Veronica Nguyen of BeSmartee: Why Mortgage Lenders Online Presence Matters

Veronica Nguyen is Co-Founder and Executive Vice President of BeSmartee, Huntington Beach, Calif. She previously served as Co-Founder and Director of Inhouse Inc. before co-founding BeSmartee in 2012. She was a 2020 HousingWire Woman of Influence Award winner and earned a 2021 Mortgage Star Award from Mortgage Women Magazine.

In 2008, we believed that online mortgage applications would become a reality and transform the industry. Today, this belief has come to fruition and is revolutionizing the way we operate.

Why is this so important?

In the last five years, there’s been a significant uptick in online mortgage originations. More and more people are turning to the internet to shop and gather information. This means that mortgage companies can no longer afford to ignore the shift toward having a digital presence.

If you’re a lender operating in the age of chat, AI and social media, it’s time to take stock and ask yourself some important questions.

Do we have a solid online presence?

What steps can we take to adapt to the online world?

While human interaction is essential when you’re closing a mortgage loan, there’s no denying the benefits of automation when it comes to improving efficiency and duplicating efforts. The key is to leverage the power of automation to your advantage.

Maybe you’re still not convinced. Perhaps you’re skeptical about the importance of your online presence in the mortgage lending industry. Let’s look at the study we conducted so you can gain some insights and help your organization.

Digital Presence Comparison of 30 Mortgage Lenders: Banks, Non-bank Lenders and Credit Unions

In this case study, we analyzed the digital presence of 30 mortgage lenders to determine which ones have the most effective online presence. Our objective was to compare and contrast mortgage lenders, including banks, non-bank lenders and credit unions.

Our investigation was impartial and unbiased, and we had no prior assumptions or expectations. Now, let us dive into the findings.

Mortgage Lenders and Social Media

We will closely examine the 30 mortgage companies to observe their online expansion strategies. Our initial step involved gathering data to determine the mortgage companies’ social media presence.

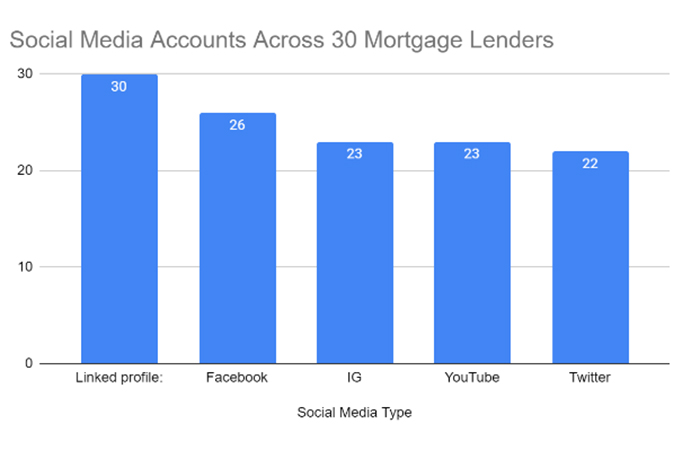

Upon analyzing the data, we discovered that the majority of lenders possessed a minimum of three to five social media accounts. Among the most popular social media platforms were LinkedIn and Facebook.

In summary, this data suggests that out of the 30 mortgage lenders analyzed, all 30 have a LinkedIn presence, 26 have a Facebook presence, 23 have an Instagram and YouTube presence, and 22 have a Twitter presence. This indicates that social media is widely used by mortgage lenders to connect with their customers and promote their services.

Are Your Social Media Posts Consistent?

Although each of them maintained a presence on social media to some extent, there were variations in their posting habits among credit unions, banks and non-bank lenders. While some entities were consistent in their posting cadence across all social media platforms, others were not.

As tempting as it may be to flood your social media channels with content in an effort to increase engagement, the truth is that quality should always trump quantity. When it comes to posting on social media, it’s not about how frequently you post, but rather the value of your posts that can make all the difference.

In today’s digital age, there are numerous tools available that can help you to post consistently without overwhelming your followers with too much content. With these tools at your disposal, you can create a manageable posting schedule that works for you and your audience.

In this analysis of the 30 mortgage lenders’ social media presence we found that consistency was key. The companies that posted regularly, rather than sporadically, saw the most engagement and positive results.

By posting consistently, these companies were able to build a relationship with their followers and establish a sense of trust and credibility within their respective industries.

So, if you want to get the most out of your social media presence, remember that it’s not about the number of posts, but the consistency of your efforts that truly matter. With the right tools and a commitment to regular posting, you can take your social media game to the next level and build a loyal following of engaged customers.

SEO Clicks: Which Mortgage Lender is Better?

In the world of marketing, driving traffic to your website is a critical step in generating leads and making sales. However, simply attracting visitors to your site doesn’t necessarily equate to revenue.

Marketers often struggle with determining the correlation between website traffic and actual sales. For example, a person clicking on your social media page may not necessarily translate into a sale for your business.

So, how can marketers determine how many website visitors it takes to make a sale? How can I attract more traffic? Which landing pages capture leads? This is where lenders’ marketing departments need to review and test to see how they can determine what is working and what is not.

