MBA: Share of Mortgage Loans in Forbearance Remains at 0.22% in March

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance remained unchanged at 0.22% as of March 31, 2024.

According to MBA’s estimate, 110,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.

In March 2024, the share of Fannie Mae and Freddie Mac loans in forbearance remained at 0.12%. Ginnie Mae loans in forbearance stayed at 0.40%, and the forbearance share for portfolio loans and private-label securities increased 2 basis points to 0.31%.

“For the past three months, the number of loans in forbearance has held steady,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The current labor market is showing resilience, minimizing the need for mortgage forbearance. However, life events and temporary hardships still happen, regardless of employment conditions, which may explain why we have reached a floor in the forbearance rate.”

Key Findings of MBA’s Loan Monitoring Survey – March 1 to March 31, 2024

Total loans in forbearance remained unchanged in March 2024 relative to February 2024 at 0.22%.

By investor type, the share of Ginnie Mae loans in forbearance remained the same relative to the prior month at 0.40%.

The share of Fannie Mae and Freddie Mac loans in forbearance remained the same relative to the prior month at 0.12%.

The share of other loans (e.g., portfolio and PLS loans) in forbearance increased relative to the prior month: from 0.29% to 0.31%.

Loans in forbearance as a share of servicing portfolio volume (#) as of March 31, 2024:

Total: 0.22% (previous month: 0.22%)

Independent Mortgage Banks (IMBs): 0.25% (previous month: 0.25%)

Depositories: 0.23% (previous month: 0.23%)

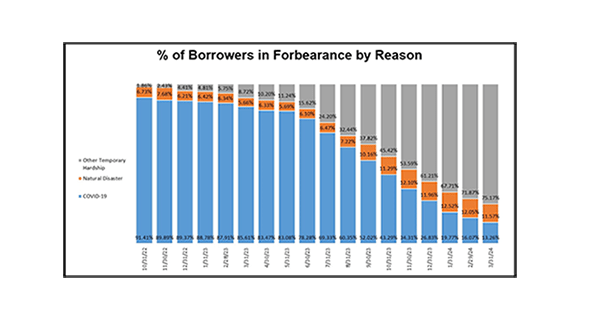

By reason, 75.2% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability; while 13.2% of borrowers are in forbearance because of COVID-19. Another 11.6% are in forbearance because of a natural disaster.

By stage, 57.2% of total loans in forbearance are in the initial forbearance plan stage, while 25.7% are in a forbearance extension. The remaining 17.1% are forbearance re-entries, including re-entries with extensions.

Total loans serviced that were current (not delinquent or in foreclosure) as a percent of servicing portfolio volume (#) increased to 95.92% (on a non-seasonally adjusted basis) in March 2024, up 19 basis points from 95.73% in February 2024 and down 43 basis points from 96.35% one year ago.

The five states with the highest share of loans that were current as a percent of servicing portfolio: Idaho, Colorado, Washington, California and Montana.

The five states with the lowest share of loans that were current as a percent of servicing portfolio: Louisiana, Mississippi, Indiana, New York and Illinois.

Total completed loan workouts from 2020 and onward (repayment plans, loan deferrals/partial claims, loan modifications) that were current as a percent of total completed workouts were 75.48% in March 2024, down 20 basis points from 75.68% the prior month and down 122 basis points from 76.70% one year ago.

MBA’s monthly Loan Monitoring Survey covers the period from March 1 through March 31, 2024, and represents 63% of the first-mortgage servicing market (31.5 million loans). To subscribe to the full report, go to www.mba.org/loanmonitoring.

NOTES: For more detailed information on performance metrics, including seasonally adjusted delinquency rates by stage (30 days, 60 days, 90+ days), please refer to MBA’s Quarterly National Delinquency Survey at www.mba.org/nds. First-quarter 2024 results are scheduled for release on Thursday, May 16, 2024.

The next publication of the Monthly Loan Monitoring Survey will be released on Monday, May 20, 2024, at 4:00 p.m. ET.