Laird Nossuli and Mark Watson: A Deep Dive into iEmergent’s August Mortgage Forecast

iEmergent, Urbandale, Iowa, recently published its downgraded forecast for purchase and refi business in 2023 and 2024. MBA NewsLink asked iEmergent CEO Laird Nossuli and chief of forecasting Mark Watson to provide more context for our members.

MBA NewsLink: iEmergent’s new forecast postpones improvement in mortgage origination levels until 2024. Why is that?

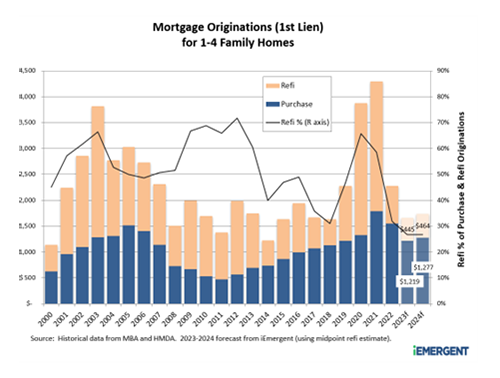

Laird Nossuli: All signs indicate the light at the end of the tunnel is still around the bend for mortgage originators. The combination of high interest rates and high home prices is setting new records for unaffordability, constraining home sales and grinding refinances to a near standstill. Inside Mortgage Finance puts refinance production during the first two quarters of 2023 at only $101 billion, less than half as much as the first two quarters of 2018, which was the slowest refinance year in the past decade. Our own analysis has caused us to lower both our purchase and refinance outlooks for 2023 and 2024.

NewsLink: Your blog mentions signs of “strength and resilience” in many areas of the American economy. What are some examples?

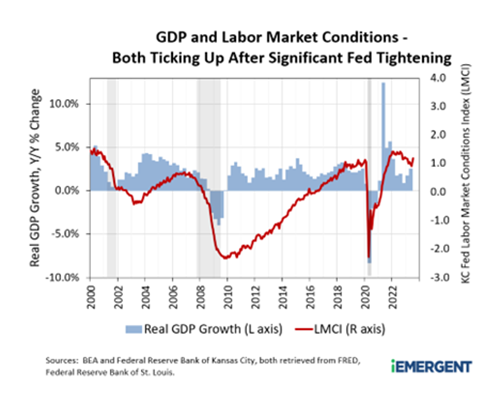

Mark Watson: The interest rate hikes by the Fed in 2022 and 2023 are having their intended effect on inflation. Growth of the core PCE deflator index, which tracks inflation in personal consumption expenditures excluding food and energy, fell from 6.0% in Q1 of last year to 3.8% in Q2 of this year. Consumer price index inflation improved even more dramatically from 9.1% in 2022 to 3.2% in July.

Gross domestic product, another primary indicator of economic health, has been growing at a surprisingly robust rate.

There are also positive trends to note in both employment and housing. The July 2023 unemployment rate was 3.5%, back to what it was before COVID-19 and the lowest since the 1960s. Plus, a resurgence in home price appreciation and home building points to confidence by both homebuyers and home builders.

NewsLink: If the economy is so healthy, what’s continuing to dampen mortgage demand?

Laird Nossuli: It’s a challenging time to be a mortgage originator. The interest rate on 30-year fixed-rate mortgages remains over 7%, making it tough for homebuyers to finance new homes at today’s prices in addition to strangling refinance activity.

NewsLink: Any good news on the horizon for lenders?

Mark Watson: Interest rates have been experiencing a yield curve inversion, where short-term rates exceed long-term ones, for over a year now. That’s historically been a nearly infallible predictor of recession, and we continue to believe an economic slowdown will arrive sometime between late this year and mid-2024. That will help bring down interest rates, at least modestly.

We also believe that rising home prices are not sustainable at the current level of housing affordability. As home sales volume continues at its current weak pace or even lower for the rest of this year, we should eventually see a softening of home prices going into next year.

In 2024, lower long-term interest rates and softening home prices should lead to slightly higher mortgage originations levels.

About iEmergent: iEmergent is a data and analytics technology provider focused on delivering insights to help organizations navigate the industry’s changing landscape. iEmergent provides powerful market intelligence to lenders of all types and sizes. Organizations use Mortgage MarketSmart, a web-based visualization tool, to access, analyze, and share data to shape strategy and make intelligent decisions. For more information, visit www.iEmergent.com.