Mark P. Dangelo: Digital Transformation—Utilizing DaaP for Revenue Gains

Mark Dangelo currently serves as an innovation officer to private equity and VC funded firms spearheading digital fabrics, data sovereignty, MAD data science and decentralized finance. He is also a country leader for Dataswift.io and a graduate professor of innovation and entrepreneurship at John Carroll University. He is author of five books on innovation and a frequent writer for MBA NewsLink.

In 2002 business researchers proclaimed early ideas surrounding digital economies, native digital consumer behaviors, and efficiency-defined digital transformations moving from paper to digital processes. And looking back the impacts of digital technology today coupled with the implications of tomorrow, advancements and layers of data-driven capabilities make those early advocates appear out of touch.

Moreover, since the 1970s the design thinking of #BFSI (banking financial service industries) industry architectures and infrastructures were amassed around application or system thinking—that is applications, network, and hardware. Data needed for automation, and as part of the transaction, were by-products of the overall system design—not as the primary requirement for system creation and adaptability for native digital operations.

Tomorrow’s BFSI leaders will have survived the Great Data Revolution not because of innovative solutions like #ChatGPT, but because the data they used, the data they leveraged, and the data fabrics they created to deliver customer for life demands became cornerstones for innovation adaptability and revenue growth.

As the generational shift to could computing becomes the first reaction to new BFSI features and functionality, we can already see the cloud providers expanding their data-as-a-product mindset to be tightly coupled to industry specific cloud solutions delivering greater functionality, adherence to standards, and lower reuse costs. The era of application design thinking is rapidly ending.

System-Constrained, Design Thinking is Ending

It is becoming clearer that design thinking mindset around systems has let to vast silos of data buried within divisions and across platforms. Additionally, with rising consumer mobility and underpinned enterprise initiatives around data warehousing, #ETL / #ELT processes, data for analytics, and many more “bridge or insight solutions,” we begrudgingly accept that over 25% of yearly IT budgets are being consumed to deliver and maintain data consistency for a limited set of assets.

It may be heretical for some, but native digital ecosystems have significantly devalued traditional BFSI system thinking in favor of data-as-a-service (#DaaP), which increasingly delivers expanded revenue using data (see supporting trends from @MIT Technology Review, “Design thinking was supposed to fix the world. Where did it go wrong?”)

With the widespread adoption of #aaS (as-a-Service) offerings underpinned by specialized industry cloud solutions, the last two decades have created digital transformation-in-a-box capabilities. These “customizable” solutions are now evolving into advanced “#BusinessScience” strategies and methods fueled by the rise of generative #AI popularity, which currently requires a minimum of 50 terabytes of vetted data just to initially train.

Additionally, with BFSI cloud computing now over 50% of all IT solutions deployed, and growing between 15% to 21% annually, digital transformation alternatives linked to virtualized data meshes and fabrics are accelerating. As the costs and benefits of cloud computing coupled with exploding regulatory compliance covering data privacy, security, and sovereignty lead to spending reviews, BFSI leaders must balance unbridled deployment against bottom line returns. Moreover, across solutions seeking to leverage both real and synthetic (i.e., machine created) data, the value and demand for cross-platform data is rising exponentially (e.g., @Salesforce Financial Services Cloud, #neobanks, #datawallets).

To leverage for both efficiencies and revenue enhancements, BFSI leaders must understand 1) the industry models and strategy actions are undergoing material transitions, 2) DaaP requires a shift of not only mindset, but also in design, and 3) the business science framework (i.e., combining industry, technology, and experiential skills) provides the most robust implementations for DaaP digital ecosystems.

BFSI Enters a Next-Gen Shift

When business is good and volumes sustain the enterprise, complex problems are left for later. During these times, the focus centers on off-the-shelf #FinTech that solves the immediate needs rather than address complex financial systems full of traditional challenges and cascading “butterfly effects” (a chaos theory reference where small early changes can have non-linear downstream impacts)

The challenge for many BFSI and mortgage leaders will be to accept that complex system redesign is in their future—it is not academic, it is not traditional, and past decisioning and reasoning will not negate the future demands. With the next technological iteration involving embedded FinTech and #RegTech solutions, the challenges of internal skills and organizational culture will stifle disruptive improvements (e.g., revenue enhancements) as contrasted to incremental efficiencies.

