Harvard Report: Older Americans Face Significant Challenges in Housing, Care

(Image via Harvard Joint Center for Housing Studies)

The Harvard Joint Center for Housing Studies released its Housing America’s Older Adults 2023 report, warning that the U.S. will face issues housing and providing care to the aging population.

As Baby Boomers continue to age, the proportion of older adults in the U.S. has swelled–the population of those 65 and up has increased 34% over the past decade. Households headed by someone over 80 are anticipated to double by 2040.

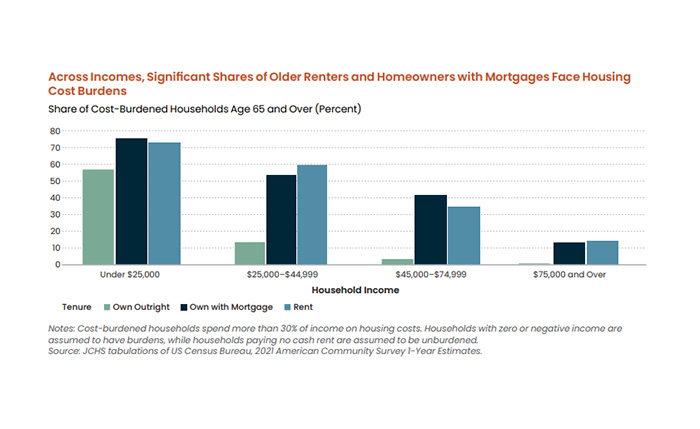

An all-time high of 11.2 million older adults are now cost burdened by housing–meaning they spend more than 30% of household income on housing costs.

Accessibility is also a big factor–fewer than 4% of U.S. homes offer three key features often needed–single-floor living, no-step entries, and wide hallways and doorways.

In terms of the housing landscape, 97.5% of older adults lived in either their own home (at 88.2%) or someone else’s, such as a family member, in 2021. The rest live in other arrangements, such as nursing home facilities.

Older adults of color are more likely to live in multigenerational households.

Most older Americans own their own homes, but more than one in five households are renters.

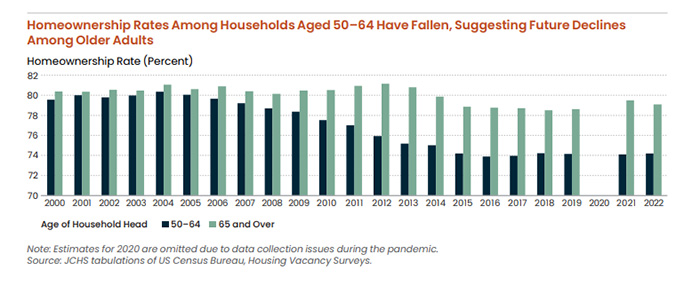

There also are significant homeownership disparities among older Americans–the homeownership gap between older Black and white households has hovered above 19 percentage points between 2015-2021. The gap between Hispanic and white households has been between 17-19 percentage points over that period.

Most older households live in single-family homes, but 20% are now in multifamily housing.

Income inequality is also increasing for older Americans, along with wealth and home equity gaps.

And, mortgage debt is rising. The share of homeowners 65-79 with a mortgage on their primary home increased from 24% to 41% between 1989 and 2022. Their median mortgage debt rose by more than 400%. For homeowners 80-plus, the share with mortgages jumped from 3% to 31%, and median mortgage debt increased by more than 750%.

“Borrowing is often a way for older homeowners to access cash for basic needs or care,” said Chris Herbert, Managing Director of the Center. “Given the importance of housing equity later in life there is a real need for safe and affordable mortgage products that work for older owners with limited incomes.”

The report noted that some products may have recently become more difficult for older Americans to access, such as cash-out refinancing.

As it stands, the availability of public assistance for housing does not meet the need, with available assistance sufficient to serve only 36.5% of eligible older households.

Four percent of older Americans live in housing described as moderately or severely inadequate. Split by demographics, that includes 6.8% of older Hispanic households, 7.1% of older Black households and 7.8% of multiracial/another race households. Only 3.2% and 4%, respectively, of older white and Asian households are categorized that way.

Other, oftentimes costly, challenges that will need to be confronted for older Americans’ housing needs include the expense of making homes accessible, housing variety (such as ADUs and cohousing communities), access to internet and transportation and climate change, particularly in states such as Florida. The dual burden of costs for housing and care also weigh heavily and will impact affordability for older Americans as the population continues to age, the report found.