ICE First Look: Delinquencies Down in January

(Image courtesy of ICE)

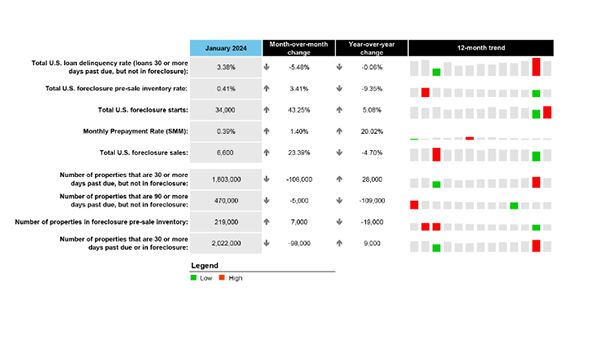

Intercontinental Exchange Inc., Atlanta, released its “first look” at mortgage performance, reporting the national delinquency rate dropped to 3.38% in January. That’s the lowest level since October.

It’s also flat from January 2023.

Serious delinquencies (defined as 90-plus days past due but not actively in foreclosure) were down 19% year-over-year.

However, foreclosure starts also ticked up to the most since April 2022, at 7.2% of serious delinquencies. That’s a 43.3% month-over-month jump, driven at least in part by seasonal pressures.

The number of loans in active foreclosure rose by 7,000 to 219,000 but remained 23% below pre-pandemic levels.

There were 6,600 foreclosure sales completed nationally in January, a 23% increase from the previous month.

However, serious delinquencies remain low, and prepayment activity rose marginally.

The top five states by non-current percentage were Mississippi (6.07%), Louisiana (5.43%), Alabama (4.48%), Oklahoma (4.45%) and West Virginia (4.24%).

The bottom five states by non-current percentage were Colorado (1.97%), Idaho (2.09%), Washington (2.09%), Montana (2.1%) and California (2.17%).