Complex BFSI systems are defined by thousands of connections, hundreds of procedures, dozens of major processes and partners, and tens of thousands of data points and values. These complex financial supply chains (e.g., mortgage, retail, secondary markets, commercial) demand a repurposing of industry offerings realigned to customer-driven digital delivery models and ecosystems. The traditional approaches echo commoditization of offerings supported by locked-in, data silos—not data-driven, cross platform capabilities needed for digital, decentralized financial solutions.

Moreover, the finance industry is undergoing a comprehensive phase shift from system ideation to DaaP. Making leadership even more difficult, in the headlines and across conferences, the world of today seems solely about generative AI (e.g., Chat GPT, #Bard)—they are mistaken, as this class of solutions represents but one toolset. For without secure, privacy preserving, immutable data, the promise of AI will be limited and represent biases of today, while reinforcing existing consumer beliefs and operational restrictions present across infrastructure and outsourcing designs.

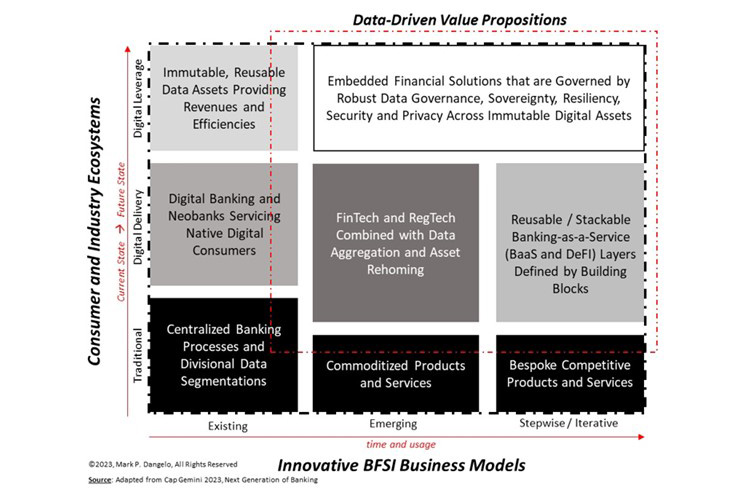

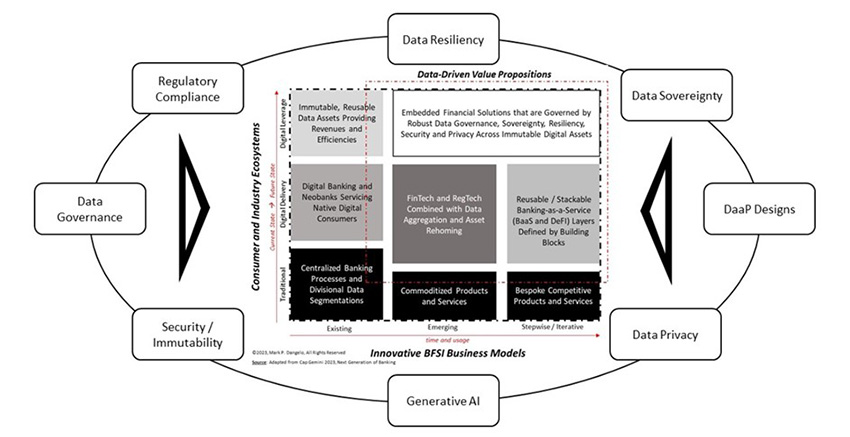

Taking a DaaP mindset (see Part 2 of this series) and applying them to next-gen digital economies (see report @Capgemini Invent, “Next-Generation Banking,” December 2022), the structural value of data transforms not just the strategy and technology, but the overall purpose and profitability of BFSI products and services (see figure below).

What the industry shifts above showcase is that there will be multiple speeds of execution depending upon numerous factors including operating models, partnerships, channels, organizational culture, markets served, and delivery capabilities. The model establishes the visual rationale for creation of a new-generational design that utilizes data building blocks, layers of functionality, and a robust DaaP architecture, which delivers the requirements demanded by customers and capabilities (necessary as an entry-fee for market competition).

