Fannie Mae: Home-Selling Sentiment Moves Higher Ahead of Spring Homebuying Season

(Illustration courtesy of Fannie Mae)

Fannie Mae reported its Home Purchase Sentiment Index increased 2.1 points in February to 72.8, inching higher for the third consecutive month.

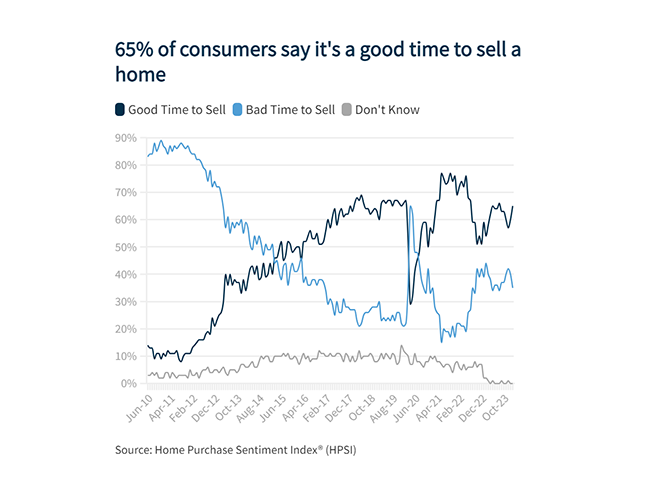

The GSE said sentiment increased mostly due to increased optimism around home-selling conditions. In February, 65% of consumers said now is a good time to sell a home, up from 60% in January.

“The share of those who believe it’s a good time to buy a home ticked up slightly this month but remains at an extremely pessimistic 19%,” the report said. “Additionally, a plurality of consumers continues to believe that mortgage rates will go down over the next 12 months, although on net that component fell slightly this month. Overall, the full index is up 14.8 points year over year.”

Doug Duncan, Senior Vice President and Chief Economist with Fannie Mae, noted the index increased for the third straight month, continuing its slow but steady rise from the low-level plateau observed through much of 2023. “Consumer sentiment toward housing now rests firmly above where it was this time last year,” he said. “Consumer attitudes toward home-selling conditions increased markedly in February, with current homeowners, in particular, expressing greater optimism that it’s a ‘good time to sell,’ a development that may foreshadow an upcoming increase in existing home listings.”

Despite the recent uptick in mortgage interest rates, consumers remain relatively optimistic that mortgage rates will decrease over the next 12 months, Duncan said. “If their expectations come true and rates move closer to the 6-percent mark by the end of 2024, as we currently expect, then it’s likely that consumer sentiment on both sides of the transaction will improve, perhaps leading to a further thawing of the housing market,” he said. “A decline in mortgage rates – and the resulting uptick in sentiment – would obviously bode well for the upcoming spring homebuying season, although affordability will likely remain a significant challenge for buyers, at least until there’s a meaningful addition to net supply.”