ATTOM: Foreclosure Activity Up in Third Quarter

(Image courtesy of ATTOM)

ATTOM, Irvine, Calif., showed a jump in foreclosures in its Q3 U.S. Foreclosure Market Report. At 124,539 properties with foreclosure filings, they’re up 28% from Q2 and 34% from last year.

One in every 1,121 properties had a foreclosure filing in Q3. Those include default notices, scheduled auctions and bank repossessions.

For September, there were 37,679 properties with foreclosure filings, up 11% from August and 18% year-over-year.

“Foreclosures are on the rise again this quarter, as indicated by our latest foreclosure numbers,” said Rob Barber, CEO at ATTOM. “The number of new cases filed by lenders in the third quarter did rise just a small amount from the same period last year and actually dipped a bit quarterly–signs that the upward pattern may be easing. But foreclosure starts are nearly back to where they were two years ago when the federal government lifted a pandemic-related moratorium on most foreclosure filings.”

Specifically, there were starts on 68,961 properties, down 1% from Q2 and up 3% from a year ago. For the month of September, there were 25,042 foreclosure starts, up 9% from August and 15% year-over-year.

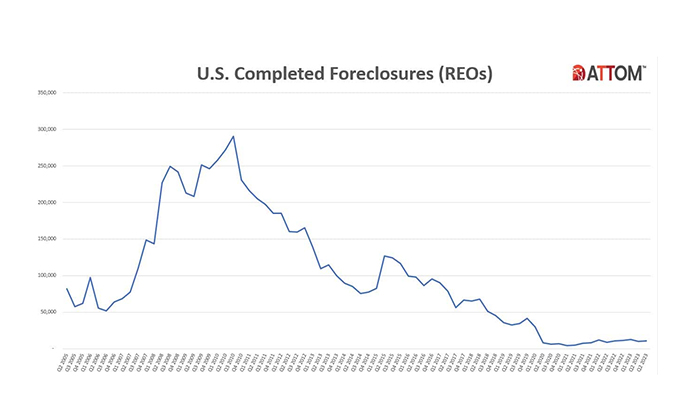

Lenders repossessed 11,020 properties via foreclosure in the quarter. That’s up 9% from Q2 and 5% from Q3 2022.

The average length of time to foreclose decreased 12% annually. Properties that were foreclosed in Q3 2023 were in the process for an average of 778 days, also down 36% from the previous quarter.

“This rise in foreclosures might also be attributed to pending filings finally processing,” Barber said. “Even with the national economic upturn and job stability, it’s evident that some homeowners are still grappling with the pandemic’s financial aftermath or encountering new challenges.”