MBA Creates Member Guide in Case of Partial Government Shutdown

The federal government remains on the brink of a partial shutdown. MBA remains directly engaged with lawmakers in both chambers of Congress--and affected regulators--and has created a member guide that outlines the potential impacts to single-family and multifamily government lending programs.

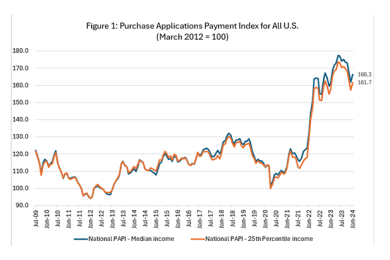

MBA: Mortgage Application Payments Increased 3.8% to $2,134 in January

Homebuyer affordability declined in January, with the national median payment applied for by purchase applicants increasing to $2,134 from $2,055 in December. This is according to the MBA Purchase Applications Payment Index, which measures how new monthly mortgage payments vary across time – relative to income – using data from MBA’s Weekly Applications Survey.

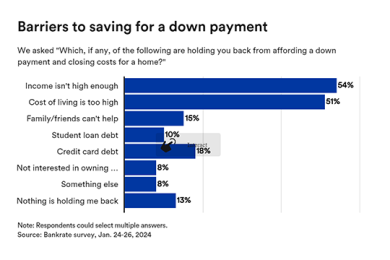

Many Aspiring Homeowners Cite Cost of Living, Insufficient Income as Roadblocks: Bankrate

More than half of aspiring homeowners say the current cost of living is too high or their income is not high enough to afford a down payment and closing costs for a home (51% and 54% respectively), reported Bankrate, New York.