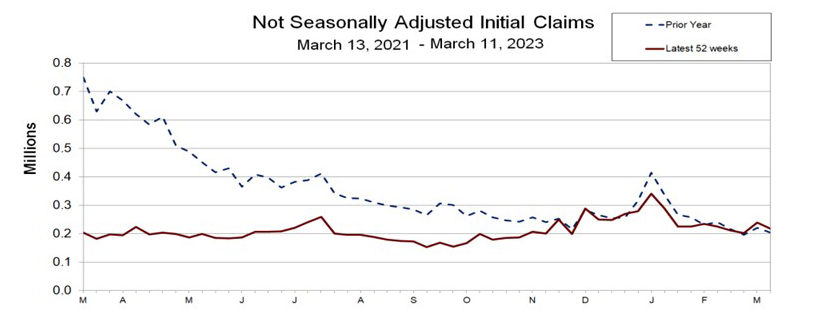

Initial Claims Fall to 8-Month Low

Initial claims for unemployment insurance fell to their lowest level since July last week, giving the Federal Open Market Committee more food for thought as it prepares to meet next week.

For the week ending March 11, the advance figure for seasonally adjusted initial claims fell to 192,000, a decrease of 20,000 from the previous week’s revised level. The four-week moving average fell to 196,500, a decrease of 750 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate was unchanged at 1.2 percent for the week ending March 4. The advance number for seasonally adjusted insured unemployment during the week ending March 4 fell to 1,684,000, a decrease of 29,000 from the previous week’s revised level. The four-week moving average fell to 1,676,500, a decrease of 1,750 from the previous week’s revised average.

The advance number of actual initial claims under state programs, unadjusted, totaled 217,444 in the week ending March 11, a decrease of 21,396 (-9.0 percent) from the previous week. Labor reported 203,911 initial claims in the comparable week in 2022.

The advance unadjusted insured unemployment rate fell to 1.3 percent during the week ending March 4, a decrease of 0.1 percentage point from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 1,914,943, a decrease of 55,075 (-2.8 percent) from the preceding week. A year earlier the rate was 1.3 percent; volume was 1,804,315.

The total number of continued weeks claimed for benefits in all programs for the week ending February 25 rose to 2,000,239, an increase of 79,630 from the previous week. Labor reported 1,968,546 weekly claims filed for benefits in all programs in the comparable week in 2022.

The FOMC holds its next regularly scheduled policy meeting on Tuesday, Mar. 21 and Wednesday, Mar. 22. MBA Chief Economist Mike Fratantoni will provide commentary and analysis on the FOMC statement.