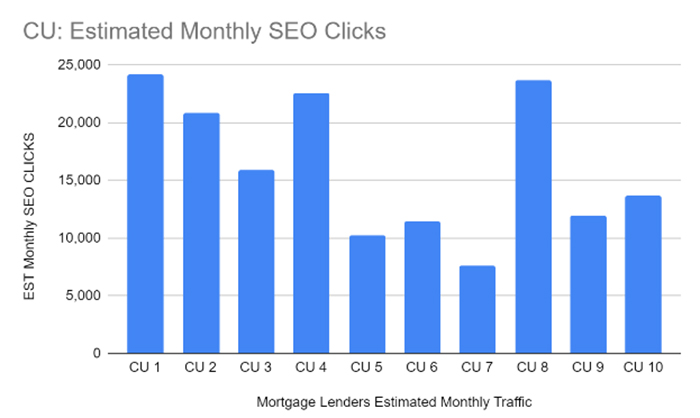

Upon examining the SEO clicks for the three types of mortgage lenders, we observed that credit unions exhibit greater consistency. Specifically, credit unions receive higher SEO clicks, indicating that their domain attracts more clicks from users.

Should Mortgage Lenders Care About Organic Traffic?

Customers trust and prefer organic search results over paid advertisements. When a customer is searching for information, they are more likely to click on a website that appears at the top of the search results page, rather than an advertisement.

This is because organic traffic is viewed as more reliable and trustworthy, as it is based on the website’s relevance and authority. Therefore, having your website appear at the top of search results through organic traffic can greatly increase the likelihood of attracting potential customers and ultimately lead to more conversions.

For example, let’s say a customer is searching for “best credit cards for cashback rewards” on Google. If a credit card company’s website appears at the top of the search results page through organic traffic, the customer is more likely to click on that website and consider the credit card options presented.

On the other hand, if the same credit card company’s website appears as a paid advertisement, the customer may be more skeptical and less likely to trust the information provided. Having strong organic traffic can be a valuable asset for companies looking to attract potential customers through online searches.

Keywords are important for organic traffic because they help search engines understand the content of a webpage and match it with relevant search queries made by users.

When a user enters a search query, search engines analyze the words used in the query and match them with relevant keywords found on various web pages. The search engines then rank these web pages based on various factors, such as the relevance and authority of the content, to determine the order in which they appear in search results.

Therefore, using relevant and specific keywords on a webpage can increase its visibility to search engines and increase the likelihood of it appearing in search results for relevant queries. This, in turn, can drive more organic traffic to the website, as users are more likely to click on links that appear at the top of search results.

The chart below shows how credit unions win when it comes to keyword rankings.

What Does the Data Tell Us?

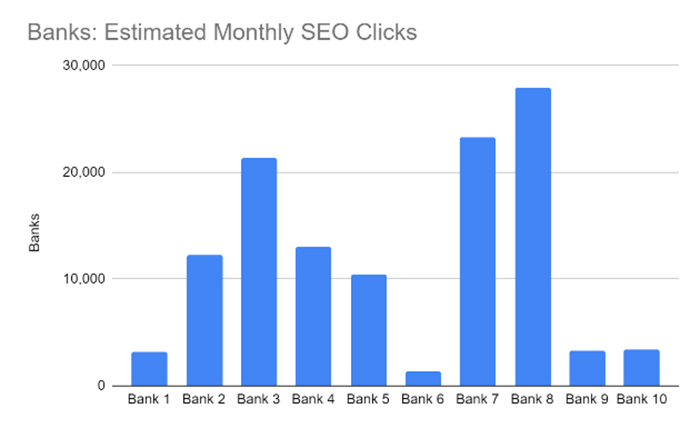

The data provided compares the number of organic keywords and estimated monthly SEO for ten credit unions, non-bank lenders, and banks.

Here are some general comparisons and contrasts:

Credit Unions:

CU one has the highest number of organic keywords (27,385) and the second-highest estimated monthly SEO (24,200).

CU five and CU six have the lowest number of organic keywords (13,279 and 10,287, respectively) and estimated monthly SEO (10,200 and 11,500, respectively).

The estimated monthly SEO for credit unions ranges from 7,650 to 23,700.

Non-bank Lenders:

Non-bank seven has the highest number of organic keywords (43,765) and the second-highest estimated monthly SEO (30,900).

Non-bank five has the lowest estimated monthly SEO (717), while non-bank 7 has the highest (30,900).

The estimated monthly SEO for non-bank lenders ranges from 262 to 30,900.

Banks:

Bank three has the highest number of organic keywords (22,452) and the second-highest estimated monthly SEO (21,300).

Bank six has the lowest number of organic keywords (1,578), while bank eight has the highest estimated monthly SEO (27,900).

The estimated monthly SEO for banks ranges from 1,320 to 27,900.

Tying Your Online Presence to Your Mortgage Process

For brands, establishing an online presence is essential as it enables them to build their reputation, manage their brand image and attract new customers. In the context of mortgage lending, customers expect to apply online rather than on paper in this digital age. Therefore, having an online mortgage application to provide to your customers portrays a professional image and keeps up with the current times.

Aside from looking good and making the customer happy, you are also able to save time and money internally when applying the right technology that is connected and not siloed.

Analyze and Execute

Creating an online experience for your customer is more than sending a link and expecting the mortgage application to get completed. Lenders must think in terms of marketing at the top of the funnel and post-close. To help you think about how this works, consider the following marketing steps that probably exist within your organization today.

Capture: In order to capture your customer there should be a clear way for the customer to apply for a mortgage.

Attract: Think about how you are attracting potential customers today.

Is an online application available for those who want to instantly apply for a mortgage on your website?

When was the last time you analyzed your website to check your intake leads and how they are performing?

Are you using any short forms to attract other product offerings such as equity loans and reverse mortgages?

Close: When you’re closing a loan, you need to keep the customer informed at all times. One way to do this is by having a robust Mortgage Point-of-Sale (POS) that will do that for you. Think about it in terms of purchasing a plane ticket, you would not want the travel agency to tell you the time but then make you pick up your tickets with the airline you selected. The experience is in one place.

(To learn more about this research reach out to sabrina@besmartee.com)

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)