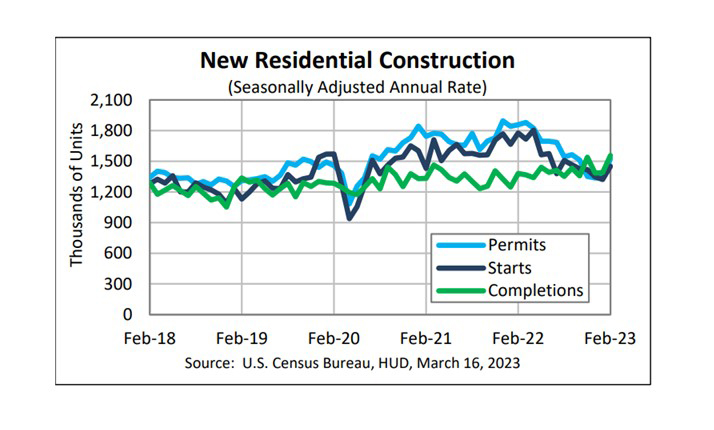

February Housing Starts Up Nearly 10%

February housing starts, permits and completions posted near double-digit percentage increases, ending five months of declines, HUD and the Census Bureau reported Thursday.

The report said privately owned housing starts in February rose to a seasonally adjusted annual rate of 1,450,000, 9.8 percent higher than the revised January estimate of 1,321,000. However, starts came in 18.4 percent below the February 2022 rate of 1,777,000. Single‐family housing starts in February rose to 830,000; 1.1 percent above the revised January figure of 821,000. The February rate for units in buildings with five units or more jumped to 608,000, an increase of 24.1 percent from January and by 14.3 percent from a year ago.

Regionally, starts rose in the South by 2.2 percent in February to 796,000 units, seasonally annually adjusted, from 779,000 units in January but fell by 20.3 percent from a year ago. In the West, starts jumped by nearly 17 percent to 347,000 units in February from 297,000 units in January but fell by 15.4 percent from a year ago.

In the Midwest, starts jumped by 70.3 percent in February to 201,000 units, seasonally annually adjusted, from 118,000 units in January but fell by 14.1 percent from a year ago. In the Northeast, starts fell by 16.5 percent in February to 106,000 units from 127,000 units in January and fell by nearly 21 percent from a year ago.

“February’s gain is mainly owed to a 24.0% surge in multifamily construction; however, single-family starts also increased 1.1% in February,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “Multifamily starts are highly volatile month-to-month; however multifamily permits also surged in February.”

Dougherty said the surge in multifamily construction in February is likely to reignite concerns of a growing imbalance in the multifamily market. “Concerns are warranted, however, the bulk of new multifamily construction is concentrated in the South and West, where strong population growth has generally led housing demand to outpace supply in recent years,” he said.

“Tight existing home inventory offers opportunity for new homes and rebound in builder sentiment continues,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The uptick in single-family housing permits and starts aligns with the recent increase in homebuilder sentiment.”

Kushi said while three months of improving home builder sentiment may indicate a turning point for single-family homebuilding, “builders continue to face headwinds in the form of higher construction costs and an affordability-constrained housing market. While down from the peak reached in the spring of last year, there is still an elevated number of single-family homes under construction, due to supply chain constraints.”

“Lower mortgage rates led to an uptick in homebuyer traffic and sales in January and the early part of February,” said Robert Rulla, Senior Director with Fitch Ratings, New York. “However, the subsequent increase in mortgage rate levels and volatility will likely weaken homebuyer demand and builder sentiment, pressuring starts during the balance of the year. Homebuilders remain cautiously optimistic, but Fitch believes most will be measured in their home production as there is considerable uncertainty in intermediate term demand.”

Building Permits

Privately owned housing units authorized by building permits in February rose to a seasonally adjusted annual rate of 1,524,000, 13.8 percent higher than the revised January rate of 1,339,000, but 17.9 percent below the February 2022 rate of 1,857,000. Single‐family authorizations in February rose to 777,000; 7.6 percent above the revised January figure of 722,000. Authorizations of units in buildings with five units or more jumped to 700,000 in February, up by 24.3 percent from January and up by nearly 17 percent from a year ago.

Housing Completions

Privately owned housing completions in February rose to a seasonally adjusted annual rate of 1,557,000, 12.2 percent higher than the revised January estimate of 1,388,000 and 12.8 percent higher than a year ago (1,380,000). Single‐family housing completions in February rose to 1,037,000; 1.0 percent higher than the revised January rate of 1,027,000. The February rate for units in buildings with five units or more jumped to 509,000, up by nearly 45 percent from January and up by 72 percent from a year ago.