Mark P. Dangelo: In an AI Reimagined Financial World, It Begins with the Consumer (Part 1)

Mark Dangelo currently serves as an independent innovation practitioner and advisor to private equity and VC funded firms. He has led diverse restructurings, MAD and transformations in more than 20 countries advising hundreds of firms ranging from Fortune 50 to startups. He is also Associate Director for Client Engagement with xLabs, adjunct professor with Case Western Reserve University, and author of five books on M&A and transformative innovation.

The storyline, potential, and chaos of artificial intelligence (#AI) captures the imagination of seemingly everyone on Earth. It fills the headlines, the daily news feeds, talk shows, political discussions, and increasingly, legislation. For business leaders facing challenging economic realities, it promises efficiencies, identification of new markets, solves regulatory compliance, ringfences precise consumer targets, and delivers granular cause-effect predictions of financial outcomes—all using continuous learning solutions, which (hopefully) improve dramatically over time against oceans of digital data assets.

For consumers, AI holds a promise to cross-connect siloed applications, safeguard their personal information, and offer inclusion to markets, products, and services that traditional brands excluded from participation. Yet, there is also the “dark side” that feeds the insecurity of workers’ rights, gainful employment opportunities, political positioning, and social inclusion at a time when polarization seems the currency of conversation. In general, AI seems to be both a savior—and an antagonist—much like a scene out of Angels and Demons.

To set the stage, this article is the first of a series addressing a value-driven approach to creating sustainable AI within and across a BFSI organization. This installment will articulate the building blocks of solution creation, and future parts will be deeper dives into the rationale and implications of their adoption. But, before we dive into the “what,” we need to understand the “why” of customer driven AI for BFSI delivery as framed by market context.

What we will uncover in this series is that AI is not a prescription or turnkey #COTS (commercial off the shelf software) taken to alleviate risks, solve inclusion, or gain competitive advantage. It will alleviate those challenges, but only if properly and precisely integrated against a shifting landscape of consumers, industry, and ecosystem demands.

Frame the Discussion Starting with the Customer—From Their Viewpoints and Values

To frame the impacts of competition for consumer loyalty and brand identity, the last 30 days there have been atypical partnerships undertaken by very traditional institutions. Illustrative of the foundational transformations taking place across industry segments, we note that @Apple (the most trusted brand in the world again this year) has partnered with @GoldmanSachs offering @FDIC savings accounts to their consumer base. As consumer trust in BFSI institutions has fallen by over one-half across four decades, Goldman Sachs is offering its charters, processes, compliance, and tech to a non-traditional competitor with access to over 2 billion consumers.

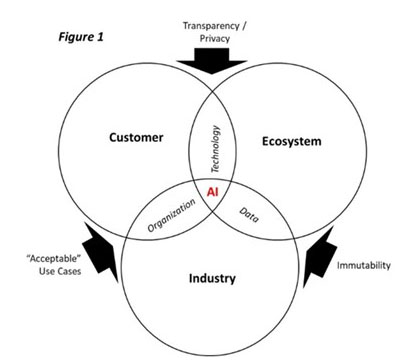

To deliver innovative and sought after financial consumer solutions, traditional BFSI firms actively began deploying AI capabilities starting in 2019. Yet, these prototype initiatives lacked the stickiness and innovative progression necessary to sustain growth, let alone profitability. Additionally, FinTech and RegTech solutions (over 15,000 and counting) were thrown into the mix hoping that “intelligent” decisioning and revenue growth could be achieved—the results were mixed. For banking and finance leaders, the challenge to focus rapid AI innovation resides (see Figure 1 illustration) with a) leveraging value shifts important to customers, b) transforming industry standards and models into the “next” reality, and c) participating in a comprehensive digital financial ecosystem where traditional approaches have lost their efficacy. In essence, the BSFI playbooks are being rewritten.

Even before the fervent #FOMO (fear of missing out) embrace of AI began in mid-2021, advanced solutions comprised of machine learning, RPA, and big data analytics dominated budget discussions and go-to-market strategies. The upside potential and promises—moving beyond The Ramifications of Innovation Singularity (2018)—has fed hypergrowth in hybrid and industry clouds at a compounded rate over 35% a year.

However, BFSI AI initiatives historically suffered failure rates against #KPI’s exceeding 85% and were innovatively relevant for less than 12 months. Why? In many cases, the AI deployments (and the data they were trained by) simply didn’t understand or anticipate consumer values and their changing behaviors. Their algorithms and models were designed to “think” and “predict” traditionally—that is, they weren’t modeled to leverage consumer innovation.

It is the Figure 1 framework of expansion and pressures—customer, industry, and ecosystem—which will envelop AI innovations, manage ever changing data sources, and permanently alter the relationships and outcomes across consumer products. That is the desired future state. But what should be done with the 90% of IT spending that is still consumed by legacy systems and maintenance? What will be needed to reskill employees where over 60% of data is “dark” and never used once captured? And, most importantly, what are the incremental and iterative value propositions that will be used by consumers and competitors to shape these new digitally driven BFSI ecosystems?

