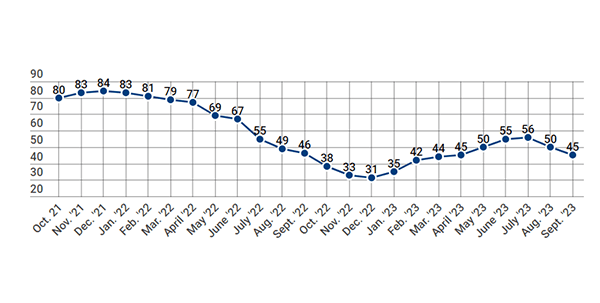

Elevated Mortgage Rates Hammer Builder Confidence

(Courtesy NAHB/Wells Fargo)

Stubbornly high mortgage rates that have remained above 7% for the past two months are taking a heavy toll on builder confidence, as sentiment levels dropped in October to the lowest point since January.

Builder confidence in the market for newly built single-family homes in October fell four points to 40 from a downwardly revised September reading, according to the National Association of Home Builders/Wells Fargo Housing Market Index. This represents the third consecutive monthly drop in builder confidence.

Since late September, mortgage rates are up nearly 40 basis points to 7.57%, according to Freddie Mac, McLean, Va. Interest rates have increased on the Federal Reserve’s apparent higher-for-longer monetary policy stance, better-than-expected economic growth during the third quarter and longer-term concerns over government budget deficits.

“The housing affordability crisis can only be solved by adding additional attainable, affordable supply,” NAHB Chief Economist Robert Dietz said. “Boosting housing production would help reduce the shelter inflation component that was responsible for more than half of the overall Consumer Price Index increase in September and aid the Fed’s mission to bring inflation back down to 2%. However, uncertainty regarding monetary policy is contributing to affordability challenges in the market.”

As a result of the extended high interest environment, many builders continue to reduce home prices to boost sales. In October, 32% of builders reported cutting home prices, unchanged from the previous month but still the highest rate since December 2022 (35%). The average price discount remains at 6%. Meanwhile, 62% of builders provided sales incentives of all forms in October, up from 59% in September and tied with the previous high for this cycle set in December 2022.

All three major HMI indices posted declines in October. The HMI index gauging current sales conditions fell four points to 46, the component charting sales expectations in the next six months dropped five points to 44 and the gauge measuring traffic of prospective buyers dipped four points to 26.