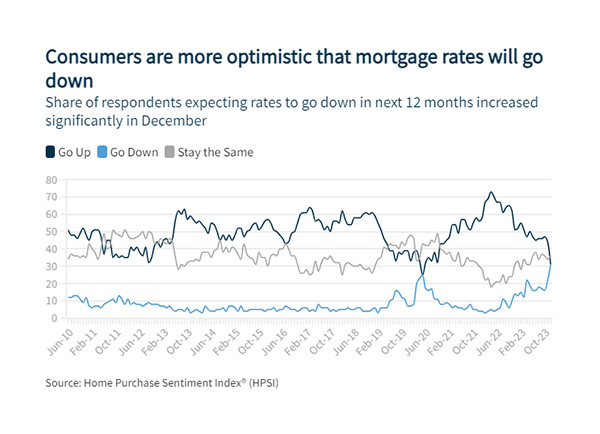

Fannie Mae: Survey-High Share of Consumers Expect Mortgage Rates to Fall

(Image courtesy of Fannie Mae; breakout image courtesy of Image courtesy of Tuesday Temptation/pexels.com)

Fannie Mae released its Home Purchase Sentiment Index for December, highlighting a 2.9-point increase to 67.2. That jump is primarily due to the survey-high 31% of consumers who believe mortgage rates will go down over the next year.

Overall, perceptions related to homebuying conditions remain pessimistic, but the full index is up 6.2 points year-over-year and 17% of consumers now indicate it’s a good time to buy a home.

However, 39% also believe that home prices will go up over the next year.

“Mortgage rate optimism increased dramatically this month, with a survey-high share of consumers anticipating mortgage rate declines over the next year,” said Mark Palim, Vice President and Deputy Chief Economist at Fannie Mae. “This significant shift in consumer expectations comes on the heels of the recent bond market rally and an already-significant downtick in 30-year mortgage rates, from their high of nearly 8% in early November to 6.62% as of this past week. Notably, homeowners and higher-income groups reported greater rate optimism than renters; in fact, for the first time in our National Housing Survey’s history, more homeowners, on net, believe mortgage rates will go down than go up.”

Additionally, 57% of respondents believe it’s a good time to sell. Seventy-five percent said they’re not concerned about job loss, and 20% say their household income is significantly higher than last year.