Constructing the Data House—Implementing Data-as-a-Product (#DaaP), Brick-by-Brick

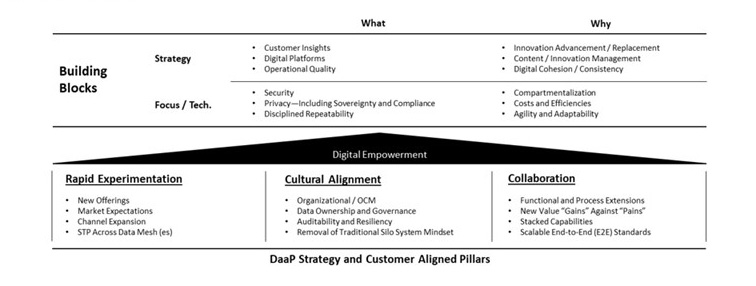

As we know, the building of a home, especially a modern one, requires a cascading set of ever more complex designs, skilled personnel, and advanced materials. The same can be said for constructing DaaP, and it begins with the creation of building blocks that can then be assembled into unique offerings (i.e., think crawl, walk, run using an engineering model). The following figure represents the pillars of DaaP strategy underpinning the creation of building blocks necessary for a data-driven organization, and the foundational elements that must be addressed before applying systems to leverage reusable data.

The illustration, which will be progressively expanded in this section, provides the rationale and implications necessary to transform. Across the enterprise, effective digital transformation initiatives require a DaaP set of solutions to handle the varied data types (e.g., metadata, structured, unstructured, synthetic, et al) and the passive to active implementations of data governance that span system thinking.

The irony of the current phase shift is that digital transformations were initially viewed as destinations. Today, the journey of digital transformations finds its origins from the paper-to-digital efforts since the #GreatRecession, yet these historical, expensive automations exposed the BFSI weaknesses and has prompted non-traditional competition to seize the day to capture customer contacts, their attention, and their business.

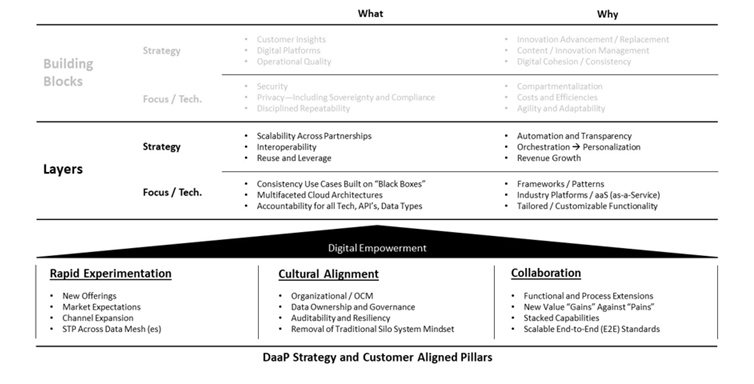

Utilizing the compartmentalized features, layers of reusable and scalable aaS fulfill varied or emerging use cases needed for digital banking and transformation. If we were to think of #Neobanks and #BaaS (banking-as-a-service) we would find that their rise has been the underpinnings of strong data-driven mindsets compared to system ideations. In the figure below, we can see the illustrative value build in creating DaaP using blocks and layers of delivery. DaaP utilizes “stacks” of capabilities to address consumer needs and behaviors. Yet the focus on data first design, eliminates many of the restrictions of traditional implementations, while offering improved accuracy, quality, and auditability of both real and emerging synthetic data types.

