Small Mortgages Lacking, Pew Says

(Courtesy Pew Charitable Trusts)

The Pew Charitable Trusts, Philadelphia, found small mortgages to purchase low-cost homes–defined as those priced below $150,000–have become increasingly scarce.

In 2004, lenders originated 2.7 million mortgages for less than $150,000 (in 2004 dollars) and 2.9 million mortgages above that amount. But Pew estimated between 2004-2021, small mortgage lending dropped by nearly 70% and large mortgage lending grew by 52%, although those numbers vary by region.

While factors such as increasing home prices can account for some of the change, they don’t explain the entire gap, the report said.

Additionally, applications for small mortgages are more likely to be denied than those for larger loans, even when the applicants have similar credit scores.

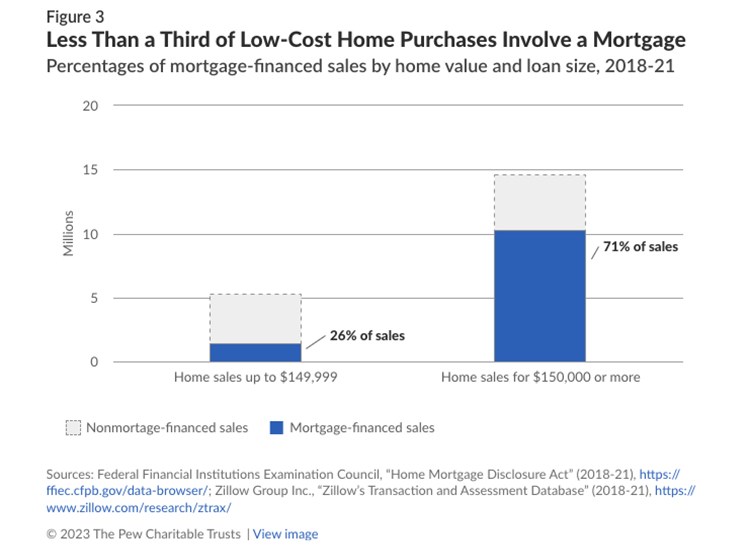

Pew found that most low-cost home purchases do not involve a mortgage–26% sold from 2018-2021 were financed using a mortgage–but there are clear problematic outcomes if borrowers can’t obtain mortgages:

• Some households aren’t able to achieve homeownership, depriving them of the ability to build wealth via that avenue.

• Some borrowers pay in cash, which comes with its own challenges.

• Some turn to alternative financing agreements, which tend to be riskier and more expensive than mortgages and may lack some consumer protections.

Overall, “policymakers should aim to expand mortgage access and the overall safety of financing for low-cost homes by reducing the structural and regulatory constraints that increase lenders’ costs and make small mortgages unprofitable and establishing strong consumer protections for alternative arrangements,” the report said. “In addition, federal agencies and lawmakers can reduce racial disparities in mortgage lending by prioritizing Black, Hispanic and Indigenous households in the development and implementation of small mortgage and alternative financing programs.”