Elevating Your Quality Quotient: Taking Stock of Mortgage Servicing in Three Acts

Kristin Broadley serves as Chief Innovation Officer with QC Ally. She is responsible for identifying strategies, business opportunities and new technologies to enhance competitiveness. She previously spent 20 years with the Rocket Family of Companies serving in various roles. Kristin.Broadley@QCAlly.com.

Stuart Quinn has worked in housing finance, mortgage policy and technology in the private sector for more than 10 years. He joined Housing Finance Strategies in mid-2022 from Accenture to provide expertise on the landscape of fintech, mortgage modernization and housing policy. While with Accenture he served as a Product Manager focusing on platform integrations, GSE technology integrations, end-user experience and Loan Origination Systems. Prior to Accenture, he worked in Advisory Services as Policy Research and Strategy Analyst for CoreLogic. squinn@housingfinancestrategies.com.

Where We Are Today in Servicing: The Role of the Servicer

A borrower’s first home purchase and introduction to homeownership leaves an imprint. Mortgage origination production is an important component of housing services, but shortly after closing and keys are in-hand, the borrower’s collective time within the home is spent interacting with another mortgage ecosystem partner, their mortgage servicer.

Servicers provide a suite of critical functions throughout the duration of the mortgage. Similar to the origination process, mortgage servicing is data intensive, evidenced through existing and ongoing disclosures and executed under regulatory requirements overlaid with policies and procedures to drive quality, compliance, consistency and deliver optimal outcomes for borrowers.

QC Ally has long been a trusted partner committed to supporting high standards of quality and compliance outcomes for mortgage lenders and servicers through tech enabled audit services.

Act I: The Great Financial Crisis and the Emergence of Standards

In the previous decade, the role of performing and non-performing loan servicing has evolved significantly. Prior to the Great Financial Crisis and enactment of the Dodd-Frank Act of 2010, distressed mortgage servicing was one of the lesser evolved components of residential housing finance. Preceded by limited delinquency rates and multiple decades of upward momentum in home prices, performing loan servicing operated on a steady keel. As delinquencies on mortgages swelled beginning in 2007, it was clear a more systematic and standards driven approach enabled by technology advancement would be required to assess borrower hardships as the economic conditions rapidly deteriorated at a national level.

Consumer guardrails and regulatory standards were put into place through new rules authored by the Consumer Financial Protection Bureau, National State Attorney’s General settlements, credit investors and administrative programs. Among other things, the new regulations and Making Home Affordable – Home Affordable Modification programs sought to create more standards through requiring individual servicer specific policies and procedures related to evaluation of loss mitigation applicants. These new regulatory standards required disclosure/notification periods, complaint management processes and the manner in which servicers should evaluate and provide ongoing communication routines between servicers and borrowers.

The finalization of the regulations and supplemental loss mitigation standards designed through USDA Rural Housing Service, the Federal Housing Administration, Veterans Administration Loan Guaranty Service, Fannie Mae and Freddie Mac and MHA created a framework of loss mitigation standards that could be leveraged to address borrower hardships by servicers going forward. In addition, specific regulatory rulemaking created enforceable compliance requirements putting a spotlight on the servicing industry and requiring navigation and adherence to the rules in-line with investor program requirements.

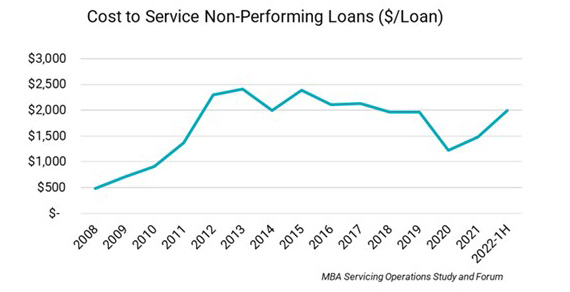

As the economy normalized and non-performing servicing costs began to stabilize under the new standards, an effort was made to refine the existing GFC programs rolled out under crisis constraints to ensure continued focus on: (i) accessibility; (ii) affordability; (iii) sustainability; (iv) transparency and (v) accountability as pillars of loss mitigation of the future. Fannie Mae and Freddie Mac introduced new servicing requirements to implement the Flex Modification for ongoing hardships and future modifications available to servicers in place of crisis related programs.