Embraced the Consumer Value Chain

Against the 43-year trend of industry consolidation (i.e., over 14,400 FDIC banks in 1980—now under 4,150 beginning in 2023) the imperatives for deploying AI to assess, frame, and deliver consumer products and services will be a top three priority until 2025. The need to generate new revenue streams and adopt sustainable business models has never been greater underneath the recent lens of banking failures (e.g., @FirstRepublic, @SVB, @Signature, @CreditSuisse), which have fractured global financial markets and the consumer trust placed within them.

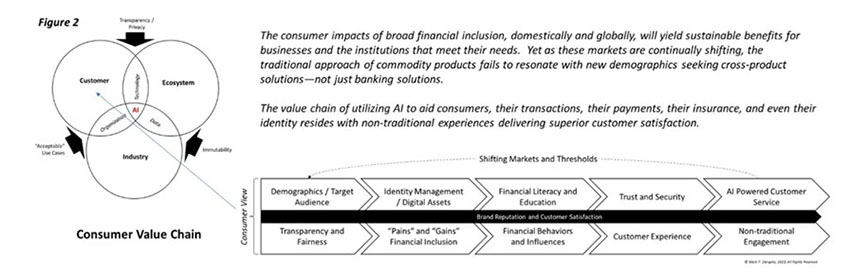

Today, and since 2020, financial growth and inclusion have been a boardroom corporate goal. The push for financial inclusion—regardless of prior practices—represents a greenfield of revenue opportunity where AI has a critical role for “good” benefiting the institution but more importantly consumers. However, if institutions accept the challenges brought on by new digital ecosystems, do they understand what these next generation of consumers value? What sequences of “crawl, walk, run” will be applicable to embrace the consumer while mitigating the risks? Figure 2 showcases a proposed value proposition that addresses customer shifting markets and thresholds within evolving digital financial ecosystems.

Figure 2’s value sequence showcases a progression of segmentation. The customer view represents the macro-level taxonomies that shape perceptions and results of brand value and customer satisfaction. For institutions to consistently deliver against the customer value sequence, there must be a digital maturity level and capability if AI is to achieve importance for new customers and existing markets. Institutions cannot jump from the beginning to the end without solving for the progressive maturity demands in the middle. Is there a “happy path” use case that delivers the intersection demands across the organization, its data, the technology stacks, and AI?

As an example, the traditional “bread-and-butter” loan markets—customer contact, origination, servicing, and securitization—there are those who advocate that applying AI to the 80+ processes which define the end-to-end supply chain of data could reduce cycle times, reestablish non-GSE private capital markets, and deliver “intelligent” loans that are continually updated with consumer information. But is that the best use-case? Is that what consumers want—what about investors? Will it promote inclusion or lead to discrimination and biases? Can BFSI’s participate in these markets even if AI were to automate many of the traditional process steps? The answer to these questions resides within the definition of the industry value chain—what does it include, how can it be delivered, and can we compete?

Industry Value Chain

Why is the decades old trend of industry consolidation a concern when it comes to revenue and profitability of BFSI across their highly segmented and extensively regulated consumer bases? Using the same timeline above, in 1980 commercial banks managed $1.8 trillion USD of assets. In 2023, against the historical loss of over 10,000 BFSI brands, the remaining 4,150 now manage over $22.9 trillion USD (with @JPMorgan representing over 10% of that total).

For regional and community banking leadership, the evolving customer value characteristics demand innovative approaches to attract and retain risk-attributed assets. This is a critical priority for AI—to help smaller institutions profitability compete (i.e., those not in the top 20 which control over 55% of all assets). It is against this backdrop of industry shifts where AI can reduce the dominance and restrictions created by extraordinarily large asset concentrations, while also mitigating the impacts of failures.

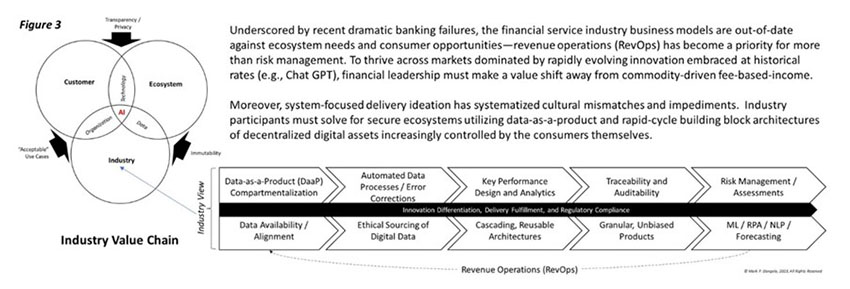

Figure 3 articulates the proposed industry value chain where all designs of AI (e.g., #ML, #generative, #explainable, #autonomous, #NLP) will be deployed. The first challenge for today’s BFSI leadership resides with objectively baselining current capabilities—for example, technology, people, process, partners, data, regulatory compliance, and traditional financial measures surrounding assets, equity, and performance.

