ATTOM: Profits for Home Sellers Decline Again in Q1

(Image courtesy of ATTOM; Breakout image courtesy of Curtis Adams/pexels.com)

ATTOM, Irvine, Calif., released its 2024 U.S. Home Sales report, showing profit margins on median-priced single-family home and condo sales in the United States decreased to 55.3% in the first quarter.

That’s the lowest level in two years and a drop from the profit margin of 57.1% in Q4 2023 and 56.5% in Q1 2023.

The decline came as the median nationwide home price fell quarterly by 4.3%. ATTOM noted while the Winter season usually brings slower home sales, the price decrease was one of the largest quarterly declines over the past decade.

Even as those seller returns fell to a two-year low, they are still higher than much of the immediate pre-pandemic era.

“The latest price and profit numbers show notably downward trends, which raises new questions about whether the housing-market boom is indeed ebbing, or even ending, after so many years of improvement,” said Rob Barber, CEO for ATTOM. “But due caution is needed in looking at the first-quarter data and what the patterns mean. We saw a similar downward pattern from late 2022 into early 2023, and then the market surged. Plus, profits and profit margins still are very high by historical measures. Amid all that, the Spring buying season will be a huge barometer for whether the market still has steam in its engine.”

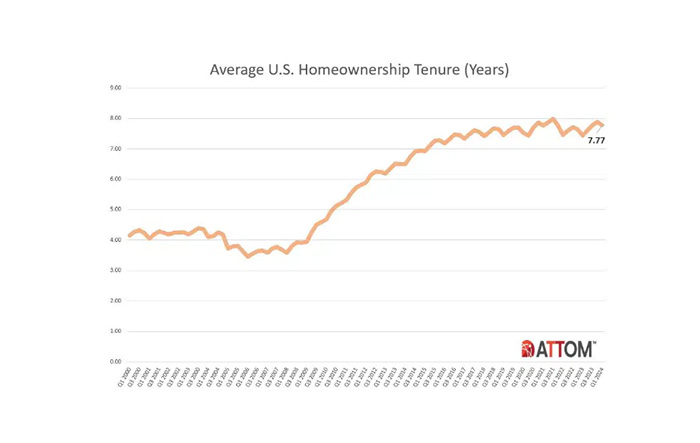

Homeownership tenure also fell slightly, to 7.77 years. That’s down from 7.88 in the fourth quarter of 2023, but up from 7.44 years in the first quarter.

Home sales following foreclosures were just 1.7% in the first quarter, up from 1.5% in Q4 and flat year-over-year.

All cash sales accounted for 41.1% of single-family home and condo sales in the first quarter of 2024, up from 40.7% in the fourth quarter of 2023 and 39.7% last year.