Home Flipping at 18-Year High, But Profits Drop Further

ATTOM, Irvine, Calif., reported an increase in home-flipping in 2022, but noted gross profits fell to their lowest point since 2008.

The company’s 2022 U.S. Home Flipping Report showed 407,417 single-family homes and condos in the United States flipped in 2022, up 14 percent from 357,666 in 2021 and up 58 percent from 2020, to the highest point since at least 2005.

Homes flipped by investors last year represented 8.4 percent of all home sales, also the largest figure since at least 2005. The latest portion was up from 5.9 percent in 2021 and 5.8 percent in 2020.

But even as quick buy-renovate-and-resell turnarounds by investors shot up, gross profit margins on home flips in 2022 sank to their lowest level since 2008 following the second major drop in two years.

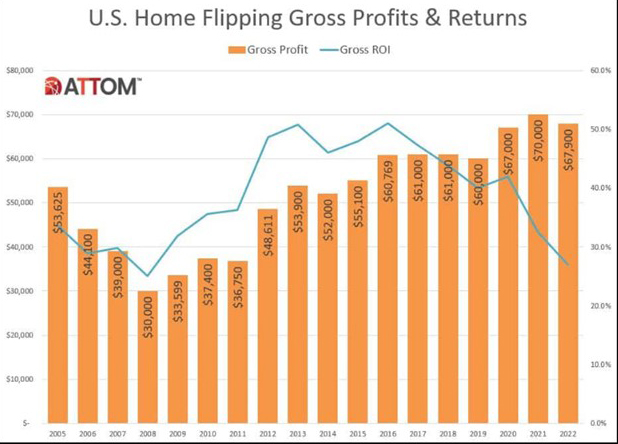

Homes flipped in 2022 typically generated a gross profit of $67,900 nationwide, down 3 percent from $70,000 in 2021. This represented just a 26.9 percent return on investment compared to the original acquisition price. The latest nationwide ROI (before accounting for mortgage interest, property taxes, renovation expenses and other holding costs) fell from 32.6 percent in 2021 and from 41.9 percent in 2020.

Additionally, ATTOM said investors saw their profit margins drop for the fifth time in the past six years as the median value of the homes they flipped rose more slowly than the median price they paid to purchase properties – 12 percent versus 17 percent. ATTOM CEO Rob Barber said the decline in home-flipping profits in 2022 continued to cast a negative light on a niche of the U.S. housing market that is growing but also struggling to figure out how to profit from changing price trends.

“Last year, home flippers throughout the U.S. experienced another tough period as returns took yet another hit. For the second straight year, more investors were flipping but found no simple path to quick profits,” Barber said. “Returns are now at the point where they could easily be wiped out by the carrying costs during the renovation and repair process, which usually accounts for 20 to 33 percent of the resale price. This year will reveal more about whether investors decide to find different ways to profit from home-flipping or take a step back and wait for conditions to get better.”

The report said home flips as a portion of all home sales increased from 2021 to 2022 in 216 of the 218 metropolitan statistical areas analyzed in the report (99 percent). Among the 25 largest increases in annual flipping rates, 20 were in the South and West. The only metro areas where home flipping rates decreased from 2021 to 2022 were New Orleans (down 8.2 percent) and Green Bay, Wis. (down 2.9 percent).

Nationally, the percentage of flipped homes purchased with financing decreased in 2022 to 35.2 percent, down from 35.9 percent in 2021 and from 41 percent in 2020. Meanwhile, 64.8 percent of homes flipped in 2022 were bought with all-cash, up from 64.1 percent in 2021 and from 59 percent two years earlier.

The report said homes flipped in 2022 sold for a median price nationwide of $320,000, generating a gross flipping profit of $67,900 above the median original purchase price paid by investors of $252,100. That national gross-profit figure was down from $70,000 in 2021 (the high point since at least 2005) but still up from $67,000 in 2020. The gross profit margin on the typical home flip in the U.S. last year fell to 26.9 percent – the smallest investment return since at least 2005. The ROI on median-priced home flips nationwide has dropped 15 percentage points since 2020 and is off by 24 points since 2016.

Home flippers who sold homes in 2022 took an average of 164 days, or about 5 ½ months, to complete the flips, up from 152 days for homes flipped in 2021 but still down from 182 days in 2020.

“While declining margin is certainly a cause for caution, it is important to remember that these numbers are somewhat backward looking in that they reflect dispositions of properties that were acquired in 2021 or early 2022 amidst the Covid-induced bidding wars in many locales”, said Maksim Stavinsky, Co-Founder and President of Roc360, New York. “On the other hand, it is encouraging that investors were able to clear in excess of four hundred thousand properties – the most ever – in an environment of rising interest rates, without a meaningful increase in project timelines.”