The industry value chain highlights the embrace of definitive and evolving or ambiguous demands to create a delivery model that is iteratively adoptable, but also longer-term adaptable or evolutionary to meet the needs of rapidly changing customer behaviors and ecosystem shifts. At its foundation, it utilizes a familiar delivery technique of deploying active triple-constraints of large program management against industry strategies and market cycles.

But is that all there is? If we align our capabilities and value chain to precisely targeted consumers and their needs, is this enough to ensure that our business models and technology solutions will be innovatively relevant and sustainable? The answer—using history as our guide—is a resounding no. AI advancements add a new dimension that requires an orchestrated integration with the three commonly recognizable elements of ecosystem composition—organization, data, and technology.

Ecosystem Compartmentalization

As highlighted, the hype and thrill of BFSI AI is here, and now its impacts are cascading across traditional systems, market segments, and internal strategic initiatives. For AI advocates, innovative ideas have become the “magic button” as individuals and corporations use advancements and building blocks designs to capture the imagination of what is possible, what is coming, and what should be done. For risk mitigators, they wonder where the pitfalls are, the hidden liabilities, the inability to transparently understand outcomes, and the optimal intersection between organization, data, technology, and the AI itself.

It is this mosaic of options and solutions that the (aforementioned) value chains must participate within and adapt towards regardless of strength of internal research, number of patents, or even current daily customer base. To participate in an evolving BFSI ecosystem of the future using AI to reach new customers, define highly tailored products and services, and to increase the profitability across the business models, leaders must create actions that evolve against demands while avoiding the pitfalls of system ideation mindsets that governed solution development for the past 30 years.

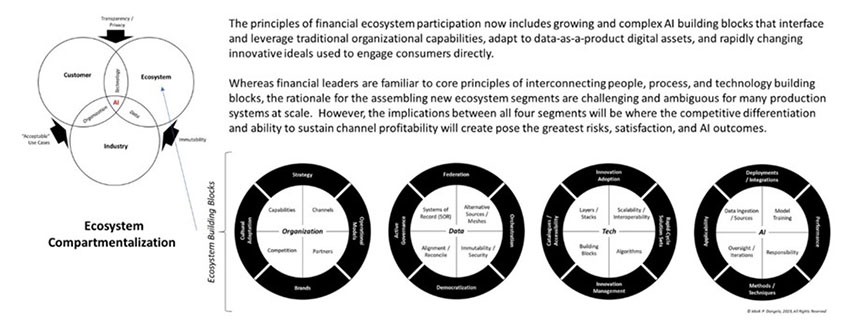

Figure 4 represents a shift in not only system or app mindset design, but a fundamental adoption of data ideation integrated with organizational capabilities. These building blocks, layered and part of a thin-level orchestrated architecture, allow leverage of existing and modern technologies that when integrated holistically created the foundation for BFSI AI solution benefits. This triple pronged approach—customer, industry, and ecosystem—meet the demands for constant change driven by innovation progression and rapidly-advancing AI features.

An implication of Figure 4, noted in the Data center of excellence circle, is the pervasive use by industry solutions of layered, crosslinked data meshes (see @FifthThird recent data mesh use case webinar). For leaders, these linked, immutable data meshes provide the “lithium batteries” needed to power solutions that will be required—but which have not been created. Stated differently, these unique embedded design features lead to accelerated business growth through revenue opportunities from “trapped” data, while preserving customer privacy and improving profitability the data mesh and enterprise fabric design of data usage.

In Summary, What Comes Next?

Mark Twain was attributed saying, “It is not what we don’t know that gets us into trouble, it is what we know for sure that just is not so.” Today, this is where the BFSI leaders find themselves—under pressure from governments, distrusted by consumers, competing against non-traditional competitors, and dealing with digitized systems that were created for an age of paper (i.e., not digitally native).

As we will explore in future article installments, we will deconstruct the three prongs to understand not just the “why” we should adopt this framework, but the “how,”—the caveats, the opportunities, “technology stacks,” and use cases of each. And finally, we will address the dreaded “implications” of adoption that contributes to numerous implementation failures for BFSI, and the Halo and Horns that come with embracing AI for inclusion, profitability, competition, and future relevancy.

For BFSI leaders, the rapid acceleration and iteration of AI solutions is sunsetting what we know for sure. For technologists, the stacking and interoperability of AI capabilities resides in how we devise the building blocks, our layers of capabilities, and how fast we can continually cycle. For consumers seeking participation and transparent products and services, they want to know what has taken BFSI as an industry so long to hear their voices.

AI across BFSI has the capability to deliver the heavy lift for smaller institutions to compete against larger ones. AI requires not just data and technology, but a shift of organizational mindset to leverage. As you examine the demands and opportunities in front of your BFSI organization at a time of great industry crisis and upheaval, will AI be a savor? Or just a horned creature leading to an unwanted merger, acquisition, or divesture (#MAD)?

(Editor’s Note: Mark Dangelo will be part of a panel discussion during an upcoming MBA Education webinar, Leveraging AI, Blockchain & New Technologies in Today’s Challenging Environment, on Wednesday, May 17 from 2:00-3:00 p.m. ET. For more information and to register, click here.)

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Michael Tucker, Editor, at mtucker@mba.org.)