Housing Starts Fall in March

(Image courtesy of Census Bureau/HUD; Breakout image courtesy of Burst/pexels.com)

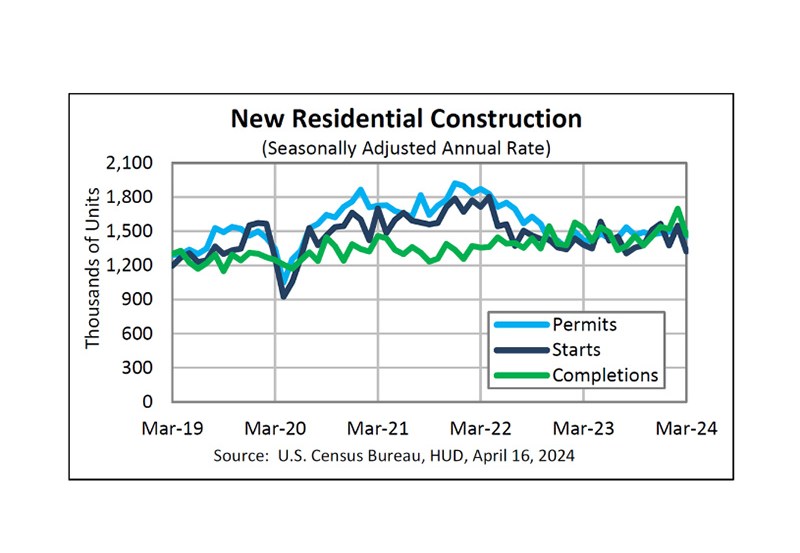

Housing starts fell 14.7% month-over-month and 4.3% year-over-year in March, per the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Privately owned housing starts were at a seasonally adjusted annual rate of 1,321,000.

Single-family starts, specifically, were at 1,022,000–or 12.4% below February’s revised figure. The rate for units in buildings with five or more units was 290,000.

Privately owned housing units authorized by permits were at a seasonally adjusted annual rate of 1,458,000, 4.3% below February, but up 1.5% from March 2023.

Single-family authorizations stood at a rate of 973,000, 5.7% below February. Authorizations of units in buildings with five units or more were at a rate of 433,000 in the month.

Completions stood at a seasonally adjusted annual rate of 1,469,000, 13.5% below February’s revised numbers, and 3.9% below March 2023.

Single-family completions hit 947,000, down 10.5% from February. The March rate for units in buildings with five units or more was 502,000.

“While elevated mortgage rates continue to throw a wrench into housing markets and expectations of housing starts, home builders remain optimistic and will continue to add more single-family homes over the course of the year. In addition, with the continued imbalance between supply and demand, home prices are expected to keep rising. However, with expectations of Federal Reserve rate cuts fading out of forecasts, potential homebuyers will not gain any cost advantage by staying on the sidelines in 2024,” said Selma Hepp, Chief Economist from CoreLogic.

“Despite the challenges, the new-home market will likely continue to outperform the existing-home market over the near term because, unlike existing homeowners, builders are not rate locked-in,” noted First American Deputy Chief Economist Odeta Kushi.