Optimal Blue: Lock Volume Nearly Flat; Rate Headwinds Continue in October

(Illustration courtesy of Optimal Blue)

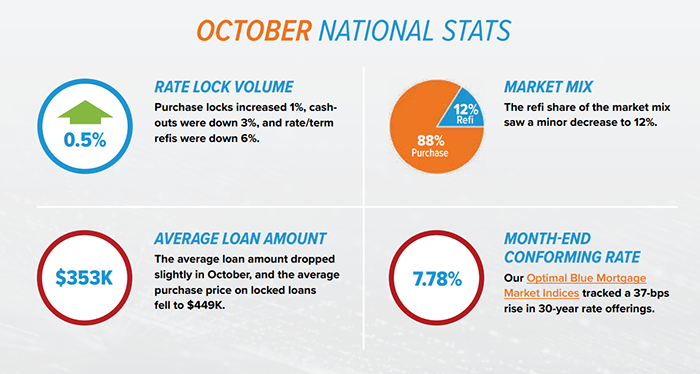

Mortgage rate-lock volume was virtually flat in October compared to September; however, when adjusting for the extra business day, volume was down 4%, reported Optimal Blue, Plano, Texas.

Both purchase and refinance volumes continued to wane amid multi-decade rate highs, Optimal Blue said in its October Originations Market Monitor report. Conventional conforming volume fell to its lowest share of rate lock volume since March, while the FHA share hit its highest point since 2017.

Although production trended lower nationally, certain warmer or more temperate geographies, which are generally less susceptible to seasonality in purchase activity, saw month-over-month growth. Both average loan amounts and purchase prices fell, while credit scores rose.

“Despite the Federal Open Market Committee’s decision to pause rate hikes, we saw rate headwinds continue in October,” said Brennan O’Connell, data solutions manager with Optimal Blue. “The mortgage rate spread to Treasurys also grew in October as investors sought safe haven assets among geopolitical concerns in Europe and the Middle East. The spread widened by 8 basis points to finish the month at 290 basis points.”

The report said the 30-year conforming rate peaked at 7.83% in October before dipping to 7.78%, a 37-basis-point increase over September month-end. Jumbo rates climbed above 8% before finishing the month at 7.94%, up 35 basis points month over month. FHA and VA rates rose 26 basis points and 40 basis points, respectively, both finishing the month at 7.4%. The steep mortgage rate increase pushed more borrowers toward adjustable-rate mortgage loans in October, with the share of adjustable-rate locks rising to 7.9% from 6.8% in September.

O’Connell noted conventional conforming volume fell in October to its lowest point since March, dropping to 56% of total lock production. “The lost market share was primarily picked up by FHA production, which rose to 22% of total volume,” he said. “FHA market share is now at the highest level seen since 2017. Non-agency and VA production finished October at 11.5% and 10.3%, respectively.”