MBA Chart of the Week: IMB Production Revenues and Costs

(Image courtesy of MBA)

MBA recently released its latest Quarterly Performance Report for the fourth quarter of 2023. The total sample of 342 independent mortgage banks and mortgage subsidiaries of chartered banks reported per-tax net production losses of 73 basis points (or $2,109) on each loan they originated. This marks the seventh consecutive quarter of net production losses.

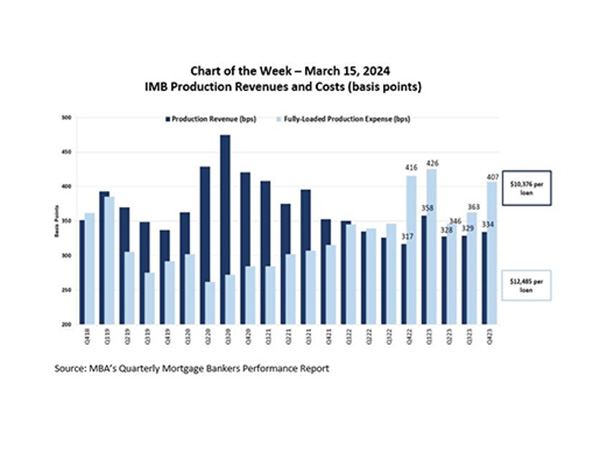

In this week’s Chart of the Week, we show production revenues compared to production expenses over the five-year period from the end of 2018 through 2023. Total production revenue (fee income, net secondary marking income and warehouse spread) increased to 334 bps in the fourth quarter of 2023, up from 329 bps in the third quarter of 2023 and 317 basis points one year ago.

While production revenue improved by 5 basis points in the fourth quarter, production costs worsened as volume dropped. Total loan production expenses–commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations–increased to 407 basis points in the fourth quarter of 2023, from 363 basis points in the third quarter of 2023. On a per-loan basis, production expenses averaged $12,485 per loan in the fourth quarter, up more than $1,000 per loan from the previous quarter but lower than the survey-high of $13,171 per loan (426 basis points) in the first quarter of 2023.

The increase in production cost, along with a concurrent decrease in productivity, reflects excess capacity and the difficulty that lenders face in adjusting resources to align with fluctuating rates and volumes.

– Jenny Masoud (jmasoud@mba.org); Marina Walsh, CMB (mwalsh@mba.org)