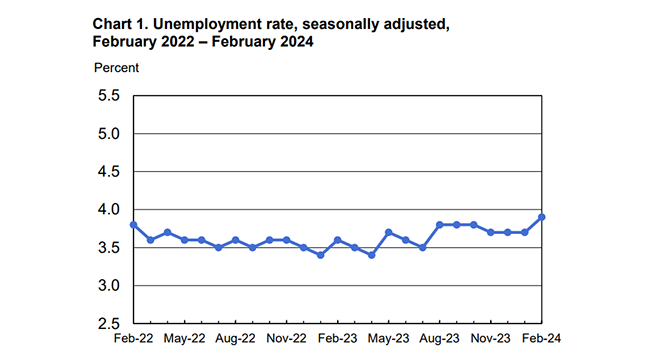

Unemployment Rate Increases But Remains Low

(Chart courtesy of Bureau of Labor Statistics)

The unemployment rate increased in February for the first time since last summer, the Bureau of Labor Statistics reported Friday. But it remains low by historical standards at 3.9%.

MBA Vice President and Deputy Chief Economist Joel Kan noted last month’s gain of 275,000 jobs outpaced the 12-month average, largely driven by service sector employment. Annual wage growth slowed slightly to 4.28 percent, but this measure also remains above the 3 percent longer-run average.

“Taken together, this labor market tightness is contributing to upward pressure on inflation, particularly in the service sectors of the economy,” Kan said. “The strength in the job market, along with an economy that is still growing at a moderate pace, are positives for the housing market, as it supports home purchase activity and helps borrowers to stay current on their mortgage payments. However, the labor market’s continued resiliency is one of several factors keeping mortgage rates from declining much further in the near term, as it increases the likelihood that the Fed will not rush to cut rates.”

First American Economist Ksenia Potapov said the February Jobs Report is unlikely to sway the Federal Reserve to begin cutting rates. “All signs point to a slowly cooling, but strong, labor market,” she said. “When the Federal Open Market Committee convenes later this month, they will issue new guidance and projections for economic conditions. This jobs report is unlikely to materially change the Fed’s expectations for economic conditions and any potential interest rate moves.”

Potapov noted the Fed expects rate cuts later this year, but wants to see more evidence that inflation is slowing. “For the housing market, this suggests the boost from lower mortgage rates likely won’t materialize until well after the traditional spring home-buying season begins,” she said.