase activity.

The average loan amount increased from $355,600 to $359,300, with the average purchase price rising from $444,900 to $454,100.

However, activity fell by 22.5% for rate/term refinances and 3.1% for cash-out refinances.

“As the spring buying season commenced, we saw a resurgence in purchase locks, despite the rise in interest rates,” said Brennan O’Connell, Director of Data Solutions at Optimal Blue. “Although lock counts were down on a year-over-year basis, the rate of decline is decelerating and suggests we may be nearing a floor for purchase lending in the current rate environment.”

Nonconforming products–including jumbo and non-QM loans–saw gains, with an additional 183 basis points of market share to end the month at 11%

Conforming loans remained flat at about 57%, and FHA and VA loans fell slightly.

Adjustable-rate mortgages increased slightly, but they remain at only about 6% of total production volume.

Credit quality improved nearly across the board, with the exception of VA loans, where it held steady.