Redfin: Spring Home Season Off to Mixed Start

Two reports from Redfin, Seattle, suggest the spring home buying/selling season could be hamstrung by cooling home prices and a usual suspect: not enough housing inventory.

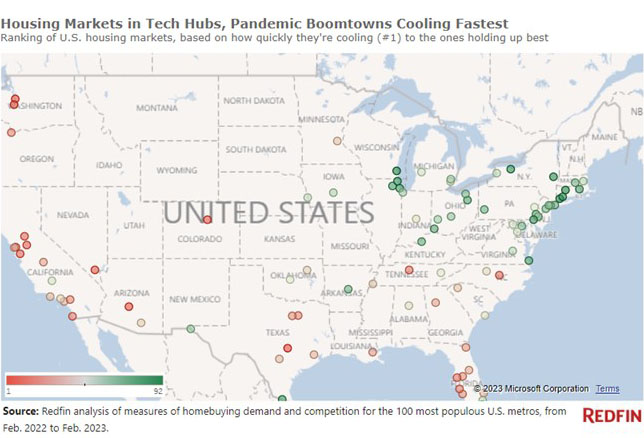

Redfin reported housing markets in tech hubs and pandemic migration hotspots are cooling more rapidly than other parts of the U.S as the tech sector falters and mortgage rates remain elevated. Austin, Texas, cooled fastest over the last year as the U.S. housing market descended from its pandemic-era boom, followed by Seattle, Phoenix, Tacoma, Wash., and Denver. Las Vegas, Stockton, Calif., San Jose, Calif., Sacramento, Calif., and Oakland round out the top 10.

Redfin noted the typical San Jose home sold for just 0.6% above its asking price in February, compared with 12% above asking price a year earlier—the biggest percentage-point drop-off in the U.S. Seattle had the third-biggest drop-off, going from 8% above asking price to 1% below during the last year. Pending home sales declined 40% year over year in Seattle, and they were down 38% in San Jose.

The Redfin analysis said housing markets in tech hubs are cooling quickly for several reasons: topsy-turvy tech stocks; tech layoffs; low inventory; unsustainable pandemic home-price increases; high mortgage rates; and still-high home prices. Home prices are falling in the Bay Area and Seattle, but they’re still high, largely because of limited inventory. The typical San Jose and Seattle homes sell for $1,250,000 and $710,000, respectively, compared with the $386,000 national median. High mortgage rates are exacerbating the expense, pushing out many would-be buyers.

“I’m seeing bidding wars on homes that are priced fairly and accurately, and the overall market looks strong this week,” said San Jose Redfin agent Laxmi Penupothula. “Overpriced listings are the ones sitting on the market.”

Separately, Redfin reported limited supply is another barrier for buyers, who are competing for the few homes on the market.

“We’re not seeing the typical spring seasonal increase in business,” said Boise, Idaho, Redfin agent Shauna Pendleton. “There’s no seasonality; homebuyers and sellers are hyper-focused on mortgage rates. If rates end the week down, all of a sudden buyers are out there making offers. If rates end the week high, buyers disappear.”

Redfin noted mortgage-purchase applications are up 17% from a month ago after increasing for the third straight week, and the number of homebuyers contacting Redfin agents for tours and other services rose this week. But prospective buyers are struggling with tight supply, as sellers are typically slower to return than buyers. New listings of U.S. homes for sale fell 22% from a year earlier during the four weeks ending March 19, one of the biggest declines since the housing market nearly ground to a halt in the beginning of the pandemic (new listings fell slightly more in December 2022). Many would-be sellers are reluctant because they want to hang onto a low mortgage rate—nearly all homeowners have a rate under 6%—and because they’re also buyers struggling with low inventory.

Redfin Chief Economist Daryl Fairweather said because there’s so little to choose from, homebuying speed is picking up even while rates stay high and demand remains low compared with last year. Nearly half of homes that went under contract had an accepted offer within two weeks of hitting the market, the highest share since June. That’s partly due to typical seasonality, as the market usually picks up speed as spring starts, but lack of inventory is causing homes to sell faster than expected when buyers are contending with 6%-plus rates.

“The banking-industry chaos of the last few weeks likely prevented the Fed from making a big, inflation-fighting hike this week that could have sent mortgage rates soaring,” Fairweather said. “They kept the hike small partly because banking turmoil naturally combats inflation. As a result, the housing market is in a better place now than it was a few weeks ago.”