MBA: IMBs Report Pre-Tax Net Production Losses in 1Q

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net loss of $1,972 on each loan they originated in the first quarter, an improvement from the reported loss of $2,812 per loan in the fourth quarter, the Mortgage Bankers Association reported Thursday in its Quarterly Mortgage Bankers Performance Report.

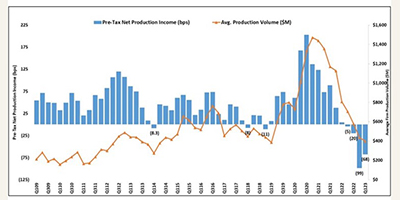

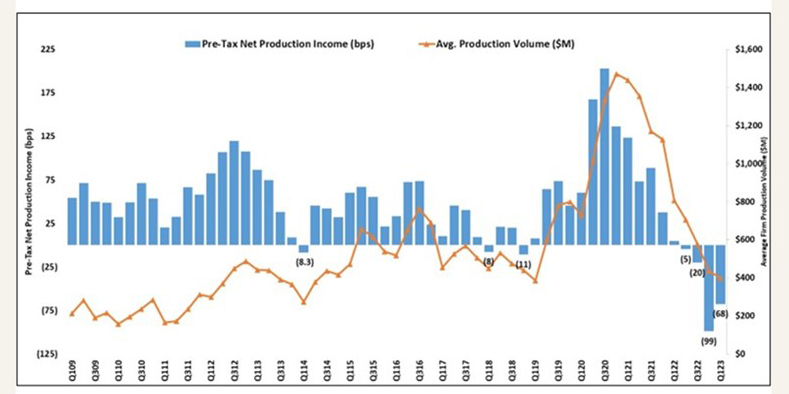

“A net production loss of 68 basis points in the first quarter of the year is an improvement over the record 99-basis-point loss reported in the fourth quarter of 2022,” said Marina Walsh, CMB, MBA Vice President of Industry Analysis. “Conditions continue to be challenging for the industry, with now four consecutive quarters of production losses and nine consecutive quarters of volume declines.”

Walsh noted one silver lining from the first quarter is that production revenues improved by 40 basis points. “However, costs continued to escalate with the further drop in volume and reached more than $13,000 per loan despite substantial personnel reductions,” she said.

In terms of profitability, Walsh noted that including both production and servicing business lines, 32 percent of companies were profitable last quarter, up from 25 percent in the fourth quarter.

Key findings of MBA First-Quarter Quarterly Mortgage Bankers Performance Report:

- Average pre-tax production loss improved to 68 basis points in the first quarter, compared to a loss of 99 bps in the fourth quarter, but down from a gain of 5 basis points one year ago. The average quarterly pre-tax production profit, from third quarter 2008 to the most recent quarter is 48 basis points.

- Average production volume fell to $398 million per company in the first quarter, down from $436 million per company in the fourth quarter. Volume by count per company averaged 1,264 loans in the first quarter, down from 1,395 loans in the fourth quarter.

- Total production revenue (fee income, net secondary marketing income and warehouse spread) increased to 358 bps in the first quarter, up from 317 bps in the fourth quarter. On a per-loan basis, production revenues increased to $11,199 per loan in the first quarter, up from $9,637 per loan in the fourth quarter.

- The purchase share of total originations, by dollar volume, remained unchanged at a study high of 88 percent in the first quarter. For the mortgage industry as a whole, MBA estimates purchase share at 80 percent in the first quarter.

- The average loan balance for first mortgages increased to $329,159 in the first quarter, up from $322,225 in the fourth quarter.

- Total loan production expenses – commissions, compensation, occupancy, equipment and other production expenses and corporate allocations – increased to a study-high of $13,171 per loan in the first quarter, up from $12,450 per loan in the fourth quarter. From third quarter 2008 to last quarter, loan production expenses averaged $7,172 per loan.

- The average number of production employees per company declined from 413 in the fourth quarter to 374 production employees in the first quarter (on a repeater company basis).

- Servicing net financial income for the first quarter (without annualizing) rose to $54 per loan, up from $37 per loan in the fourth quarter. Servicing operating income, which excludes MSR amortization, gains/loss in the valuation of servicing rights net of hedging gains/losses and gains/losses on the bulk sale of MSRs, fell to $102 per loan in the first quarter, down slightly from $104 per loan in the fourth quarter.

- Including all business lines (both production and servicing), 32 percent of firms in the study posted pre-tax net financial profits in the first quarter, up from 25 percent in the fourth quarter.

The MBA Mortgage Bankers Performance Report series offers a variety of other performance measures on the mortgage banking industry including revenue and cost breakouts, productivity, product mixes for originations and servicing volume and pull-through rates. The Performance Report is intended as a financial and operational benchmark for independent mortgage companies, bank subsidiaries and other non-depository institutions. Eighty-four percent of the 312 companies that reported production data for the first quarter were independent mortgage companies; the remaining 16 percent were subsidiaries and other non-depository institutions.

MBA produces five Mortgage Bankers Performance Report publications per year: four quarterly reports and one annual report. To purchase or subscribe to the publications, call (202) 557-2879. Reports can also be purchased on MBA’s website by visiting www.mba.org/PerformanceReport.