MBA Chart of the Week: New Home Purchase Applications

(Source: MBA Builder Applications Survey)

Purchase activity for newly built homes has outperformed existing home purchases for most of 2023. The lack of existing home inventory has been due to low mortgage rates in 2020 and 2021 that are keeping current homeowners from listing their homes. New homes have provided prospective homebuyers with more options and now account for around one-third of for-sale inventory, compared to a less than 10 percent share historically.

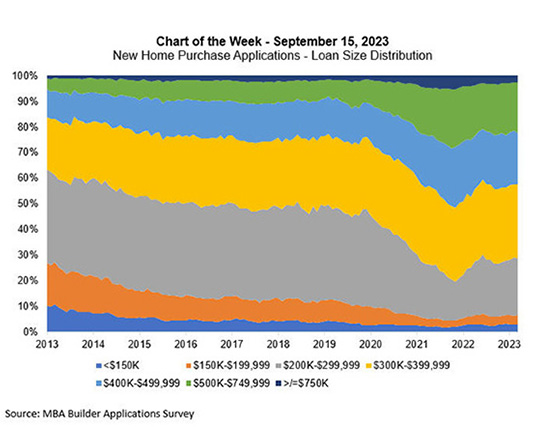

This week’s Chart of the Week highlights the distribution of new home purchase loan sizes, using data from MBA’s Builder Applications Survey, which captures purchase application data from mortgage lenders affiliated with home builders. Despite rates at elevated levels, we have seen new home purchase applications increase on a year-over-year basis for seven consecutive months, ending August 2023 with a 21 percent annual gain. Loan applications of $400,000 and under continued to grow in share, accounting for 58 percent of applications, as home builders respond to incoming demand from first-time home buyers for more affordable entry level homes. The $200,000 to $299,999 loan size category drove much of this increase, accounting for 22 percent of applications in August 2023, up from a low of 15 percent in April 2022.

Between 2013 and 2022, there was a steady decline in the share of loan sizes under $400,000, culminating in April 2022, when that share hit a low of 48.5 percent of applications. Contrast that with January 2014, when the share peaked at 84 percent. Steady home price appreciation and insufficient building of smaller starter homes over the past decade partly contributed to that shift. This was also made more acute when mortgage rates dropped to historic lows in 2020 and 2021, which fueled more purchase activity in the higher price tiers, increasing the share of higher loan balances and driving the average loan size to a record high of $436,576 in April 2022.

However, mortgage rates increased dramatically in 2022 and are currently close to their highest level in over 20 years. This caused a pullback in purchase activity as purchasing power was reduced, particularly in the high loan balance categories, and the average loan size is down to $398,092 as of August 2023.