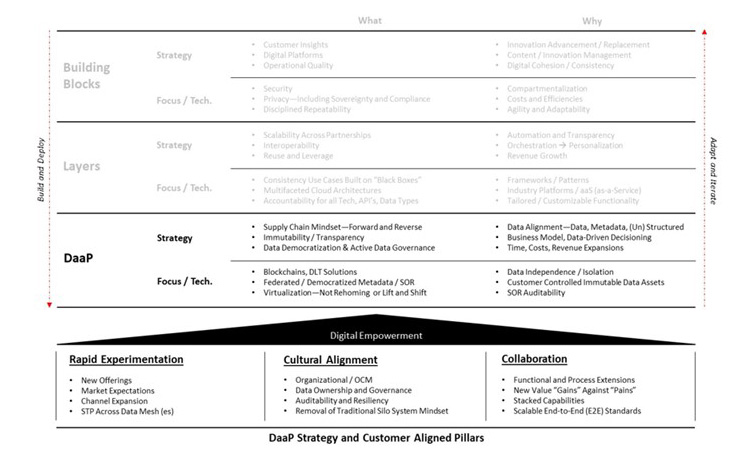

As we continue to build the DaaP house brick-by-brick, layer upon layer, DaaP implementations moves beyond the conceptual and into the pragmatic. Examined holistically from a requirements and conceptual architecture view, the approach elements driven by the “Why” and “What” drivers create a blueprint of need and inclusion. And like many pictures I have created for breaking down complex thoughts, DaaP incorporates point-based solutions which captures the imagination of technologists and the promised hype of innovation. However, DaaP from both a technological capability and business returns now has the toolsets needed for its active implementation. From its inception in 2018, industry leaders (e.g., @IBM, @Snowflake, @Tableau) and hundreds of funded startup enterprises have rushed to capitalize on the phase shift from system to data ideation.

Finally, beyond the market shifts, the advances in DaaP-capable technology and changing ideation approaches, the final model above also shows that this approach is not one-way—it is bidirectional DaaP is a journey because the data volumes (as noted in Part 1 of this series) are four times greater than all the gallons of water in the world—and doubling every 18-22 months. Adding to the complexity of using and delivering data, synthetic data (created by AI or other ML solutions) will vastly increase and dwarf consumer generated data likely before the end of 2024. The cascading impacts, the hidden liabilities, and the rise of innovation singularity (see The Ramifications of Innovation Singularity, 2018) are permanently shifting system thinking and ideation to DaaP delivery.

So, what is next? How will all this be efficiently managed? Why doesn’t any of this sound familiar?

The Business Science, Data Zeitgeist Emerges

If you are still reading this article, it is clear you have an interest in DaaP, its on-going impacts to BFSI, and the traditional systems that controlled consumer behaviors. In October 2022, the MBA published as part of its Annual Conference, an article “Adapt or Die: Customers for Life Demand a Comprehensive Digital Experience.” Implied in this brief and presented in greater detail in the full 20-page report, are the business scientist skills necessary in a data-driven enterprise to bridge and remove system level thinking and process silos detailing the change of mindset of how data is used.

The data zeitgeist represents the “political, cultural, economic, social, and disciplinary imperatives that impact the quantity and quality of DaaP in a particular time and place.” Data zeitgeists acts as invisible agents or forces dominating the characteristics of a given digital ecosystem. Translation: with the movement of passive data governance ideals ingrained as part of system ideation, these management principles, practices, and solutions fail to adapt and scale with DaaP and the explosion of digital ecosystems.

As we can see below, taking the evolution of BFSI and encasing it with the demands of DaaP functions the model of operation has shifted. The impacts are highly noticeable within regulatory compliance, sovereignty, immutability, and of course, the progression of generative AI tools.

DaaP incorporates the industry skills and experiential knowledge with rising (and often natural language processing, #NPL) data science capabilities. Yet, traditional thinking is that each of the components, the markets served are tackled independently using different teams, unique software, and a system ideation to make the “pain” into a “gain.” In a data-driven world where nearly 90% of analytic and transformative solutions fail to be sustainable (e.g., ROI) in 12 to 15 months, the caustic results should demand a change of mindset?

In summary, we have covered in this series a great deal of new ideas and are not traditional BFSI core competencies. The premise of DaaP is not academic, it’s mainstreaming began in 2018, and a framework to create a lasting model of delivery and iteration has been provided above. This series has set the rationale and foundation for a BFSI phase-shift currently underway to move from system ideation to DaaP. And yes, there are numerous methods and techniques to shift operational mindsets—but DaaP is not a system-thinking destination point.

For organizations seeking to prosper during a time of BFSI shifts to DaaP, we only must look at the playbooks adopted by non-traditional competitors. For those traditional BFSI firms, they need to decide where across the new markets they want to participate, their timing, and their ability to compete. Otherwise, the rapid phase shift driven by DaaP innovations may make their decisions for them—and likely too late.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)