Zillow: Buyer Demand Hanging Tough Despite High Rates, Seasonal Cooldown

(Charts courtesy of Zillow)

Low inventory levels are spurring surprisingly strong housing market competition despite mortgage rates reaching 23-year highs, according to Zillow, Seattle.

Depleted inventory stocks are gradually recovering and price appreciation is slowing, but demand has remained resilient, and attractive, appropriately priced listings are moving quickly, Zillow said in its latest Real Estate Market Report.

“With mortgage rates nearing 8% in October, the U.S. housing market continues to turn cooler, with inventory rising and appreciation decelerating,” Zillow Chief Economist Skylar Olsen said. “As interest rates rose, some pent-up sellers appear to have been shaken free of waiting for rates to drop. New listings have nearly escaped the red annually and are trending out of a mortgage rate lock-induced hole.”

Olsen noted a record number of households in prime home-buying ages are providing buyers, despite the current headwinds.

The key number for any potential buyer or seller is the mortgage rate, which marched skyward through October and finished the month near 8%. Rate hikes pushed monthly payments on a typical U.S. home up by more than 4% from September to October. At $1,991, monthly payments are up almost 10% compared to last October and have nearly doubled in two years, Zillow calculated.

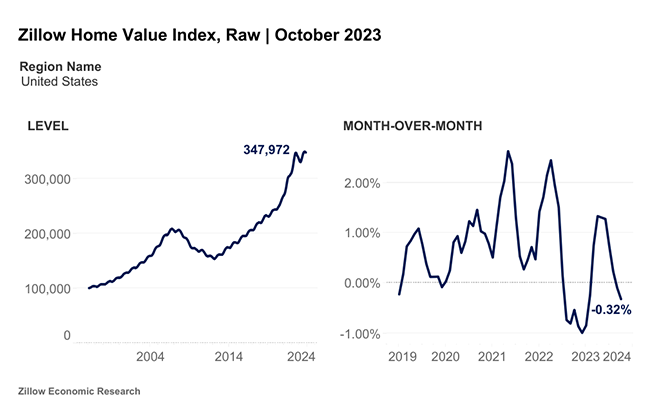

The Zillow Home Value Index puts the typical U.S. home value at $347,972, up 2.3% from a year ago. A 0.3% monthly decline in values in October is a bit steeper than the 0.1% dip from August to September and shows a slightly faster deceleration than pre-pandemic norms, Zillow said.

Home values fell during October in 40 of the top 50 markets, with the largest declines in Austin (-1.5%), Minneapolis (-1%) and New Orleans (-1%). The largest monthly growth was in sunny (and costly) Miami (0.5%), San Jose (0.4%) and San Diego (0.2%). Annual appreciation was strongest in Hartford (11.4%), Milwaukee (8.5%), Providence (7%) and Boston (6.8%) — all metros that avoided extreme early-pandemic growth spurts, the report said.