Act II: Pandemic Protocols in Servicing

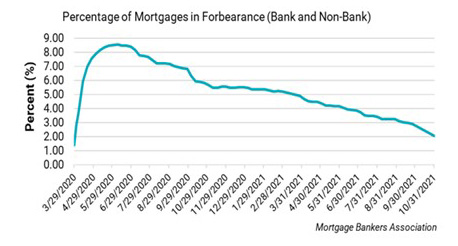

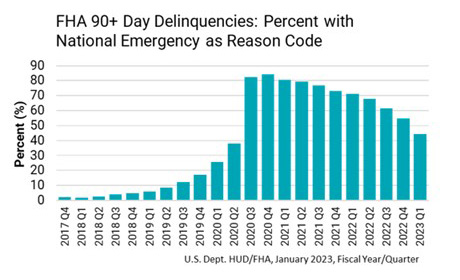

Fast forward a few years, COVID-19 brought forward a new set of wrinkles to the existing set of programs and safeguards in place. Upon the national disaster declaration formalized in mid-March 2020, federal housing agencies took swift action to bring forward and modify new policies to assist homeowners affected by the nationwide pandemic. Federal housing agencies put a foreclosure moratorium in place, and legislators passed the Coronavirus Aid, Relief and Economic and Security Act (CARES Act) allocating assistance funds and enabling flexibilities in forbearance, partial payment and loan modification relief for consumers. In addition, changes were made to the information creditors and servicers reported to Consumer Credit Reporting Agencies as well as the impact of the deferred payments under the Act. A second round of funding under the American Rescue Act in 2021 established the Homeowners Assistance Fund overseen by the U.S. Treasury and administered by the States. This further expanded the levers and toolkit available to mortgage servicers to assist distressed borrowers.

The immediacy of response, close coordination of government and industry, coupled with the level of dollars allocated allowed for avoidance of ballooning foreclosures as borrowers’ payments were forborne. Though attention was paid to reducing barriers for borrowers and standardizing the waterfall of payment relief options, servicers were required to quickly navigate significant changes to their policies to adhere to the changes and standardization across all credit-investors was not comprehensive.

Act III: The Road Ahead: Future Challenges and Opportunities

As hardships from the pandemic continue to subside, similar to the GFC, it will be important to take stock of the innovative programs launched under duress and preserve the critical features that worked to allow for future borrower access to options. The current Administration most recently extended the emergency declaration to May 11. The VA LGY has already allowed for their VA Partial Claim Payment program to expire in October 2022. Credit investors should be evaluating program options under new constraints imposed by higher rates, including mortgage lending rates. Increased rates impose challenges on the availability of options a servicer may be able to offer in reducing a borrowers monthly payment given their current rate is likely to be well below prevailing market rates.

These transition periods offer opportunities for servicers to take time to review QC and QA programs across performing and non-performing portfolios to ensure monitoring and processes remain preventative and proactive. Additionally, expected increases in mortgage servicing right sales offer an opportune time to further tailor QC and QA approaches to transfers and onboarding. QC Ally has a 99% accuracy rate and a variable cost structure which allows servicers and sub-servicers to confirm their existing processes are compliant and working as intended. Beginning the review of the governance process now allows servicers a leg up in what may need to be evolved over time as federal regulatory and credit investor requirements are adjusted to meet the housing market and the borrower of today.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)

[1] U.S. Treasury, Federal Housing Finance Agency and U.S. Department of Housing and Urban Development, “Guiding Principles for the Future of Loss Mitigation,” joint-agency whitepaper, July 25, 2016. https://www.ncsha.org/wp-content/uploads/2016/08/guiding-principles-future-of-loss-mitigation.pdf and Consumer Financial Protection Bureau, “CFPB’s Principles for the Future of Loss Mitigation,” August 2, 2016. https://files.consumerfinance.gov/f/documents/20160802_CFPB_Principles_for_Future_of_Loss_Mitigation.pdf.

[2] President Donald Trump White House, “Proclamation on Declaring a National Emergency Concerning the Novel Coronavirus (COVID-19) Outbreak,” March 13, 2020. https://trumpwhitehouse.archives.gov/presidential-actions/proclamation-declaring-national-emergency-concerning-novel-coronavirus-disease-covid-19-outbreak/.

[3] National Council of State Housing Agencies, “Summary of the Homeowners Assistance Fund,” March 11, 2021. https://www.ncsha.org/wp-content/uploads/Summary-of-HAF-Provisions-Final-Bill-1.pdf.

[4 ]Executive Office of the President, “Statement of Administration Policy,” January 30, 2023. https://www.whitehouse.gov/wp-content/uploads/2023/01/SAP-H.R.-382-H.J.-Res.-7.pdf.